PROTECTED SOURCE SCRIPT

Aggiornato 🎯 SLO Pro-J-Algo

🎯 SLO Pro-J-Algo - Advanced Sessions, Liquidity & OTE Indicator

📊 Overview

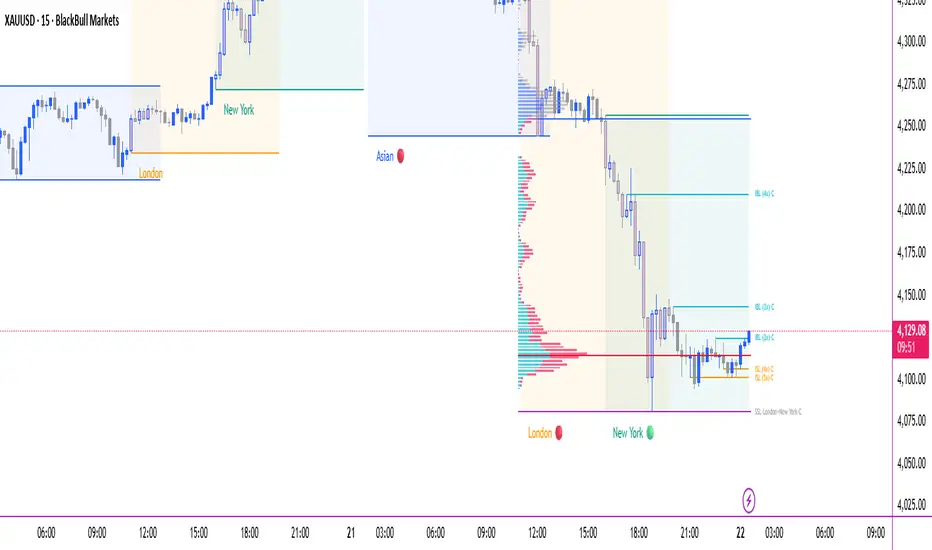

SLO Pro-J-Algo is a comprehensive smart money trading indicator that combines three essential ICT (Inner Circle Trader) concepts into one powerful tool. Designed for professional traders who follow institutional trading methodologies, this indicator helps identify high-probability trade setups by tracking trading sessions, liquidity zones, and optimal trade entry points.

Perfect for: Forex, Gold (XAUUSD), Indices, and Crypto traders who use smart money concepts.

✨ Key Features

🕐 Trading Sessions

Asian, London, and New York sessions with customizable colors

Real-time session status indicators (🟢 Open / 🔴 Closed)

Session high/low tracking with visual lines

Session overlap detection (when multiple sessions are active)

Fully customizable transparency and colors for each session

Individual session background toggle - Show/hide each session independently

💧 Liquidity Sweeps

Automatic detection of Buyside Liquidity (BSL) and Sellside Liquidity (SSL)

Multiple sweep detection methods:

Wick Break - Any wick beyond the level

Close Break - Close price beyond the level

Full Retrace - Break and close back inside

Session labeling on liquidity zones (shows which session created the liquidity)

Adjustable sweep buffer (ATR-based) for precision

Visual customization (line style, width, colors, text size)

Smart zone management (displays only most relevant zones)

🎯 Optimal Trade Entry (OTE)

Automatic Fibonacci retracement zones (0.618, 0.705, 0.786)

Bullish OTE - Entry zones after swing lows with upside breakout

Bearish OTE - Entry zones after swing highs with downside breakout

Visual zone boxes highlighting the golden pocket (0.618-0.786)

Entry confirmation with ✅ / Exit tracking with ❌

Structure break requirement (optional)

Real-time status indicators (🎯↑ Bullish / 🎯↓ Bearish)

🎨 Customization Options

Master Controls

Enable/disable each component independently (Sessions, Liquidity, OTE)

Anti-Repainting Mode - Use confirmed signals with adjustable confirmation bars

Choose between live signals (instant but may repaint) or confirmed signals (stable, no repainting)

Session Colors

Individual ON/OFF toggles for each session background

Customizable colors for Asian, London, and New York sessions

Global transparency slider (0-100%)

Separate colors for session high/low lines

Liquidity Settings

Adjustable lookback period (5-30 bars)

Multiple sweep detection types

Custom colors for buyside and sellside liquidity

Line style options (Solid, Dashed, Dotted)

Control maximum displayed zones

OTE Settings

Adjustable swing length (5-50 bars)

Show/hide individual Fibonacci levels (0.618, 0.705, 0.786)

Optional structure break requirement

Custom colors for each Fibonacci level

Control maximum displayed OTE zones

📖 How to Use

For Day Traders:

Enable all three sessions to identify session boundaries

Watch for liquidity sweeps during session opens (especially London and New York)

Wait for price to retrace into OTE zones after liquidity is taken

Enter trades when price reaches 0.705-0.786 levels with confirmation

For Swing Traders:

Use higher timeframes (4H, Daily) for better swing detection

Focus on HTF liquidity sweeps that get taken during major sessions

Look for OTE zones that align with session highs/lows

Combine with market structure for confluence

Best Practices:

✅ Use Confirmed Signals mode to avoid repainting (set confirmation bars to 2-3)

✅ Combine with price action and market structure

✅ Wait for OTE entry confirmation (✅ indicator)

✅ Look for liquidity sweeps during high-impact session opens

✅ Use session overlaps for increased volatility awareness

⚠️ Always use proper risk management and stop losses

⚙️ Recommended Settings

For Forex/Gold (15m-1H charts):

- OTE Swing Length: 10-15

- Liquidity Lookback: 15

- Confirmation Bars: 2

- Require Structure Break: ON

- Session Transparency: 93%

```

### **For Indices (5m-15m charts):**

```

- OTE Swing Length: 8-10

- Liquidity Lookback: 12-15

- Confirmation Bars: 1-2

- Require Structure Break: ON

- Session Transparency: 90%

```

### **For Crypto (1H-4H charts):**

```

- OTE Swing Length: 12-20

- Liquidity Lookback: 15-20

- Confirmation Bars: 2-3

- Require Structure Break: OFF

- Session Transparency: 85%

🔔 Alert Features

Set up custom alerts for:

💧 Liquidity sweep events (BSL/SSL taken)

🕐 Session opens/closes (Asian, London, NY)

🎯 OTE zone entries (when price enters optimal entry zones)

📌 Important Notes

Anti-Repainting: Enable "Use Confirmed Signals" for stable, non-repainting indicators

Performance: Optimized for multiple timeframes with efficient memory management

Flexibility: All colors, sizes, and thresholds are fully customizable

Education: Best used by traders familiar with ICT concepts and smart money trading

⚠️ Disclaimer

This indicator is a technical analysis tool and should not be used as the sole basis for trading decisions. Always:

Conduct your own research and analysis

Use proper risk management (stop losses, position sizing)

Practice on demo accounts before live trading

Understand that past performance does not guarantee future results

Consider multiple timeframe analysis and market context

Trading involves substantial risk of loss. Trade responsibly.

📞 Support & Feedback

If you find this indicator helpful, please:

⭐ Leave a rating and review

💬 Share your feedback and suggestions

🔔 Follow for updates and new indicators

Happy Trading! 🎯📈

📊 Overview

SLO Pro-J-Algo is a comprehensive smart money trading indicator that combines three essential ICT (Inner Circle Trader) concepts into one powerful tool. Designed for professional traders who follow institutional trading methodologies, this indicator helps identify high-probability trade setups by tracking trading sessions, liquidity zones, and optimal trade entry points.

Perfect for: Forex, Gold (XAUUSD), Indices, and Crypto traders who use smart money concepts.

✨ Key Features

🕐 Trading Sessions

Asian, London, and New York sessions with customizable colors

Real-time session status indicators (🟢 Open / 🔴 Closed)

Session high/low tracking with visual lines

Session overlap detection (when multiple sessions are active)

Fully customizable transparency and colors for each session

Individual session background toggle - Show/hide each session independently

💧 Liquidity Sweeps

Automatic detection of Buyside Liquidity (BSL) and Sellside Liquidity (SSL)

Multiple sweep detection methods:

Wick Break - Any wick beyond the level

Close Break - Close price beyond the level

Full Retrace - Break and close back inside

Session labeling on liquidity zones (shows which session created the liquidity)

Adjustable sweep buffer (ATR-based) for precision

Visual customization (line style, width, colors, text size)

Smart zone management (displays only most relevant zones)

🎯 Optimal Trade Entry (OTE)

Automatic Fibonacci retracement zones (0.618, 0.705, 0.786)

Bullish OTE - Entry zones after swing lows with upside breakout

Bearish OTE - Entry zones after swing highs with downside breakout

Visual zone boxes highlighting the golden pocket (0.618-0.786)

Entry confirmation with ✅ / Exit tracking with ❌

Structure break requirement (optional)

Real-time status indicators (🎯↑ Bullish / 🎯↓ Bearish)

🎨 Customization Options

Master Controls

Enable/disable each component independently (Sessions, Liquidity, OTE)

Anti-Repainting Mode - Use confirmed signals with adjustable confirmation bars

Choose between live signals (instant but may repaint) or confirmed signals (stable, no repainting)

Session Colors

Individual ON/OFF toggles for each session background

Customizable colors for Asian, London, and New York sessions

Global transparency slider (0-100%)

Separate colors for session high/low lines

Liquidity Settings

Adjustable lookback period (5-30 bars)

Multiple sweep detection types

Custom colors for buyside and sellside liquidity

Line style options (Solid, Dashed, Dotted)

Control maximum displayed zones

OTE Settings

Adjustable swing length (5-50 bars)

Show/hide individual Fibonacci levels (0.618, 0.705, 0.786)

Optional structure break requirement

Custom colors for each Fibonacci level

Control maximum displayed OTE zones

📖 How to Use

For Day Traders:

Enable all three sessions to identify session boundaries

Watch for liquidity sweeps during session opens (especially London and New York)

Wait for price to retrace into OTE zones after liquidity is taken

Enter trades when price reaches 0.705-0.786 levels with confirmation

For Swing Traders:

Use higher timeframes (4H, Daily) for better swing detection

Focus on HTF liquidity sweeps that get taken during major sessions

Look for OTE zones that align with session highs/lows

Combine with market structure for confluence

Best Practices:

✅ Use Confirmed Signals mode to avoid repainting (set confirmation bars to 2-3)

✅ Combine with price action and market structure

✅ Wait for OTE entry confirmation (✅ indicator)

✅ Look for liquidity sweeps during high-impact session opens

✅ Use session overlaps for increased volatility awareness

⚠️ Always use proper risk management and stop losses

⚙️ Recommended Settings

For Forex/Gold (15m-1H charts):

- OTE Swing Length: 10-15

- Liquidity Lookback: 15

- Confirmation Bars: 2

- Require Structure Break: ON

- Session Transparency: 93%

```

### **For Indices (5m-15m charts):**

```

- OTE Swing Length: 8-10

- Liquidity Lookback: 12-15

- Confirmation Bars: 1-2

- Require Structure Break: ON

- Session Transparency: 90%

```

### **For Crypto (1H-4H charts):**

```

- OTE Swing Length: 12-20

- Liquidity Lookback: 15-20

- Confirmation Bars: 2-3

- Require Structure Break: OFF

- Session Transparency: 85%

🔔 Alert Features

Set up custom alerts for:

💧 Liquidity sweep events (BSL/SSL taken)

🕐 Session opens/closes (Asian, London, NY)

🎯 OTE zone entries (when price enters optimal entry zones)

📌 Important Notes

Anti-Repainting: Enable "Use Confirmed Signals" for stable, non-repainting indicators

Performance: Optimized for multiple timeframes with efficient memory management

Flexibility: All colors, sizes, and thresholds are fully customizable

Education: Best used by traders familiar with ICT concepts and smart money trading

⚠️ Disclaimer

This indicator is a technical analysis tool and should not be used as the sole basis for trading decisions. Always:

Conduct your own research and analysis

Use proper risk management (stop losses, position sizing)

Practice on demo accounts before live trading

Understand that past performance does not guarantee future results

Consider multiple timeframe analysis and market context

Trading involves substantial risk of loss. Trade responsibly.

📞 Support & Feedback

If you find this indicator helpful, please:

⭐ Leave a rating and review

💬 Share your feedback and suggestions

🔔 Follow for updates and new indicators

Happy Trading! 🎯📈

Note di rilascio

🔄 MAJOR UPDATE: Internal Liquidity Detection AddedWhat's New?

This indicator now includes Internal Liquidity Sweep Detection - a powerful feature that identifies liquidity pools WITHIN consolidation ranges, not just at market extremes.

🎯 What is Internal Liquidity?

Internal Liquidity refers to equal highs and equal lows that form INSIDE a price range during consolidation or pullbacks. These levels represent clustered stop losses and pending orders that smart money often targets before making their next move.

Key Differences:

External Liquidity (BSL/SSL): Swing highs/lows at market extremes

Internal Liquidity (IBL/ISL): Equal highs/lows within consolidation zones

📊 How It Works

The indicator automatically detects:

Equal Highs - Multiple candle highs at nearly identical levels (Internal Buyside Liquidity - IBL)

Equal Lows - Multiple candle lows at nearly identical levels (Internal Sellside Liquidity - ISL)

Occurrence Count - Shows how many times each level has been tested (e.g., "IBL 3x")

Sweep Detection - Alerts when internal liquidity is taken

⚙️ Customizable Settings

Internal Liquidity Settings:

Lookback Period (3-15 bars) - Range for detecting equal levels

Equal Level Threshold - How close prices must be to qualify as "equal"

Min Occurrences (2-5x) - Minimum tests required for validation

Sweep Type - Wick break or close break detection

Colors & Styling - Fully customizable appearance

Max Zones Display - Control chart cleanliness

💡 Trading Applications

1. Continuation Setups:

Price consolidates → Internal liquidity forms → Sweep → Continuation in trend direction

2. Reversal Confirmation:

External liquidity swept → Internal liquidity forms → Internal sweep → Reversal confirmed

3. OTE Zone Confluence:

Internal liquidity near OTE 0.618-0.786 levels = high-probability entry zones

4. Session Targeting:

Watch for internal liquidity sweeps during London/NY open for directional bias

🎨 Visual Design

IBL (Internal Buyside): Cyan color - levels above price

ISL (Internal Sellside): Orange color - levels below price

Labels: Show type and occurrence count (e.g., "IBL 3x")

Clean Display: Only shows key levels to avoid chart clutter

🔔 Alert System

Enable alerts for:

Internal liquidity sweep detection

Occurrence count included in alerts

Confirmed signals option (non-repainting)

🚀 Why This Matters

Internal liquidity sweeps often precede major moves because:

Early Stop Hunt Signal - Catches liquidity grabs before larger moves

Higher Frequency - More trading opportunities than external sweeps alone

Better Entries - Provides precise entry levels within larger structures

Confluence - Combines with OTE zones and session analysis for complete picture

📈 Best Practices

Combine with External Liquidity - Use both for complete market structure view

Watch for 3x+ Tests - Higher occurrence count = stronger liquidity pool

Session Context - Internal liquidity often forms during Asian session consolidation

Confirm with OTE - Look for internal sweeps within optimal trade entry zones

Trend Alignment - Take sweeps that align with higher timeframe bias

⚡ Performance Optimized

Efficient array management for smooth performance

Automatic cleanup of old zones

Adjustable history limits

No lag on real-time charts

This update transforms the indicator into a complete liquidity analysis tool, giving you both macro (external) and micro (internal) liquidity perspectives for superior trade timing.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.