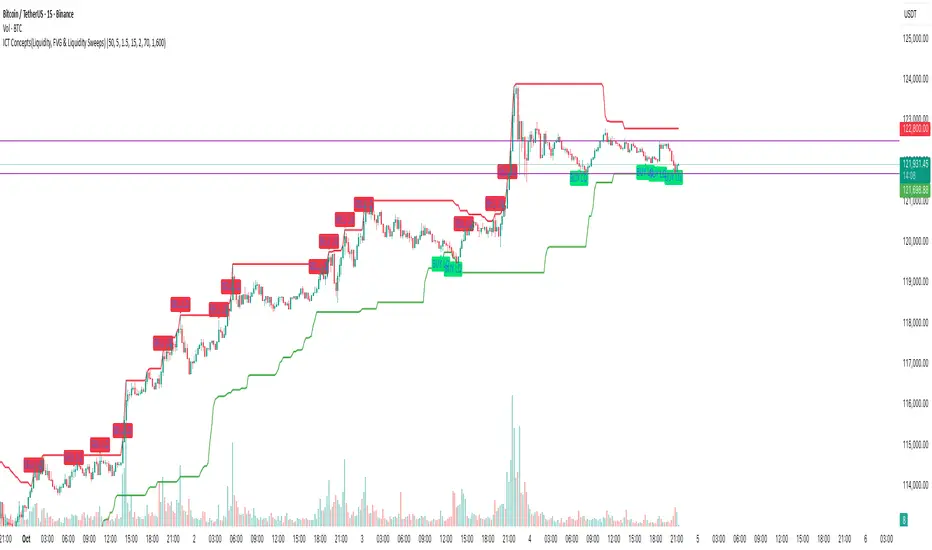

ICT Concepts(Liquidity, FVG & Liquidity Sweeps)

A Smart Money Concept (SMC)-based utility that blends ICT-style Liquidity Sweeps, Fair Value Gap (FVG) mapping, and Swing Structure proxies – designed for traders seeking clean precision in price imbalance analysis.

⸻

🔍 1. What This Script Does

This indicator brings together three core Institutional Concepts:

• Liquidity Sweep Detection: Identifies buy/sell-side liquidity grabs (fakeouts) confirmed by volume spikes – a common precursor to institutional order flow shifts.

• Fair Value Gaps (FVGs): Highlights inefficiencies between price legs using strict ICT-style 3-candle or gap-based rules. These are areas institutions often revisit.

• Swing Structure Proxy (OB Mapping): Tracks dynamic swing highs/lows to act as proxy zones for potential order blocks and structural boundaries.

It also includes a cooldown-based signal filtering engine to prevent overfitting and noise, helping traders avoid false positives in choppy markets.

⚙️ 2. How It Works (Core Logic)

✅ A. Liquidity Sweep Engine

• Looks back N bars to find Equal Highs or Equal Lows.

• Triggers a signal only if price sweeps the level and closes on the other side with a volume spike.

• Customizable volume threshold (e.g., 1.5x average volume).

• Includes a signal cooldown period to reduce clutter and boost quality.

Bullish Sweep = Price dips below equal lows but closes higher

Bearish Sweep = Price spikes above equal highs but closes lower

Visuals: Signal arrows with alerts (BUY LQ / SELL LQ)

⸻

✅ B. Fair Value Gap (FVG) Zones

• Detects FVGs using:

• Sequential logic: Low[1] > High[2] (bullish), High[1] < Low[2] (bearish)

• Gap logic: Open gaps at bar open

• Dynamic box drawing:

• Automatically extends FVG zones until price fully closes through them.

• Different color coding for bullish (teal) and bearish (orange) gaps.

• Customizable:

• Opacity control

• Option to include/exclude gap-based FVGs

• Hide filled zones

• Limit total zones rendered (for performance)

⸻

✅ C. Swing High/Low Structure

• Uses a lookback period to find latest swing high/low levels.

• Acts as a proxy for Order Block zones or structural shift reference points.

• Plotted as red (high) and green (low) lines.

⸻

🚀 3. How to Use It

• Scalpers and Intraday Traders can use Liquidity Sweep + FVG Confluence to time reversals or catch early entries into trend continuation moves.

• Swing Traders can observe swing OB proxies and recent FVG zones to frame directional bias and target zones.

• Volume-Aware Traders benefit from the volume filter that confirms sweeps are meaningful – not just random stop hunts.

🔔 Set alerts on:

• Bullish Liquidity Sweeps

• Bearish Liquidity Sweeps

You can use this in combination with your own trend filters, or even confluence it with Order Blocks, VWAP, or EMA trend tools.

⸻

💡 What Makes It Original?

• The script doesn’t merely combine standard tools — it builds a cohesive ICT-style detection system using:

• A custom volume-confirmed liquidity sweep filter

• Dynamic FVG rendering with filled logic + performance optimization

• Visual hierarchy to avoid clutter: clean line plots, contextual boxes, and conditional signals

• Highly customizable yet lightweight, making it suitable for fast-paced decision making.

⸻

✅ Notes

• Invite-only script for serious traders interested in Smart Money and ICT concepts.

• Does not repaint signals.

• All visuals are dynamically managed for clarity and performance.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente TradeTechanalysis.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente TradeTechanalysis.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

TradeTech Analysis

Telegram Channel - t.me/Tradetech2024

Youtube Channel - youtube.com/@TradeTechAnalysis

Website - tradetechanalysis.com/

Super Profile - superprofile.bio/tradetechanalysis