OPEN-SOURCE SCRIPT

Volatility Bias Model

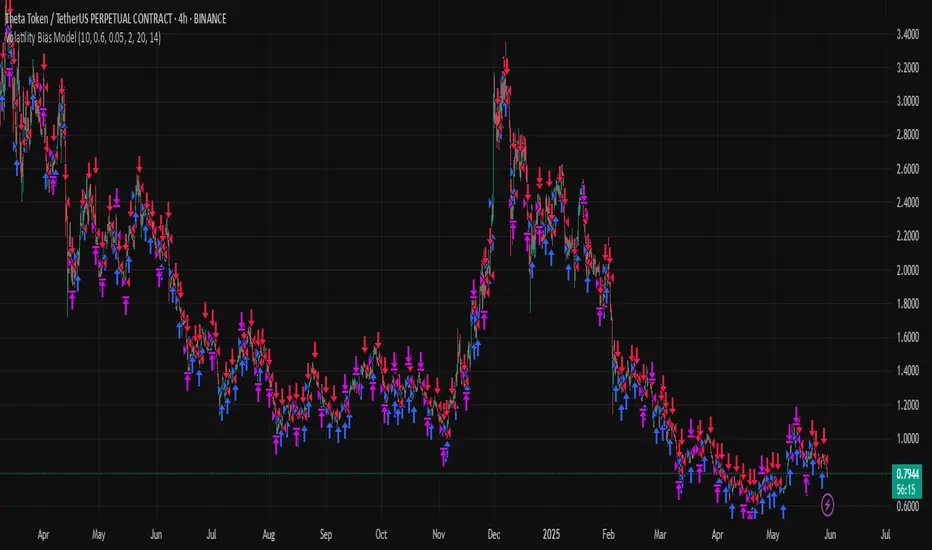

Volatility Bias Model

Overview

Volatility Bias Model is a purely mathematical, non-indicator-based trading system that detects directional probability shifts during high volatility market phases. Rather than relying on classic tools like RSI or moving averages, this strategy uses raw price behavior and clustering logic to determine potential breakout direction based on recent market bias.

How It Works

Over a defined lookback window (default 10 bars), the strategy counts how many candles closed in the same direction (i.e., bullish or bearish).

Simultaneously, it calculates the price range during that window.

If volatility is above a minimum threshold and a clear directional bias is detected (e.g., >60% of closes are bullish), a trade is opened in the direction of that bias.

This approach assumes that when high volatility is coupled with directional closing consistency, the market is probabilistically more likely to continue in that direction.

ATR-based stop-loss and take-profit levels are applied, and trades auto-exit after 20 bars if targets are not hit.

Key Features

- 100% non-indicator-based logic

- Statistically-driven directional bias detection

- Works across all timeframes (1H, 4H, 1D)

- ATR-based risk management

- No pyramiding, slippage and commissions included

- Compatible with real-world backtesting conditions

Realism & Assumptions

To make this strategy more aligned with actual trading environments, it includes 0.05% commission per trade and a 1-point slippage on every entry and exit.

Additionally, position sizing is set at 10% of a $10,000 starting capital, and no pyramiding is allowed.

These assumptions help avoid unrealistic backtest results and make the performance metrics more representative of live conditions.

Parameter Explanation

Bias Window (10 bars): Number of past candles used to evaluate directional closings

Bias Threshold (0.60): Required ratio of same-direction candles to consider a bias valid

Minimum Range (1.5%): Ensures the market is volatile enough to avoid noise

ATR Length (14): Used to dynamically define stop-loss and target zones

Risk-Reward Ratio (2.0): Take-profit is set at twice the stop-loss distance

Max Holding Bars (20): Trades are closed automatically after 20 bars to prevent stagnation

Originality Note

Unlike common strategies based on oscillators or moving averages, this script is built on pure statistical inference. It models the market as a probabilistic process and identifies directional intent based on historical closing behavior, filtered by volatility. This makes it a non-linear, adaptive model grounded in real-world price structure — not traditional technical indicators.

Disclaimer

This strategy is for educational and experimental purposes only. It does not constitute financial advice. Always perform your own analysis and test thoroughly before applying with real capital.

Overview

Volatility Bias Model is a purely mathematical, non-indicator-based trading system that detects directional probability shifts during high volatility market phases. Rather than relying on classic tools like RSI or moving averages, this strategy uses raw price behavior and clustering logic to determine potential breakout direction based on recent market bias.

How It Works

Over a defined lookback window (default 10 bars), the strategy counts how many candles closed in the same direction (i.e., bullish or bearish).

Simultaneously, it calculates the price range during that window.

If volatility is above a minimum threshold and a clear directional bias is detected (e.g., >60% of closes are bullish), a trade is opened in the direction of that bias.

This approach assumes that when high volatility is coupled with directional closing consistency, the market is probabilistically more likely to continue in that direction.

ATR-based stop-loss and take-profit levels are applied, and trades auto-exit after 20 bars if targets are not hit.

Key Features

- 100% non-indicator-based logic

- Statistically-driven directional bias detection

- Works across all timeframes (1H, 4H, 1D)

- ATR-based risk management

- No pyramiding, slippage and commissions included

- Compatible with real-world backtesting conditions

Realism & Assumptions

To make this strategy more aligned with actual trading environments, it includes 0.05% commission per trade and a 1-point slippage on every entry and exit.

Additionally, position sizing is set at 10% of a $10,000 starting capital, and no pyramiding is allowed.

These assumptions help avoid unrealistic backtest results and make the performance metrics more representative of live conditions.

Parameter Explanation

Bias Window (10 bars): Number of past candles used to evaluate directional closings

Bias Threshold (0.60): Required ratio of same-direction candles to consider a bias valid

Minimum Range (1.5%): Ensures the market is volatile enough to avoid noise

ATR Length (14): Used to dynamically define stop-loss and target zones

Risk-Reward Ratio (2.0): Take-profit is set at twice the stop-loss distance

Max Holding Bars (20): Trades are closed automatically after 20 bars to prevent stagnation

Originality Note

Unlike common strategies based on oscillators or moving averages, this script is built on pure statistical inference. It models the market as a probabilistic process and identifies directional intent based on historical closing behavior, filtered by volatility. This makes it a non-linear, adaptive model grounded in real-world price structure — not traditional technical indicators.

Disclaimer

This strategy is for educational and experimental purposes only. It does not constitute financial advice. Always perform your own analysis and test thoroughly before applying with real capital.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.