SmartTrade - ALMCorp

It uses the daily timeframe as the basis for displaying levels. For each cryptocurrency, a unique deviation coefficient is calculated for each level. Essentially, we take two deviation zones—the buy zone and the sell zone—treating them as 0 and 1, respectively. From there, we can plot internal levels based on the Fibonacci sequence.

To summarize:

The indicator displays two main zones (buy/sell).

It also shows internal Fibonacci levels, which exert strong influence on price movements.

For convenience, each level is marked with its corresponding numerical value.

Key Levels for Altcoins: The 0.25–0.5 Range and Imbalance

For many altcoins, the most critical levels are 0.25 and 0.5. Prices tend to stay within this range most of the time—breaking beyond these levels signals a market imbalance, which is usually short-lived.

Example Scenario:

Normal Movement: Price moves between 0.25 (support) and 0.5 (resistance).

Downside Break (Imbalance): If price falls below 0.25 into the buy zone (green area), the failure to hold 0.25 creates a strong imbalance. This typically forces price back up into its usual range.

Upside Break (Imbalance): Similarly, if price breaks above 0.5 (e.g., reaching 0.75), this also creates imbalance, and price tends to revert back down into its standard range.

Conclusion:

Most altcoins trade primarily between 0.25 and 0.5.

A breakout in either direction usually results in a temporary imbalance, which the market quickly corrects.

By recognizing these patterns, we can make more informed trading decisions.

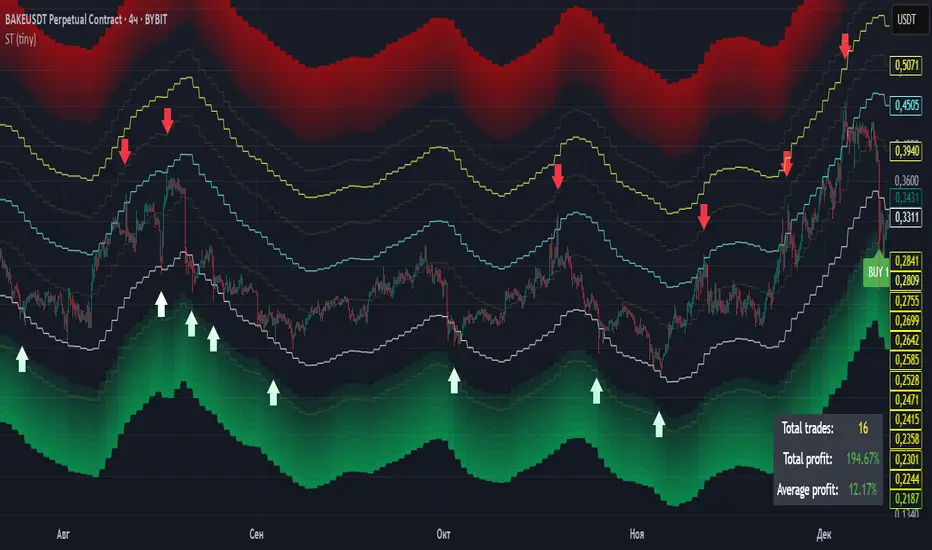

Visualizing Imbalances – From Small to Large

In the chart above, I’ve highlighted all imbalances, ranging from minor to major.

Why This Indicator is Perfect for Spot Trading

I’ve developed a trading strategy for this indicator that displays:

Buy signals (with entry zones)

Average entry price

Sell signals

How the Buy Signals Work:

BUY 1 – Triggered when price touches the upper boundary of the buy zone.

BUY 2 – Activated when price reaches the middle of the buy zone.

BUY 3 – Executed when price tests the lower boundary of the buy zone.

This structured approach ensures you capitalize on optimal entry points while managing risk.

Understanding the Average Entry Line & Profit-Taking System

You may have noticed an additional line on the chart above, displayed alongside the buy signals. This is the average entry line, which represents your mean entry price—calculated based on executing equal-sized purchases at each buy signal (BUY 1, BUY 2, BUY 3).

Where to Sell? Smart Profit-Taking Rules

While precise entries are critical, knowing when to exit is equally important. Here’s how the system works:

Primary Take-Profit Level (0.375)

Historically, this level offers the optimal balance for quick profit-taking.

Adaptive Exit Strategy

If the position is unprofitable by the time of closure, the system automatically shifts the exit to the next higher level (0.5).

This ensures you lock in greater gains when the market favors your trade.

Advanced Performance Tracking & Asset Selection

The indicator provides comprehensive trade analytics, displayed in the bottom-right information panel:

Trade count tracking (total number of executed trades)

Cumulative profitability (combined returns across all trades)

Average profitability per trade (total returns ÷ trade count)

How to Leverage This Data

These metrics allow you to:

Identify high-potential assets

Example: Asset A shows 5% average profit/trade vs. Asset B with 40% → prioritize Asset B for spot trading.

Filter for optimal volatility

Higher average profitability often correlates with stronger momentum/volatility.

Multi-Market Utility

While designed for spot trading, the indicator’s imbalance detection (described earlier) also works for:

Futures market analysis

Entry point identification

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente ALEKSEI_MAKSIMOV.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

👉 t.me/+AQWwxRhhrXI0YTgy

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente ALEKSEI_MAKSIMOV.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

👉 t.me/+AQWwxRhhrXI0YTgy