AtroNox GOD Mode v8 - Professional Trading Strategy

Overview

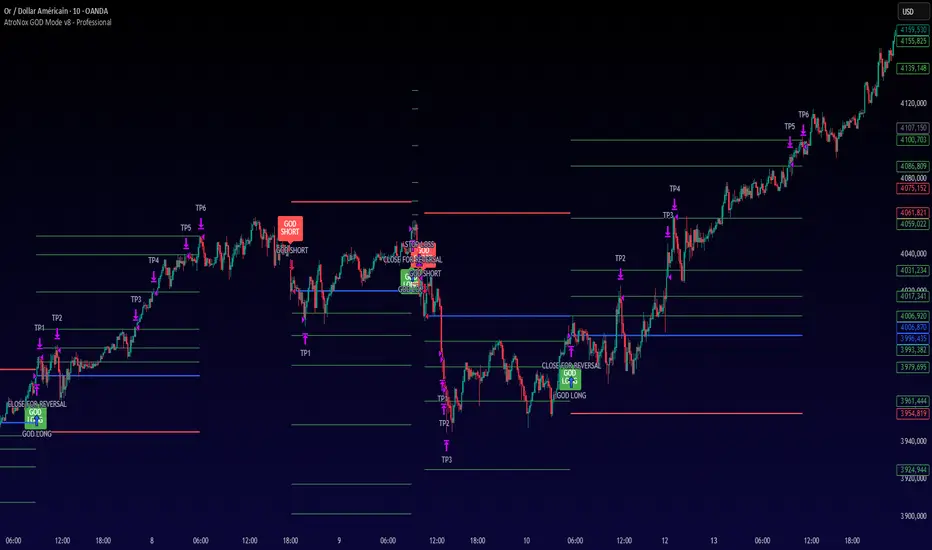

AtroNox GOD Mode v8 is an advanced trading strategy that combines dynamic Bollinger Band analysis with proprietary trend detection algorithms. The strategy features six-tier take profit management, multiple filtering systems, and optional integration with PineConnector for automated trading through MetaTrader platforms.

Key Features & Originality

1. GOD Mode Signal Generation System

- **Proprietary Trend Detection**: Custom algorithm that analyzes Bollinger Band breakouts with dynamic trend line generation

- **Adaptive Trend Line**: Automatically adjusts support/resistance levels based on market structure

- **Dual Confirmation**: Combines price action with trend direction changes for high-probability signals

2. Six-Tier Take Profit System

- **Progressive Profit Taking**: Six distinct take profit levels for optimal position management

- **Flexible Sizing**: Customizable position allocation across all six targets

- **Dual Calculation Methods**: Choose between ATR-based or percentage-based targets

- **Dynamic Adjustment**: Targets automatically scale based on market volatility

3. Advanced Market Filtering

Multiple filter options to adapt to different market conditions:

- **ATR Filter**: Entry only when volatility exceeds moving average threshold

- **RSI Filter**: Entry based on momentum extremes

- **Combined Filters**: ATR OR RSI, ATR AND RSI options

- **Flat Market Detection**: Option to trade only in ranging markets

- **No Filtering**: For trending market conditions

4. PineConnector Integration (Optional)

- **MT4/MT5 Compatibility**: Direct integration with MetaTrader platforms

- **Automated Execution**: Sends trade signals directly to your broker

- **Custom Lot Sizing**: Adjustable position sizes for different account types

- **Pip Multiplier Configuration**: Supports Forex, Gold, Indices, and other instruments

5. Enhanced Position Management

- **Intelligent Reversal Handling**: Automatically closes opposite positions before new entries

- **State Tracking**: Monitors position transitions to prevent conflicts

- **Multi-Level Exit Logic**: Progressive profit taking with remainder management

- **Dynamic Stop Loss Options**: ATR-based, percentage-based, or trendline-based stops

How to Use

Initial Setup

1. **Authentication**: Enter "GOD FX" in the authentication field to activate the strategy

2. **Direction Selection**: Enable/disable long and short trades based on your preference

3. **Filter Configuration**: Choose appropriate market filter for current conditions

4. **Risk Management**: Configure TP/SL method (ATR or percentage-based)

Parameter Configuration

GOD Mode Core Settings

- **Sensitivity (default: 100)**: Bollinger Band period - higher values create smoother signals

- **Offset (default: 1.5)**: Band deviation multiplier - adjusts signal sensitivity

Take Profit Configuration

- **Six TP Levels**: Configure multipliers or percentages for each level

- **Position Sizing**: Allocate percentage of position to close at each TP

- **Method Selection**: Choose between ATR-based or percentage-based calculations

Market Filters

- **RSI Settings**: Configure period and threshold levels

- **ATR Settings**: Adjust length and moving average parameters

- **Filter Type**: Select based on current market behavior

Signal Interpretation

- **GOD LONG/SHORT Labels**: Primary entry signals with clear visual markers

- **Trend Line Color**: Visual representation of current trend direction

- **Dashboard Display**: Real-time position status and performance metrics

- **TP Level Lines**: Visual targets displayed when in position

Important Considerations

Strategy Limitations

- **No Guarantee of Future Performance**: Past results do not predict future outcomes

- **Market Dependency**: Performance varies significantly with market conditions

- **Volatility Impact**: High volatility can trigger premature exits

- **Slippage and Fees**: Real trading involves costs not reflected in backtesting

### Risk Warnings

- **Capital at Risk**: Trading involves substantial risk of loss

- **Leverage Warning**: Using leverage magnifies both profits and losses

- **Not Investment Advice**: This tool is for educational purposes only

- **Thorough Testing Required**: Always test on demo accounts before live trading

- **Regular Monitoring Needed**: Automated strategies require ongoing supervision

Technical Components

Core Indicators

- **Modified Bollinger Bands**: Custom deviation calculation with adjustable parameters

- **Dynamic Trend Line**: Proprietary algorithm for trend direction

- **RSI (Relative Strength Index)**: Momentum confirmation

- **ATR (Average True Range)**: Volatility measurement and target calculation

Position Management Features

- **Progressive Take Profits**: Six levels with customizable allocation

- **Multiple Stop Loss Options**: ATR, percentage, or trendline-based

- **Reversal Detection**: Automatic position flipping on opposite signals

- **State Management**: Tracks position status to prevent conflicts

PineConnector Setup (Optional)

Requirements

- Active PineConnector license

- MetaTrader 4 or 5 with EA installed

- Proper symbol configuration matching broker format

- Correct pip multiplier settings for your instruments

Configuration Guide

1. Enable PineConnector in strategy settings

2. Enter your unique Connector ID

3. Input exact symbol name as shown in MT4/MT5

4. Set appropriate lot size for your account

5. Configure pip multiplier (100 for Gold/Indices, 10000 for Forex majors)

Performance Dashboard

Real-Time Metrics

- **Position Status**: Current direction and entry price

- **P&L Display**: Live profit/loss percentage

- **Trend Status**: Current GOD Mode trend direction

- **RSI Value**: Current momentum reading

- **Performance Stats**: Win rate, total trades, net profit

TP Status Tracking

- Visual indicators for each completed take profit level

- Position management status display

- PineConnector connection status (if enabled)

Recommended Usage

Best Practices

1. **Start with Demo**: Test thoroughly on demo account for at least 30 days

2. **Small Position Sizes**: Begin with minimum lot sizes when going live

3. **Market Selection**: Test on different instruments to find best performers

4. **Regular Review**: Monitor and adjust parameters based on performance

5. **Risk Management**: Never risk more than 1-2% per trade

Timeframe Recommendations

- **Scalping**: 1-minute to 5-minute charts with tight targets

- **Day Trading**: 15-minute to 1-hour charts with standard settings

- **Swing Trading**: 4-hour to daily charts with wider targets

- **Position Trading**: Weekly charts with maximum target distances

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente Heuchache.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente Heuchache.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.