PROTECTED SOURCE SCRIPT

Range Signal - Lite (DTCTradingClub)

Range Signal - Lite (DTCTradingClub)

Script Type: Indicator | Overlay

Version: Lite

Powered by: DTCTradingClub

Overview

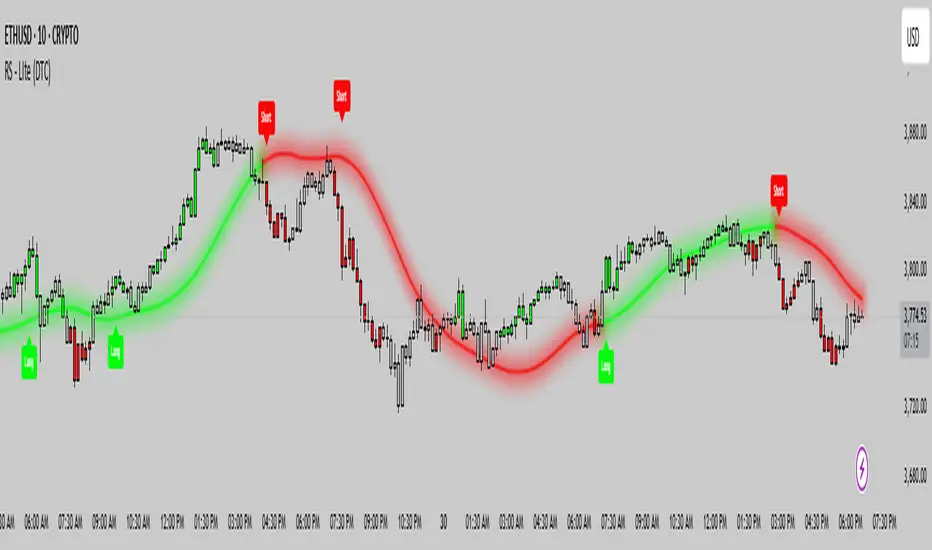

Range Signal - Lite is a precision-based signal indicator developed to identify filtered long and short opportunities using a combination of ATR-based trailing stops and trend-confirming Hull Moving Averages (HMA). The indicator is designed to reduce false signals and enhance entry timing for both short-term and trend-following traders.

Key Features

ATR Trailing Stop System:

Dynamically calculated stop levels based on user-defined sensitivity to recent volatility. The system ensures signals are reactive yet robust during fast market moves.

Triple Hull MA Filter:

The script utilizes three Hull Moving Averages to assess trend strength and direction. Signals are validated only when the short-, medium-, and long-term HMAs align in a directional bias.

Trade Mode Configuration:

Switch between Scalp and Hold modes:

Scalp Mode uses faster MA periods for quick, responsive entries.

Hold Mode uses slower MA periods to align with broader trends.

Hull MA Glow Visualization:

A glowing trail is applied to the Hull MA, changing color dynamically:

Green for buy bias

Red for sell bias

Gray for neutral zones

Bar Color Coding:

Candles change color based on the current filter conditions to support quick visual confirmation.

Signal Labels:

Clear “Long” and “Short” labels are plotted near the long-term Hull MA to mark filtered entries with precision.

Signal Logic

Buy Signal Criteria:

Price crosses above the ATR trailing stop.

Trend filter confirms bullish momentum:

Long-term MA (ma3) is below mid- and short-term MAs, and short-term MA is above the mid-term MA.

Sell Signal Criteria:

Price crosses below the ATR trailing stop.

Trend filter confirms bearish momentum:

Long-term MA (ma3) is above mid- and short-term MAs, and mid-term MA is above the short-term MA.

Customization Parameters

Sensitivity (Gyro): Controls the width of the ATR stop.

Trade Type: Switch between "Scalp" and "Hold" setups.

Show MA Toggle: Option to enable/disable the Hull MA visualization.

Usage Guidelines

This tool is best used in trending or semi-trending market conditions. It is not designed for choppy, low-volatility ranges. Use the Hull MA glow and candle color coding to quickly assess trend alignment before acting on signals.

Disclaimer

This is a Lite version and intended for educational purposes only. No guarantees are made regarding profitability or signal accuracy. Always test thoroughly and use proper risk management. For advanced features such as alerts, backtesting, or multi-timeframe logic, consider upgrading to a full version from DTCTradingClub

Script Type: Indicator | Overlay

Version: Lite

Powered by: DTCTradingClub

Overview

Range Signal - Lite is a precision-based signal indicator developed to identify filtered long and short opportunities using a combination of ATR-based trailing stops and trend-confirming Hull Moving Averages (HMA). The indicator is designed to reduce false signals and enhance entry timing for both short-term and trend-following traders.

Key Features

ATR Trailing Stop System:

Dynamically calculated stop levels based on user-defined sensitivity to recent volatility. The system ensures signals are reactive yet robust during fast market moves.

Triple Hull MA Filter:

The script utilizes three Hull Moving Averages to assess trend strength and direction. Signals are validated only when the short-, medium-, and long-term HMAs align in a directional bias.

Trade Mode Configuration:

Switch between Scalp and Hold modes:

Scalp Mode uses faster MA periods for quick, responsive entries.

Hold Mode uses slower MA periods to align with broader trends.

Hull MA Glow Visualization:

A glowing trail is applied to the Hull MA, changing color dynamically:

Green for buy bias

Red for sell bias

Gray for neutral zones

Bar Color Coding:

Candles change color based on the current filter conditions to support quick visual confirmation.

Signal Labels:

Clear “Long” and “Short” labels are plotted near the long-term Hull MA to mark filtered entries with precision.

Signal Logic

Buy Signal Criteria:

Price crosses above the ATR trailing stop.

Trend filter confirms bullish momentum:

Long-term MA (ma3) is below mid- and short-term MAs, and short-term MA is above the mid-term MA.

Sell Signal Criteria:

Price crosses below the ATR trailing stop.

Trend filter confirms bearish momentum:

Long-term MA (ma3) is above mid- and short-term MAs, and mid-term MA is above the short-term MA.

Customization Parameters

Sensitivity (Gyro): Controls the width of the ATR stop.

Trade Type: Switch between "Scalp" and "Hold" setups.

Show MA Toggle: Option to enable/disable the Hull MA visualization.

Usage Guidelines

This tool is best used in trending or semi-trending market conditions. It is not designed for choppy, low-volatility ranges. Use the Hull MA glow and candle color coding to quickly assess trend alignment before acting on signals.

Disclaimer

This is a Lite version and intended for educational purposes only. No guarantees are made regarding profitability or signal accuracy. Always test thoroughly and use proper risk management. For advanced features such as alerts, backtesting, or multi-timeframe logic, consider upgrading to a full version from DTCTradingClub

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.