PROTECTED SOURCE SCRIPT

Aggiornato First Presented Fair Value Gap [TakingProphets]

🧠 Indicator Purpose:

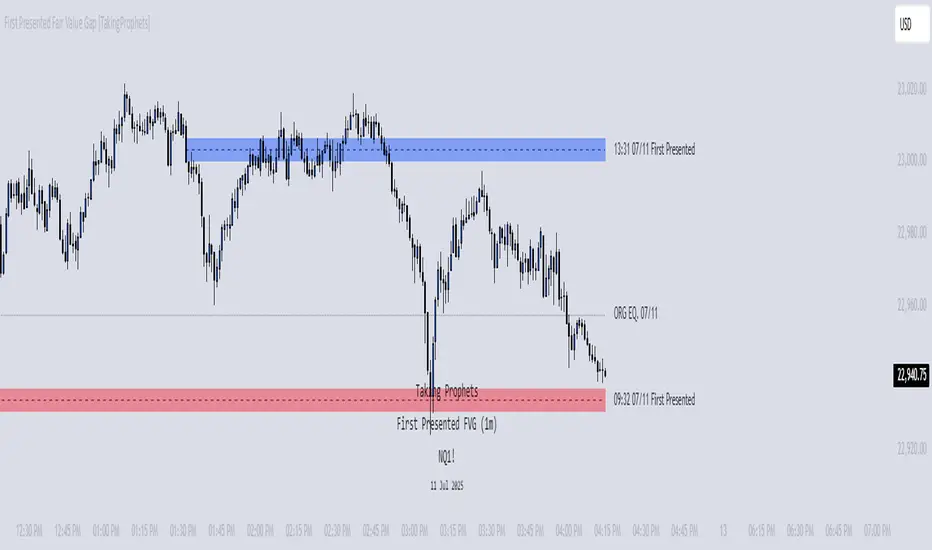

The "First Presented Fair Value Gap" (FPFVG) by Taking Prophets is a precision tool designed for traders utilizing Inner Circle Trader (ICT) concepts. It automatically detects and highlights the first valid Fair Value Gap (FVG) that forms between 9:30 AM and 10:00 AM New York time — one of the most critical windows in ICT-based trading frameworks.

It also plots the Opening Range Equilibrium (the average of the previous day's 4:14 PM close and today's 9:30 AM open) — a key ICT reference point for premium/discount analysis.

🌟 What Makes This Indicator Unique:

This script is highly specialized for early session trading and offers:

Automatic Detection: Finds the first Fair Value Gap after the 9:30 AM NYSE open.

Clear Visualization: Highlights the FVG zone and labels it with optional time stamps.

Equilibrium Line: Plots the Opening Range Equilibrium for instant premium/discount context.

Time-Sensitive Logic: Limits detection to the most volatile early session (9:30 AM - 10:00 AM).

Extension Options: You can extend both the FVG box and Equilibrium line out to 3:45 PM (end of major session liquidity).

⚙️ How the Indicator Works (Detailed):

Pre-Market Setup:

Captures the previous day's 4:14 PM close.

Captures today's 9:30 AM open.

Calculates the Equilibrium (midpoint between the two).

After 9:30 AM (New York Time):

Monitors each 1-minute candle for the creation of a Fair Value Gap:

Bullish FVG: Low of the current candle is above the high two candles ago.

Bearish FVG: High of the current candle is below the low two candles ago.

The first valid gap is boxed and optionally labeled.

Post-Detection Management:

The FVG box and label extend forward in time until 3:45 PM (or the current time, based on settings).

If enabled, the Equilibrium line and label also extend to help with premium/discount analysis.

🎯 How to Use It:

Step 1: Wait for market open (9:30 AM New York time).

Step 2: Watch for the first presented FVG on the 1-minute chart.

Step 3: Use the FPFVG zone to guide entries (retracements, rejections, or breaks).

Step 4: Use the Opening Range Equilibrium to determine premium vs. discount conditions:

Price above Equilibrium = Premium market.

Price below Equilibrium = Discount market.

Best Application:

In combination with ICT Killzones, especially during the London or New York Open.

When framing intraday bias and identifying optimal trade locations based on liquidity theory.

🔎 Underlying Concepts:

Fair Value Gaps: Price imbalances where liquidity is likely inefficient and future rebalancing can occur.

Opening Range Equilibrium: Key ICT price anchor used to separate premium and discount conditions post-open.

Time-Gated Setup: Limits focus to early session price action, aligning with inner circle trader timing models.

🎨 Customization Options:

FVG color, label visibility, and label size.

Opening Range Equilibrium line visibility and label styling.

Extend lines and boxes to 3:45 PM automatically for full session tracking.

✅ Recommended for:

Traders applying Inner Circle Trader (ICT) models.

Intraday scalpers or day traders trading the New York session open.

Traders who want to frame early session bias and liquidity traps effectively.

The "First Presented Fair Value Gap" (FPFVG) by Taking Prophets is a precision tool designed for traders utilizing Inner Circle Trader (ICT) concepts. It automatically detects and highlights the first valid Fair Value Gap (FVG) that forms between 9:30 AM and 10:00 AM New York time — one of the most critical windows in ICT-based trading frameworks.

It also plots the Opening Range Equilibrium (the average of the previous day's 4:14 PM close and today's 9:30 AM open) — a key ICT reference point for premium/discount analysis.

🌟 What Makes This Indicator Unique:

This script is highly specialized for early session trading and offers:

Automatic Detection: Finds the first Fair Value Gap after the 9:30 AM NYSE open.

Clear Visualization: Highlights the FVG zone and labels it with optional time stamps.

Equilibrium Line: Plots the Opening Range Equilibrium for instant premium/discount context.

Time-Sensitive Logic: Limits detection to the most volatile early session (9:30 AM - 10:00 AM).

Extension Options: You can extend both the FVG box and Equilibrium line out to 3:45 PM (end of major session liquidity).

⚙️ How the Indicator Works (Detailed):

Pre-Market Setup:

Captures the previous day's 4:14 PM close.

Captures today's 9:30 AM open.

Calculates the Equilibrium (midpoint between the two).

After 9:30 AM (New York Time):

Monitors each 1-minute candle for the creation of a Fair Value Gap:

Bullish FVG: Low of the current candle is above the high two candles ago.

Bearish FVG: High of the current candle is below the low two candles ago.

The first valid gap is boxed and optionally labeled.

Post-Detection Management:

The FVG box and label extend forward in time until 3:45 PM (or the current time, based on settings).

If enabled, the Equilibrium line and label also extend to help with premium/discount analysis.

🎯 How to Use It:

Step 1: Wait for market open (9:30 AM New York time).

Step 2: Watch for the first presented FVG on the 1-minute chart.

Step 3: Use the FPFVG zone to guide entries (retracements, rejections, or breaks).

Step 4: Use the Opening Range Equilibrium to determine premium vs. discount conditions:

Price above Equilibrium = Premium market.

Price below Equilibrium = Discount market.

Best Application:

In combination with ICT Killzones, especially during the London or New York Open.

When framing intraday bias and identifying optimal trade locations based on liquidity theory.

🔎 Underlying Concepts:

Fair Value Gaps: Price imbalances where liquidity is likely inefficient and future rebalancing can occur.

Opening Range Equilibrium: Key ICT price anchor used to separate premium and discount conditions post-open.

Time-Gated Setup: Limits focus to early session price action, aligning with inner circle trader timing models.

🎨 Customization Options:

FVG color, label visibility, and label size.

Opening Range Equilibrium line visibility and label styling.

Extend lines and boxes to 3:45 PM automatically for full session tracking.

✅ Recommended for:

Traders applying Inner Circle Trader (ICT) models.

Intraday scalpers or day traders trading the New York session open.

Traders who want to frame early session bias and liquidity traps effectively.

Note di rilascio

-Bug fixingNote di rilascio

Bug FixesNote di rilascio

Update:Changed to now show gaps from previous 3 trading days

Note di rilascio

UPDATE: NOW SHOWING PM GAPS !

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.