SEMA JMA | QuantEdgeB

📈 Introducing SEMA JMA by QuantEdgeB

🛠️ Overview

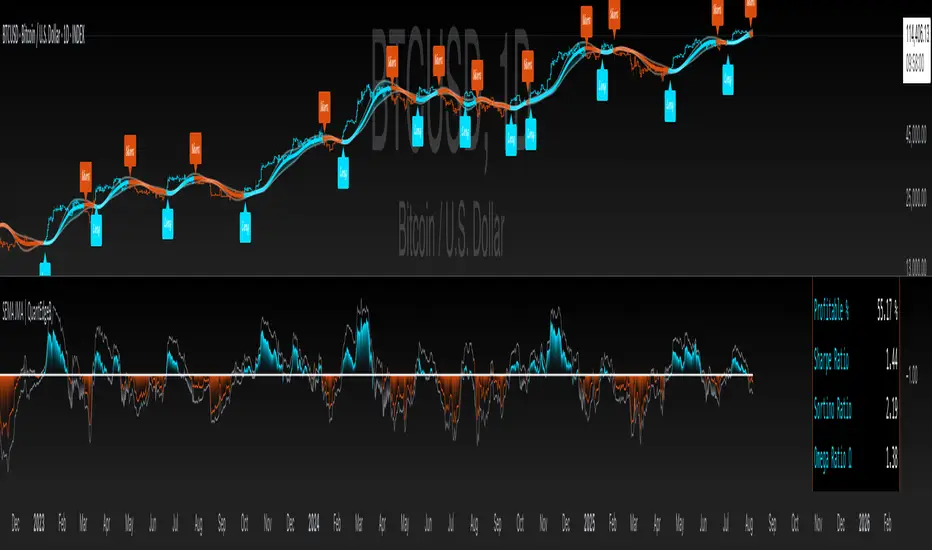

SEMA JMA is a precision-engineered, dual-signal trend indicator that blends Jurik Moving Average (JMA) logic with Double Exponential Moving Average (DEMA) smoothing and normalized statistical filters.

This advanced indicator is built for high-quality trend detection, reducing false signals by confirming momentum through both price-based SD bands and normalized JMA logic. The result is a powerful, noise-filtered tool ideal for directional trading in volatile and ranging environments.

SEMA JMA offers adaptive volatility bands, backtest-ready analytics, and dynamic signal labeling, making it a favorite for traders demanding speed, precision, and strategic clarity.

✨ Key Features

🔹 Hybrid JMA + DEMA Core

Combines the ultra-smooth JMA with lag-reducing DEMA for exceptional trend clarity.

🔹 Volatility-Based SD Band Filtering

Uses rolling standard deviation on JMA for adaptive long/short bands that respond to market dynamics.

🔹 Normalized Price Filter Confirmation

A second JMA stream is normalized against price and filtered via SD for added trend confirmation and false signal suppression.

🔹 Backtest Integration & Equity Curve Plotting

Built-in compatibility with QuantEdgeB/BacktestingIndV2, delivering historical metrics, equity visualization, and strategic evaluation.

🔹 Fully Customizable UI

Includes label toggles, signal overlays, visual themes, and backtest table position selection.

📊 How It Works

1️⃣ JMA-DEMA Hybrid Trend Engine

The foundation of SEMA JMA lies in a custom-built JMA engine, enhanced by a DEMA smoothing layer to:

• Minimize lag without losing trend integrity.

• Maintain responsiveness in noisy or low-volume environments.

• Create a central trend structure used by both raw price and normalized filters.

2️⃣ Standard Deviation Band Filtering

SEMA JMA applies a rolling SD filter over the JMA signal. This creates adaptive upper and lower bands:

• Long Signal = Price > Upper Band

• Short Signal = Price < Lower Band

These bands adjust based on price volatility, offering a dynamic alternative to traditional fixed thresholds.

3️⃣ Normalized JMA for Momentum Confirmation

A second JMA-DEMA structure is normalized by dividing by price, then smoothed:

• If the normalized signal rises above -1, it suggests upside pressure.

• If it drops below -1, it signals momentum decay.

Only when both raw and normalized signals agree does the indicator issue a trade trigger.

✅ Signal Logic

📌 Long Signal →

🔹 Price breaks above volatility-adjusted upper SD band

🔹 AND Normalized JMA rises above -1

📌 Short Signal →

🔹 Price breaks below lower SD band

🔹 AND Normalized JMA falls below -1

⚙️ SEMA JMA stays in its active trend state until an opposing signal triggers, enabling tren riding while filtering short lived swings.

👥 Who Should Use It?

✅ Swing & Trend Traders → Ride strong directional moves with reduced whipsaws

✅ Volatility-Adaptive Systems → Filter trades using rolling SD-based thresholds

✅ Quantitative Strategy Builders → Deploy within algo-driven strategies using backtest-ready metrics

✅ Risk-Aware Traders → Use dual confirmation to minimize signal risk

⚙️ Customization & Default Settings

🔧 Core Settings:

• JMA Length (Default: 35) → Defines JMA sensitivity.

• DEMA Length (Default: 20) → Smoothing after JMA to refine structure.

• Normalized JMA Lengths → Control confirmation layer smoothness (default: 1 for short and long).

• Standard Deviation Length (Default: 30) → Determines the volatility lookback.

• SD Weight Factors → Separate values for long (default: 1.0) and short (default: 1.002) bands.

📊 Backtest Mode

SEMA JMA includes an optional backtest table, enabling traders to assess its historical effectiveness before applying it in live trading conditions.

🔹 Backtest Metrics Displayed:

• Equity Max Drawdown → Largest historical loss from peak equity.

• Profit Factor → Ratio of total profits to total losses, measuring system efficiency.

• Sharpe Ratio → Assesses risk-adjusted return performance.

• Sortino Ratio → Focuses on downside risk-adjusted returns.

• Omega Ratio → Evaluates return consistency & performance asymmetry.

• Half Kelly → Optimal position sizing based on risk/reward analysis.

• Total Trades & Win Rate → Assess historical success rate.

📌 Disclaimer:

Backtest results are based on past performance and do not guarantee future success. Always incorporate real-time validation and risk management in live trading.

🚀 Why This Matters?

✅ Strategy Validation → Gain insight into historical trend accuracy.

✅ Customization Insights → See how different settings impact performance.

✅ Risk Awareness → Understand potential drawdowns before deploying capital.

📌 How to Use SEMA JMA

🌀 Trend-Following Strategy

✔ Go Long: When price breaks above SD band and normalized momentum rises

✔ Go Short: When price breaks below SD band and normalized momentum falls

✔ Stay in position: Until signal reversal confirms

⚙️ Volatility-Adaptive Configuration

✔ Tune w1 (Long SD weight) and w2 (Short SD weight) for responsiveness

✔ Increase SD length in noisy markets for smoother bands

📌 Conclusion

SEMA JMA by QuantEdgeB delivers surgical precision trend signals using a dual-layer approach:

• JMA + DEMA core smoothing

• Statistical SD breakout filters

• Normalized confirmation logic

It’s a versatile indicator suited for trend-following, volatility tracking, and system-based signal generation—engineered for clarity, confidence, and adaptability.

🔹 Key Takeaways:

1️⃣ Multi-Filter Trend Logic – JMA + DEMA + Normalized filtering for high-confidence signals

2️⃣ SD-Based Volatility Control – Reduces noise, avoids ATR limitations

3️⃣ Quant-Ready System – Includes full backtesting

📌 Master your market edge with precision – SEMA JMA | QuantEdgeB

🔹 Disclaimer: Past performance is not indicative of future results.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente QuantEdgeB.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente QuantEdgeB.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only