The Samurai

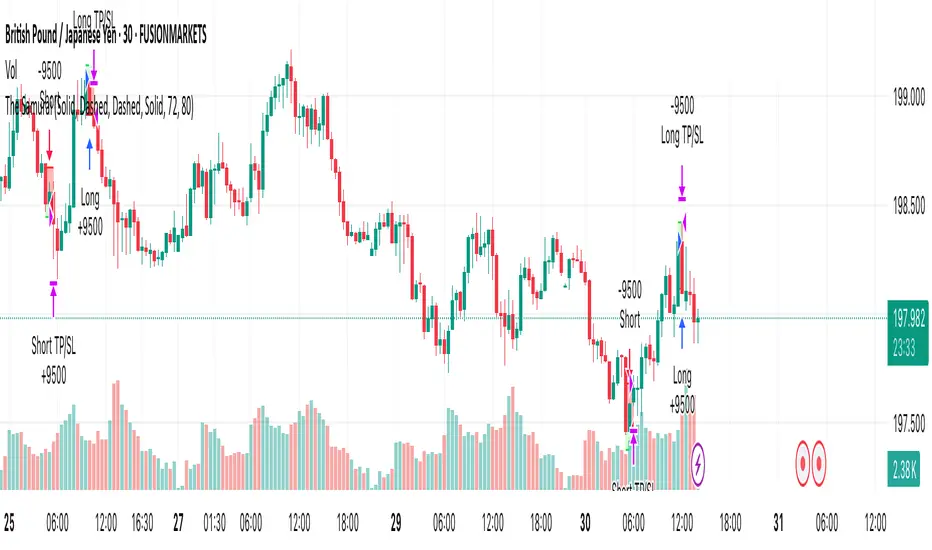

This strategy implements a session-based range breakout system specifically designed for GBP/JPY trading. The approach focuses on identifying key price ranges during specific market sessions and trading breakouts of these ranges during optimal trading windows. The strategy combines multi-timeframe analysis using 30-minute data with precise session timing to capture high-probability breakout moves.

Entry Logic

The strategy operates on a two-phase approach:

Range Collection Phase:

Monitors price action during a specified session window

Identifies session high and low levels

Only collects ranges on selected trading days

Trading Phase:

Long Entry: Price closes above the established session high

Short Entry: Price closes below the established session low

Entries only occur on valid trading days (day after range collection)

One trade per direction per session to prevent overtrading

Exit Conditions

Stop Loss: Set at a percentage of the session range below entry (long) or above entry (short)

Take Profit: Calculated using a Risk-Reward Ratio based on stop loss distance

Session Close: All positions are closed at the end of the trading window

Risk Management Features

Fixed risk-reward ratio of for consistent risk management

Stop loss calculated as percentage of session range for adaptive sizing

Visual risk/reward boxes display potential outcomes before entry

Daily session close protection prevents overnight exposure

Visual Features

Customizable Colors: Full control over line colors, styles, and box opacities

Risk/Reward Visualization: Color-coded boxes showing potential profit and loss zones

Take Profit Lines: TP level with different line styles for clarity

Stop Loss Line: Clear visual indication of risk level

Clean Interface: Streamlined settings focused on essential visual customization

Important Notes

Timeframe Dependency: Strategy uses 30-minute data regardless of chart timeframe for consistency

Session Timing: All times are in UTC - ensure proper timezone conversion for your location

Trading Days: Default setup trades Tuesday-Friday ranges (Monday-Thursday collection)

Single Position: Only one position per direction per session to maintain discipline

No Pyramiding: Strategy prevents position averaging to maintain clear risk parameters

Suggested Use

Recommended Pairs: Optimized for GBP/JPY but may work on other volatile pairs

Best Timeframes: Display on any timeframe (strategy uses 30m data internally)

Session Awareness: Most effective during high-volatility session transitions

Risk Management: Consider position sizing based on account risk tolerance

Market Conditions: Performs best in trending or breakout market environments

Backtesting Considerations

Strategy includes realistic entry/exit conditions based on closing prices

Visual elements help understand historical performance context

Built-in position management prevents unrealistic results

Session-based logic ensures trades align with actual market sessions

This strategy is designed for traders who prefer systematic, rule-based approaches to breakout trading with clear risk management parameters. The visual feedback helps in understanding market context and decision-making process.

Disclaimer: Past performance does not guarantee future results. Always test thoroughly on historical data and consider your risk tolerance before live trading.

This strategy implements a session-based range breakout system specifically designed for GBP/JPY trading. The approach focuses on identifying key price ranges during specific market sessions and trading breakouts of these ranges during optimal trading windows. The strategy combines multi-timeframe analysis using 30-minute data with precise session timing to capture high-probability breakout moves.

08/01/2025 Update - Allows for visual panel range selection TP1, TP2, TP3

Entry Logic

The strategy operates on a two-phase approach:

Range Collection Phase:

Monitors price action during a specified session window

Identifies session high and low levels

Only collects ranges on selected trading days

Trading Phase:

Long Entry: Price closes above the established session high

Short Entry: Price closes below the established session low

Entries only occur on valid trading days (day after range collection)

One trade per direction per session to prevent overtrading

Exit Conditions

Stop Loss: Set at a percentage of the session range below entry (long) or above entry (short)

Take Profit: Calculated using a Risk-Reward Ratio based on stop loss distance

Session Close: All positions are closed at the end of the trading window

Risk Management Features

Fixed risk-reward ratio of for consistent risk management

Stop loss calculated as percentage of session range for adaptive sizing

Visual risk/reward boxes display potential outcomes before entry

Daily session close protection prevents overnight exposure

Visual Features

Customizable Colors: Full control over line colors, styles, and box opacities

Risk/Reward Visualization: Color-coded boxes showing potential profit and loss zones

Take Profit Lines: TP level with different line styles for clarity

Stop Loss Line: Clear visual indication of risk level

Clean Interface: Streamlined settings focused on essential visual customization

Important Notes

Timeframe Dependency: Strategy uses 30-minute data regardless of chart timeframe for consistency

Session Timing: All times are in UTC - ensure proper timezone conversion for your location

Trading Days: Default setup trades Tuesday-Friday ranges (Monday-Thursday collection)

Single Position: Only one position per direction per session to maintain discipline

No Pyramiding: Strategy prevents position averaging to maintain clear risk parameters

Suggested Use

Recommended Pairs: Optimized for GBP/JPY but may work on other volatile pairs

Best Timeframes: Display on any timeframe (strategy uses 30m data internally)

Session Awareness: Most effective during high-volatility session transitions

Risk Management: Consider position sizing based on account risk tolerance

Market Conditions: Performs best in trending or breakout market environments

Backtesting Considerations

Strategy includes realistic entry/exit conditions based on closing prices

Visual elements help understand historical performance context

Built-in position management prevents unrealistic results

Session-based logic ensures trades align with actual market sessions

This strategy is designed for traders who prefer systematic, rule-based approaches to breakout trading with clear risk management parameters. The visual feedback helps in understanding market context and decision-making process.

Disclaimer: Past performance does not guarantee future results. Always test thoroughly on historical data and consider your risk tolerance before live trading.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente tradexorb.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente tradexorb.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.