OPEN-SOURCE SCRIPT

Aggiornato [blackcat] L1 volume Oscillator Indicator

Level: 1

Background

Omega Research proposed volume oscillator indicator in June 2000.

Function

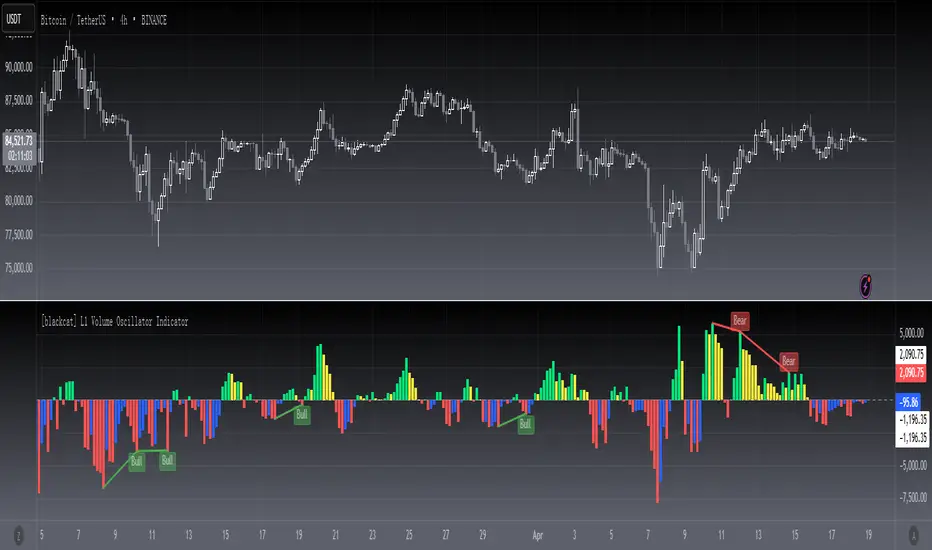

This is actually a volume-price indicator. With columns greater than zero line, which indicates a up trend. Otherwise, it is a down trend. Green columns indicate up trend pump; yellow columns indicate up trend retracements; red columns indicate down trend dump; blue columns indicate down trend re-bounce.

Key Signal

VolOsc --> volume osillator indicator.

Remarks

This is a Level 1 free and open source indicator.

Feedbacks are appreciated.

Background

Omega Research proposed volume oscillator indicator in June 2000.

Function

This is actually a volume-price indicator. With columns greater than zero line, which indicates a up trend. Otherwise, it is a down trend. Green columns indicate up trend pump; yellow columns indicate up trend retracements; red columns indicate down trend dump; blue columns indicate down trend re-bounce.

Key Signal

VolOsc --> volume osillator indicator.

Remarks

This is a Level 1 free and open source indicator.

Feedbacks are appreciated.

Note di rilascio

OVERVIEWThe L1 Volume Oscillator Indicator by blackcat1402 is designed to help traders identify potential buy or sell opportunities based on volume divergences in the market. This script calculates a volume oscillator using customizable average lengths and detects various types of divergences (regular and hidden). It plots these divergences directly on the chart with clear labels and colors, making it easier for users to spot trends and make informed trading decisions.

This indicator supports four main types of divergences:

Regular Bullish Divergences 📈💚

Hidden Bullish Divergences 📉💛

Regular Bearish Divergences 📉❤️🔥

Hidden Bearish Divergences 📈🧡

It also provides alert conditions that can be used to notify you when specific divergence patterns are detected.

FEATURES

Customizable average length for calculating the volume oscillator.

Detection of both regular and hidden bullish/bearish divergences.

Clear plotting of divergences with distinct colors and labels.

Alerts for different types of divergences.

Adjustable lookback ranges for detecting pivots.

HOW TO USE

Add the L1 Volume Oscillator indicator to your TradingView chart.

Configure the input parameters according to your preferences:

Average Length: The period over which the volume oscillator is calculated.

Pivot Lookback Right/Lef: The number of bars to consider for identifying pivots.

Max/MIn of Lookback Range: Define the range within which to detect divergences.

Enable/disable the plotting of each type of divergence as needed.

Set up alerts if desired to receive notifications when specific divergence patterns occur.

INPUT PARAMETERS

Average Length: Defines the period for calculating the volume oscillator.

Pivot Lookback Left/Right: Specifies the number of bars to analyze for detecting pivots.

Max/Min of Lookback Range: Sets the upper and lower bounds for detecting divergences.

Plot Options:

Plot Bullish: Toggle to show/hide regular bullish divergences.

Plot Hidden Bullish: Toggle to show/hide hidden bullish divergences.

Plot Bearish: Toggle to show/hide regular bearish divergences.

Plot Hidden Bearish: Toggle to show/hide hidden bearish divergences.

NOTES

Ensure that the maximum bars back setting is sufficient to capture all necessary data points.

Experiment with different parameter values to optimize performance for your specific trading strategy.

Use this indicator alongside other technical analysis tools for more robust decision-making.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.