PROTECTED SOURCE SCRIPT

Aggiornato Session Overlaps & KZ's @MaxMaserati

Session Overlap & KZ's MaxMaserati - Indicator Explanation

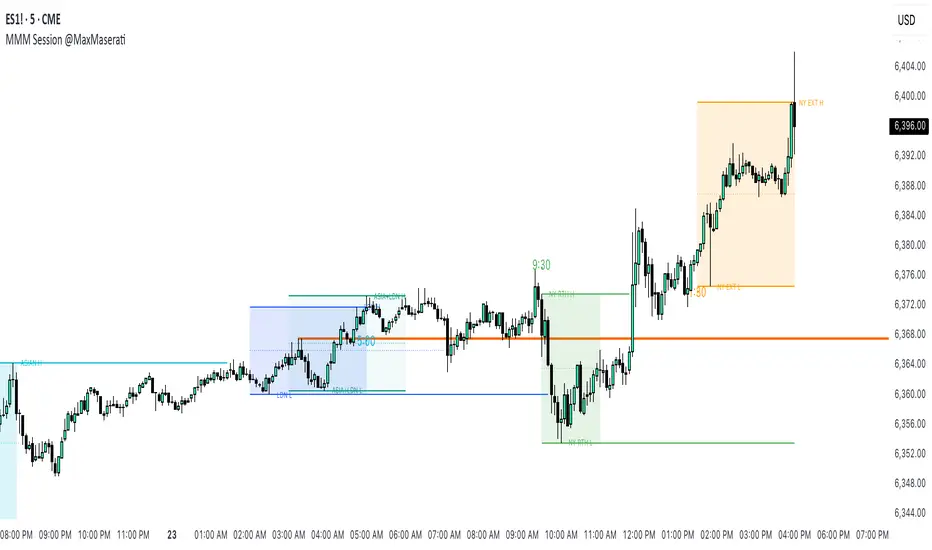

This comprehensive trading session indicator specializes in identifying critical market overlap periods and key session levels with two main operating modes: Normal Sessions and ICT KZ's

Dual Session Modes:

- Normal Sessions: Extended timeframes (Asia 9PM-6AM, London 3AM-12PM, NY AM 8AM-5PM, NY PM 1-7PM)

- ICT Killzones: Focused timeframes (Asia 6-8PM, London 2-5AM, NY AM 9:30-11AM, NY PM 1:30-4PM)

Primary Focus - Market Overlap Sessions:

- Asian + London Overlap (3-6AM ET): The most volatile early morning period when Asian and London markets intersect, creating significant liquidity and price movement opportunities.

- London + NY Overlap (8AM-12PM ET): The highest volume trading window of the day when London and New York markets are simultaneously active, offering maximum institutional activity and trend continuation.

- London Solo (6-8AM ET): Pure London trading period after Asian close but before NY open, often used for trend establishment and key level testing.

- NY Solo (12-5PM ET): Isolated New York session after London close, typically showing strong directional moves and institutional positioning.

- NY AM + PM Overlap (1:30-4PM ET): Critical afternoon overlap period when morning and afternoon NY sessions intersect, often marking significant reversal or continuation points.

Session Level Analysis:

Tracks High, Low, and Midpoint levels for each active session and overlap period

Smart line extension that continues levels until price interaction

Visual session boxes with customizable transparency

Show Only Overlaps mode to focus purely on market intersection periods

Critical Time Markers:

9:30 AM: NY AM Open (green dot)

5:00 AM: MMM Foundational time for MMM trading strategies (blue dot)

1:30 PM: NY PM Open (orange dot)

Additional Features:

Previous Day High/Low (PDH/PDL) levels

Multi-timezone support

Session limit control (last 3 sets by default)

Optimized for 15-minute and lower timeframes

Full customization of colors, labels, and styles

This indicator is essential for overlap-based trading strategies, providing clear visual identification of high-probability windows when multiple markets create enhanced liquidity and institutional activity.

This comprehensive trading session indicator specializes in identifying critical market overlap periods and key session levels with two main operating modes: Normal Sessions and ICT KZ's

Dual Session Modes:

- Normal Sessions: Extended timeframes (Asia 9PM-6AM, London 3AM-12PM, NY AM 8AM-5PM, NY PM 1-7PM)

- ICT Killzones: Focused timeframes (Asia 6-8PM, London 2-5AM, NY AM 9:30-11AM, NY PM 1:30-4PM)

Primary Focus - Market Overlap Sessions:

- Asian + London Overlap (3-6AM ET): The most volatile early morning period when Asian and London markets intersect, creating significant liquidity and price movement opportunities.

- London + NY Overlap (8AM-12PM ET): The highest volume trading window of the day when London and New York markets are simultaneously active, offering maximum institutional activity and trend continuation.

- London Solo (6-8AM ET): Pure London trading period after Asian close but before NY open, often used for trend establishment and key level testing.

- NY Solo (12-5PM ET): Isolated New York session after London close, typically showing strong directional moves and institutional positioning.

- NY AM + PM Overlap (1:30-4PM ET): Critical afternoon overlap period when morning and afternoon NY sessions intersect, often marking significant reversal or continuation points.

Session Level Analysis:

Tracks High, Low, and Midpoint levels for each active session and overlap period

Smart line extension that continues levels until price interaction

Visual session boxes with customizable transparency

Show Only Overlaps mode to focus purely on market intersection periods

Critical Time Markers:

9:30 AM: NY AM Open (green dot)

5:00 AM: MMM Foundational time for MMM trading strategies (blue dot)

1:30 PM: NY PM Open (orange dot)

Additional Features:

Previous Day High/Low (PDH/PDL) levels

Multi-timezone support

Session limit control (last 3 sets by default)

Optimized for 15-minute and lower timeframes

Full customization of colors, labels, and styles

This indicator is essential for overlap-based trading strategies, providing clear visual identification of high-probability windows when multiple markets create enhanced liquidity and institutional activity.

Note di rilascio

- Normal session and overlapping fixedScript protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

MMM : No body close (PO4), No Trade.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

MMM : No body close (PO4), No Trade.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.