OPEN-SOURCE SCRIPT

CTM — Composite Trend & Momentum

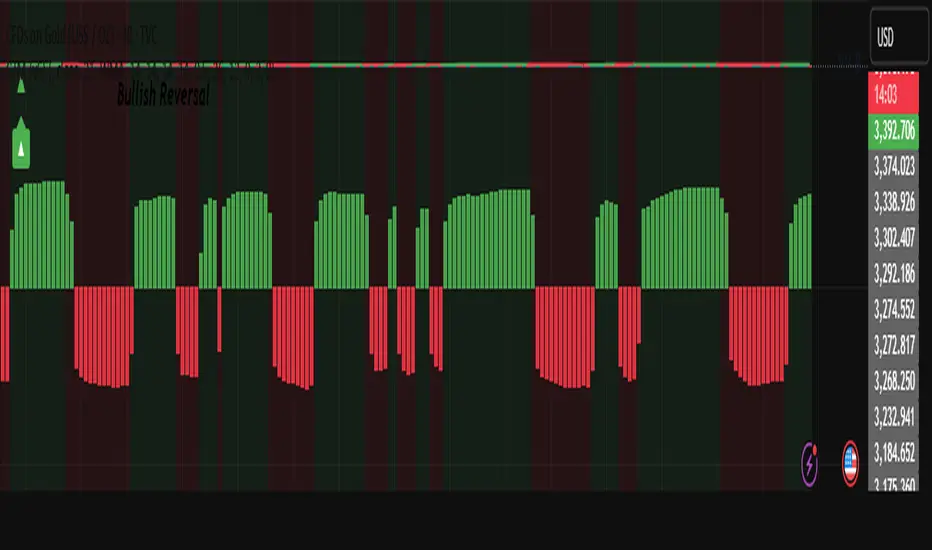

The Composite Trend & Momentum (CTM) indicator is designed to bring together multiple dimensions of market analysis — trend, momentum, and volatility — into a single, easy-to-read tool.

🔹 Trend Detection

Uses a Hull Moving Average (or optional SMA/EMA/WMA) to smooth price action.

Direction is confirmed with ADX (trend strength).

🔹 Momentum Signals

RSI is scaled to highlight overbought/oversold shifts.

MACD-style momentum is normalized against ATR for consistency across assets.

🔹 Volatility Filter

ATR ensures signals only appear when there’s enough price movement to matter.

Helps filter out false signals in flat markets.

🔹 Composite Score

All components are blended into a single “composite strength” line.

Histogram and background colors visualize bullish/bearish conditions.

🔹 Buy & Sell Signals

Arrows and markers show entry points when trend, momentum, and volatility align.

Alerts included for buy/sell signals and trend flips.

✅ Best used for:

Identifying when trend and momentum agree (stronger setups).

Filtering noise with volatility confirmation.

Swing trading and intraday setups across stocks, forex, crypto, and futures.

⚠️ Note: This is not financial advice. Always combine with risk management and your own analysis.

🔹 Trend Detection

Uses a Hull Moving Average (or optional SMA/EMA/WMA) to smooth price action.

Direction is confirmed with ADX (trend strength).

🔹 Momentum Signals

RSI is scaled to highlight overbought/oversold shifts.

MACD-style momentum is normalized against ATR for consistency across assets.

🔹 Volatility Filter

ATR ensures signals only appear when there’s enough price movement to matter.

Helps filter out false signals in flat markets.

🔹 Composite Score

All components are blended into a single “composite strength” line.

Histogram and background colors visualize bullish/bearish conditions.

🔹 Buy & Sell Signals

Arrows and markers show entry points when trend, momentum, and volatility align.

Alerts included for buy/sell signals and trend flips.

✅ Best used for:

Identifying when trend and momentum agree (stronger setups).

Filtering noise with volatility confirmation.

Swing trading and intraday setups across stocks, forex, crypto, and futures.

⚠️ Note: This is not financial advice. Always combine with risk management and your own analysis.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.