PROTECTED SOURCE SCRIPT

Aggiornato KB Dinamik Grid Bot V8 Trailing

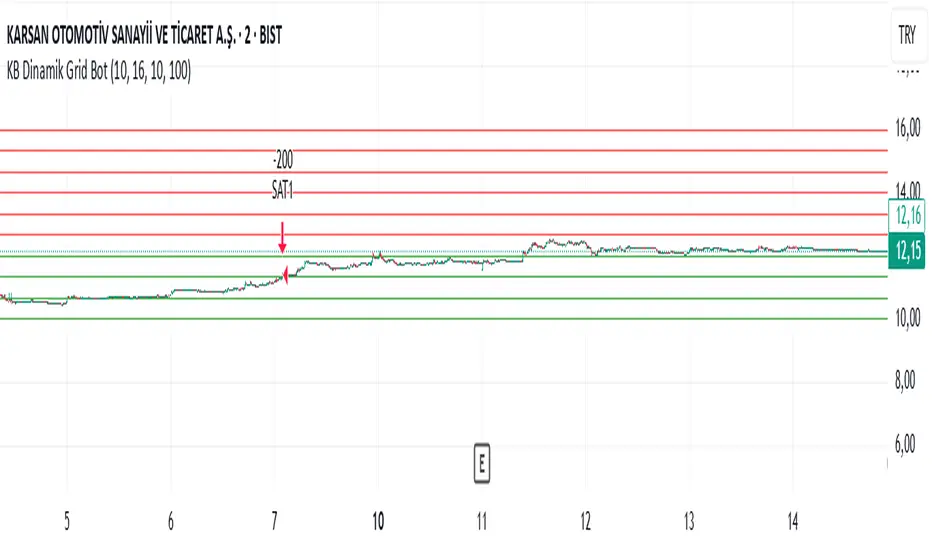

This Pine Script code aims to create a "Dynamic Grid Trading Bot" and perform automatic trading between price ranges. Let's break it down into sections to better understand its functions:

1. Settings and User Inputs

The user can specify the following parameters for the bot:

Lower and Upper Price Limit: Determines the price range where the grid levels are defined.

Number of Grid Lines: Defines how many levels the grid will consist of.

Transaction Amount: Specifies the trading volume for each trading transaction.

Start Date: The date when the bot will start trading.

Price Step (priceStep): Specifies specific steps after the comma to adjust the grid levels more precisely.

Trailing: A feature that activates dynamic selling by following price movements.

2. Calculating Grid Levels

Grid levels: Divides the specified price range into user-defined levels and rounds each level with priceStep.

Lines and labels: Lines and labels are created to visually represent grid levels.

3. Buying and Selling Logic

Buying Transaction: When the price approaches a lower grid level (as much as the offset) and the position is empty, a purchase is made.

Trailing Selling: If Trailing is active, a sale is made when the price passes the specified "trailing step" level.

Normal Selling: If Trailing is not active, a sale is made when the price approaches an upper grid level.

4. Profit and Statistics Tracking

The bot tracks the profit-loss status per transaction and in total.

The number of purchases and sales and net profit information are calculated from the start date.

5. Table Display

The bot places statistical data in a table:

Number of purchases and sales.

Starting date.

Total number of transactions.

Net profit.

Amount of open positions.

6. Drawing and Tracking

Each price movement is updated and the color of the grid lines (green or red) is changed depending on the price's status relative to the level.

This code is a strategy that aims to make a profit by continuously buying and selling in the event of price fluctuations within a range. The "Trailing" feature allows you to keep your profits when the price moves upwards. Net profit, open positions and other statistics are displayed in the table.

1. Settings and User Inputs

The user can specify the following parameters for the bot:

Lower and Upper Price Limit: Determines the price range where the grid levels are defined.

Number of Grid Lines: Defines how many levels the grid will consist of.

Transaction Amount: Specifies the trading volume for each trading transaction.

Start Date: The date when the bot will start trading.

Price Step (priceStep): Specifies specific steps after the comma to adjust the grid levels more precisely.

Trailing: A feature that activates dynamic selling by following price movements.

2. Calculating Grid Levels

Grid levels: Divides the specified price range into user-defined levels and rounds each level with priceStep.

Lines and labels: Lines and labels are created to visually represent grid levels.

3. Buying and Selling Logic

Buying Transaction: When the price approaches a lower grid level (as much as the offset) and the position is empty, a purchase is made.

Trailing Selling: If Trailing is active, a sale is made when the price passes the specified "trailing step" level.

Normal Selling: If Trailing is not active, a sale is made when the price approaches an upper grid level.

4. Profit and Statistics Tracking

The bot tracks the profit-loss status per transaction and in total.

The number of purchases and sales and net profit information are calculated from the start date.

5. Table Display

The bot places statistical data in a table:

Number of purchases and sales.

Starting date.

Total number of transactions.

Net profit.

Amount of open positions.

6. Drawing and Tracking

Each price movement is updated and the color of the grid lines (green or red) is changed depending on the price's status relative to the level.

This code is a strategy that aims to make a profit by continuously buying and selling in the event of price fluctuations within a range. The "Trailing" feature allows you to keep your profits when the price moves upwards. Net profit, open positions and other statistics are displayed in the table.

Note di rilascio

Grid trading is a strategy that aims to profit from price fluctuations by automatically placing buy and sell orders at certain price levels. This special script, named "KB Dynamic Grid Bot V19 TR + TDO + Stop + Share Settings", automatically performs buy-sell transactions and offers various analysis tools according to the parameters determined by the users.Grid Trading Strategy:

It creates a certain number of grid lines between the lower and upper price limits determined by the user.

When the price reaches these grid lines, it automatically places buy or sell orders.

Grid lines are created by rounding according to the price step.

Stock Settings:

The user can specify custom grid settings (lower/upper price, number of grids, share amount, price step, trailing stop, stop loss) for different stocks.

These settings can be defined separately for each stock.

It automatically implements a grid trading strategy according to the parameters determined by the users. This strategy, used to profit from price fluctuations, can be especially effective in volatile markets. Additionally, users can make custom settings for different stocks, increasing the flexibility of the strategy.

Note di rilascio

This code is used to implement a Grid Trading Strategy written in Pine Script on the TradingView platform. Grid trading is a strategy that aims to profit from price fluctuations by placing automatic buy-sell orders within a certain price range (between the lower and upper grid prices). This strategy can be especially effective in volatile (fluctuating) markets.Basic Functions of the Code:

Creating Grid Levels:

Automatically creates buy-sell levels (grid levels) according to a certain price range (lower and upper grid prices) and grid number.

For example, if the lower grid price is 50, the upper grid price is 100 and the grid number is 10, 10 equally spaced levels are determined between 50 and 100.

Buy-Sell Logic:

Automatically places a buy or sell order when the price reaches a certain grid level.

If the price increases by a certain amount after the purchase is made with the Trailing Stop feature, the sell order is automatically updated.

With the Stop Loss feature, the position is automatically closed when a certain loss level is exceeded.

Stock-Based Settings:

The code allows separate grid settings (lower/upper price, grid number, stock amount, price step, trailing stop and stop loss values) for 20 different stocks.

The settings specific to the stock being worked on are automatically applied.

Visualization:

Grid levels, top/bottom/midpoint lines and labels are displayed on the chart.

Transaction statistics (number of purchases and sales, net profit, open position, etc.) are displayed on the chart as a table.

Start Date and Performance Tracking:

The strategy works from a certain start date and follows the transactions after this date.

Information such as purchase-sale numbers, net profit and open position amount are calculated and displayed on the table.

Areas of Use of the Code:

Volatile Markets: In markets where prices fluctuate frequently, small profits can be accumulated with the grid trading strategy.

Automatic Trading: Suitable for those who want to trade with an automatic system instead of trading manually.

Multiple Stock Management: It is possible to work with different grid settings for multiple stocks at the same time.

Conclusion:

This code is an advanced tool for investors who want to implement an automatic grid trading strategy.

Note di rilascio

Grid trading is a strategy that aims to profit from price fluctuations by automatically placing buy and sell orders at specific price levels. This strategy is especially effective in range-bound markets.This strategy is used to profit from price fluctuations, especially in markets that move sideways.

Note di rilascio

Please contact us to use the current version.Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.