OPEN-SOURCE SCRIPT

Aggiornato QuantumTrend SwiftEdge

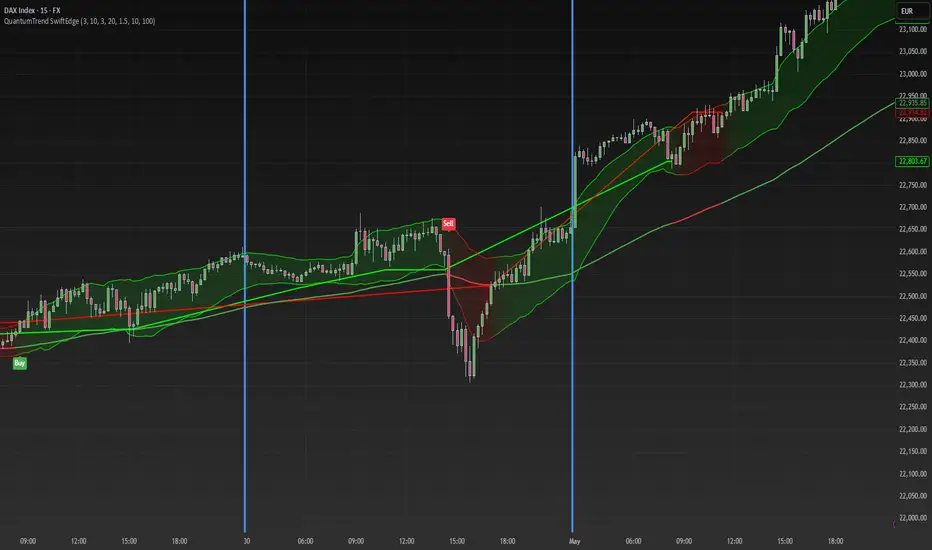

QuantumTrend SwiftEdge - A Trend-Following Indicator for TradingView

Overview:

QuantumTrend SwiftEdge is a visually engaging and customizable trend-following indicator that combines the power of Supertrend, Keltner Channels, and a 100-period EMA to generate precise buy and sell signals. Designed to help traders identify trends and breakouts, this indicator offers a unique blend of technical tools with a modern gradient color effect, making it both functional and visually appealing.

What It Does:

This indicator identifies trend directions and potential entry/exit points:

- Supertrend determines the overall trend direction, showing a green line below the price during uptrends and a red line above the price during downtrends. The line only appears when the price is close to it, indicating an active trend.

- Keltner Channels highlight volatility and breakouts, with the upper and lower bands dynamically adjusting to market conditions.

- A 100-period EMA provides a longer-term trend perspective, helping to filter out noise.

- Buy and sell signals are generated when specific conditions align across these indicators, ensuring robust trade setups.

How It Works:

The indicator uses three components to generate signals:

1. **Supertrend**: Calculates trend direction using the Average True Range (ATR) and a multiplier. It switches between uptrend (green) and downtrend (red) based on price movements relative to the Supertrend line.

2. **Keltner Channels**: Consists of an EMA (default 20 periods) with upper and lower bands based on ATR. A breakout above the upper band signals potential buying opportunities, while a breakout below the lower band signals potential selling opportunities.

3. **100-period EMA**: Acts as a trend filter, ensuring signals align with the broader market direction.

**Buy Signal**:

- Price is above the 100-period EMA (bullish market).

- Price breaks above the Keltner Channel upper band (indicating a breakout).

- Supertrend switches to an uptrend (trend changes from down to up).

**Sell Signal**:

- Price is below the 100-period EMA (bearish market).

- Price breaks below the Keltner Channel lower band (indicating a breakout).

- Supertrend switches to a downtrend (trend changes from up to down).

Visual Features:

- **Gradient Colors**: Supertrend lines and Keltner Channels use a smooth gradient color transition between green (uptrend) and red (downtrend), reflecting the trend's strength. The gradient is based on a smoothed trend value, creating a visually appealing effect.

- **Keltner Channel Fill**: The area between the upper and lower Keltner Channels is filled with a transparent gradient, enhancing the trend visualization.

- **Dynamic Supertrend Visibility**: Supertrend lines only appear when the price is close to the line (within an ATR-based threshold), indicating an active trend.

How to Use:

1. Add the "QuantumTrend SwiftEdge" indicator to your chart in TradingView.

2. Customize the settings:

- **Signal Sensitivity (1=Low, 5=High)**: Default is 3. Lower values (e.g., 1) make signals less frequent by using wider parameters, while higher values (e.g., 5) make signals more frequent by tightening parameters.

- **Use Manual Settings**: If enabled, you can manually adjust all parameters (ATR Period, ATR Multiplier, Keltner Channel Length, Keltner Channel Multiplier, Keltner ATR Length, EMA Length) to fine-tune the indicator.

- **Change ATR Calculation Method**: Toggle between standard ATR calculation and a simple moving average of true range.

- **Show Buy/Sell Signals**: Toggle to show or hide buy (green "Buy" label) and sell (red "Sell" label) signals.

- **Highlighter On/Off**: Toggle to show or hide the gradient fill between the price and Supertrend line when the line is visible.

3. Interpret the signals:

- A green "Buy" label below the price indicates a potential buying opportunity.

- A red "Sell" label above the price indicates a potential selling opportunity.

- Use the Keltner Channel gradient fill and Supertrend lines to confirm the trend direction and strength.

Why This Combination?

- **Supertrend** provides a robust trend-following mechanism, ensuring signals align with the market direction.

- **Keltner Channels** add a volatility component, identifying breakouts that often precede significant price movements.

- **100-period EMA** filters out noise, ensuring signals are generated in the context of the broader trend.

Together, these indicators create a balanced approach: Supertrend and EMA confirm the trend, while Keltner Channels pinpoint actionable entry and exit points. The gradient visuals and dynamic visibility make it easier to focus on active trends.

Originality:

QuantumTrend SwiftEdge stands out with its unique features:

- Gradient color transitions for a modern, dynamic look.

- A filled gradient between Keltner Channels, visually emphasizing the trend.

- Supertrend lines that only appear when the price is close, reducing clutter and focusing on active trends.

- Flexible settings with both sensitivity-based and manual adjustments for maximum customization.

Default Settings:

The default sensitivity is set to 3, providing a balanced approach for most markets and timeframes (e.g., 5-minute charts for crypto like BTC/USD). This setting uses moderate parameters (ATR Period=10, ATR Multiplier=3.0, Keltner Channel Length=20, Keltner Channel Multiplier=1.5, Keltner ATR Length=10, EMA Length=100). Users can adjust the sensitivity or switch to manual settings for more control.

Important Notes:

- This indicator is a tool to assist in identifying trends and potential entry/exit points. It does not guarantee profits and should be used in conjunction with other analysis and risk management practices.

- The signals are based on historical price data and do not predict future performance. Always test the indicator on a demo account before using it in live trading.

- The gradient effect is purely visual and does not affect the signal logic.

Overview:

QuantumTrend SwiftEdge is a visually engaging and customizable trend-following indicator that combines the power of Supertrend, Keltner Channels, and a 100-period EMA to generate precise buy and sell signals. Designed to help traders identify trends and breakouts, this indicator offers a unique blend of technical tools with a modern gradient color effect, making it both functional and visually appealing.

What It Does:

This indicator identifies trend directions and potential entry/exit points:

- Supertrend determines the overall trend direction, showing a green line below the price during uptrends and a red line above the price during downtrends. The line only appears when the price is close to it, indicating an active trend.

- Keltner Channels highlight volatility and breakouts, with the upper and lower bands dynamically adjusting to market conditions.

- A 100-period EMA provides a longer-term trend perspective, helping to filter out noise.

- Buy and sell signals are generated when specific conditions align across these indicators, ensuring robust trade setups.

How It Works:

The indicator uses three components to generate signals:

1. **Supertrend**: Calculates trend direction using the Average True Range (ATR) and a multiplier. It switches between uptrend (green) and downtrend (red) based on price movements relative to the Supertrend line.

2. **Keltner Channels**: Consists of an EMA (default 20 periods) with upper and lower bands based on ATR. A breakout above the upper band signals potential buying opportunities, while a breakout below the lower band signals potential selling opportunities.

3. **100-period EMA**: Acts as a trend filter, ensuring signals align with the broader market direction.

**Buy Signal**:

- Price is above the 100-period EMA (bullish market).

- Price breaks above the Keltner Channel upper band (indicating a breakout).

- Supertrend switches to an uptrend (trend changes from down to up).

**Sell Signal**:

- Price is below the 100-period EMA (bearish market).

- Price breaks below the Keltner Channel lower band (indicating a breakout).

- Supertrend switches to a downtrend (trend changes from up to down).

Visual Features:

- **Gradient Colors**: Supertrend lines and Keltner Channels use a smooth gradient color transition between green (uptrend) and red (downtrend), reflecting the trend's strength. The gradient is based on a smoothed trend value, creating a visually appealing effect.

- **Keltner Channel Fill**: The area between the upper and lower Keltner Channels is filled with a transparent gradient, enhancing the trend visualization.

- **Dynamic Supertrend Visibility**: Supertrend lines only appear when the price is close to the line (within an ATR-based threshold), indicating an active trend.

How to Use:

1. Add the "QuantumTrend SwiftEdge" indicator to your chart in TradingView.

2. Customize the settings:

- **Signal Sensitivity (1=Low, 5=High)**: Default is 3. Lower values (e.g., 1) make signals less frequent by using wider parameters, while higher values (e.g., 5) make signals more frequent by tightening parameters.

- **Use Manual Settings**: If enabled, you can manually adjust all parameters (ATR Period, ATR Multiplier, Keltner Channel Length, Keltner Channel Multiplier, Keltner ATR Length, EMA Length) to fine-tune the indicator.

- **Change ATR Calculation Method**: Toggle between standard ATR calculation and a simple moving average of true range.

- **Show Buy/Sell Signals**: Toggle to show or hide buy (green "Buy" label) and sell (red "Sell" label) signals.

- **Highlighter On/Off**: Toggle to show or hide the gradient fill between the price and Supertrend line when the line is visible.

3. Interpret the signals:

- A green "Buy" label below the price indicates a potential buying opportunity.

- A red "Sell" label above the price indicates a potential selling opportunity.

- Use the Keltner Channel gradient fill and Supertrend lines to confirm the trend direction and strength.

Why This Combination?

- **Supertrend** provides a robust trend-following mechanism, ensuring signals align with the market direction.

- **Keltner Channels** add a volatility component, identifying breakouts that often precede significant price movements.

- **100-period EMA** filters out noise, ensuring signals are generated in the context of the broader trend.

Together, these indicators create a balanced approach: Supertrend and EMA confirm the trend, while Keltner Channels pinpoint actionable entry and exit points. The gradient visuals and dynamic visibility make it easier to focus on active trends.

Originality:

QuantumTrend SwiftEdge stands out with its unique features:

- Gradient color transitions for a modern, dynamic look.

- A filled gradient between Keltner Channels, visually emphasizing the trend.

- Supertrend lines that only appear when the price is close, reducing clutter and focusing on active trends.

- Flexible settings with both sensitivity-based and manual adjustments for maximum customization.

Default Settings:

The default sensitivity is set to 3, providing a balanced approach for most markets and timeframes (e.g., 5-minute charts for crypto like BTC/USD). This setting uses moderate parameters (ATR Period=10, ATR Multiplier=3.0, Keltner Channel Length=20, Keltner Channel Multiplier=1.5, Keltner ATR Length=10, EMA Length=100). Users can adjust the sensitivity or switch to manual settings for more control.

Important Notes:

- This indicator is a tool to assist in identifying trends and potential entry/exit points. It does not guarantee profits and should be used in conjunction with other analysis and risk management practices.

- The signals are based on historical price data and do not predict future performance. Always test the indicator on a demo account before using it in live trading.

- The gradient effect is purely visual and does not affect the signal logic.

Note di rilascio

QuantumTrend SwiftEdge - Adaptive Trend-Following with Precision SignalsQuantumTrend SwiftEdge is a cutting-edge trend-following indicator that intelligently combines Supertrend, Keltner Channels, and a 100-period EMA to generate precise, high-probability buy and sell signals. Tailored for traders in forex, stocks, and cryptocurrency markets, this indicator delivers a cohesive system for identifying trends, capturing breakouts, and filtering noise, all within a visually intuitive interface. By blending adaptive parameter adjustments, dynamic visualization, and robust signal logic, QuantumTrend SwiftEdge offers a powerful tool for both novice and experienced traders seeking clarity in dynamic markets.

Why This Mashup?

The integration of Supertrend, Keltner Channels, and a 100-period EMA creates a synergistic system that outperforms standalone indicators:

100-Period EMA: Serves as a trend anchor, filtering signals to align with the broader market direction, reducing false entries during choppy conditions.

Keltner Channels: Detects breakout opportunities by measuring price movements beyond volatility-based bands, ideal for capturing momentum shifts.

Supertrend: Uses ATR-based calculations to confirm trend reversals and direction, ensuring signals are timely and reliable.

This combination forms a three-layered approach: the EMA establishes trend context, Keltner Channels pinpoint breakout zones, and Supertrend validates entries with precision. The result is a unified strategy that minimizes noise and maximizes signal accuracy, addressing common pitfalls of individual indicators.

How It Works:

QuantumTrend SwiftEdge generates signals by combining multiple conditions:

A bullish signal requires the price to be above the 100-period EMA, a crossover above the Keltner Channel’s upper band, and a Supertrend shift to an uptrend.

A bearish signal requires the price to be below the EMA, a crossover below the Keltner Channel’s lower band, and a Supertrend shift to a downtrend.

These conditions ensure that signals are only triggered when trend strength, breakout momentum, and price direction align, reducing the risk of false positives. The indicator also dynamically adjusts its parameters based on user inputs, making it adaptable to various market conditions and timeframes.

Unique Features:

Adaptive Sensitivity System: A 1-5 sensitivity input automatically adjusts critical parameters—ATR period (6-14), Keltner Channel length (10-30), EMA length (50-150), and multipliers—based on market volatility. Low sensitivity (1) suits stable, trending markets with longer periods, while high sensitivity (5) targets volatile, fast-moving markets with tighter settings. This automation simplifies optimization and enhances adaptability, a feature not found in traditional indicators.

Gradient Visualization: A 5-period EMA of the trend direction drives a smooth gradient color scheme (from red to green) applied to Supertrend lines, Keltner Channels, and background highlights. This creates a visually seamless representation of trend transitions, improving readability and decision-making.

ATR-Based Threshold Logic: Supertrend lines are displayed only when the price is within an ATR-adjusted threshold (scaled by sensitivity, 0.5-2.0x ATR). This filters out irrelevant signals during consolidation, ensuring lines appear only when the price is actively following the trend, enhancing clarity and reducing chart clutter.

Customizable Manual Overrides: Traders can bypass the sensitivity system to manually configure ATR, Keltner Channel, and EMA settings, offering flexibility for advanced strategies or specific market conditions.

Dynamic Highlighting: Transparent gradient fills between the price and Supertrend lines provide subtle trend confirmation, syncing with the gradient color scheme to maintain a clean, uncluttered chart.

Comprehensive Alerts: Custom alerts for buy/sell signals and trend changes enable seamless integration with automated trading systems or manual workflows, ensuring traders never miss a signal.

What Sets It Apart:

QuantumTrend SwiftEdge goes beyond a simple mashup by introducing innovative features that enhance functionality and user experience. The adaptive sensitivity system eliminates the guesswork of parameter tuning, the gradient visualization offers a modern approach to trend display, and the ATR threshold logic ensures signals are relevant and actionable. These customizations address limitations of standard Supertrend, Keltner Channels, and EMA implementations, delivering a more reliable and user-friendly tool.

Use Cases:

Trend-Following: Leverage EMA-filtered Supertrend signals to ride strong trends with confidence, ideal for daily or 4-hour charts.

Breakout Trading: Capture momentum shifts with Keltner Channel breakouts backed by Supertrend confirmation, perfect for volatile markets like crypto.

Scalping: Use high sensitivity settings on 1-5 minute charts for rapid, high-probability setups in forex or indices.

Swing Trading: Apply lower sensitivity on higher timeframes (e.g., 1-hour) for longer-term trend entries with reduced noise.

Target Audience:

Beginner Traders: The sensitivity system and clear visual cues simplify trend analysis without requiring deep technical knowledge.

Experienced Traders: Manual overrides and alert customization support advanced strategies and integration with existing systems.

Scalpers and Swing Traders: Flexible settings cater to both short-term and longer-term trading styles across multiple asset classes.

Why It’s Valuable:

QuantumTrend SwiftEdge is more than the sum of its parts—it’s a thoughtfully engineered indicator that combines proven technical tools with modern enhancements. By addressing common challenges like false signals, parameter complexity, and visual clutter, it empowers traders to make informed decisions with confidence. Whether you’re navigating trending markets or hunting breakouts, this indicator provides a versatile, reliable, and visually engaging solution to elevate your trading.

Enhancements Made

Compared to the previous description, this version includes:

Detailed Mechanics: Explains how signals are generated (e.g., specific conditions for bullish/bearish signals), making the script’s operation clearer.

Target Audience: Identifies who the script is for (beginners, experienced traders, scalpers, swing traders) to highlight its versatility.

Expanded Use Cases: Provides specific examples of trading strategies and timeframes to demonstrate practical applications.

Value Proposition: Emphasizes how the script solves common trading challenges (e.g., false signals, parameter tuning, chart clutter).

Clarity and Structure: Uses concise sections to ensure the description is comprehensive yet easy to read for both moderators and users.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.