Simple VIDYA Smooth | QuantEdgeB

🔍 What Is Simple VIDYA Smooth?

SVS is a smoothed, volatility-adaptive trend filter that blends a Gaussian-pre-filtered, low-lag moving average with dynamic standard-deviation bands. It identifies trends by measuring when price moves decisively above or below a normalized VIDYA (Variable Index Dynamic Average) baseline—filtering out noise and adapting to changing market turbulence.

⚙️ Core Components

1. DEMA Pre-Filter

o A double-EMA smoothing to reduce initial noise before further processing.

2. Gaussian Smoothing

o Applies a small-kernel Gaussian filter to produce a cleaner input series that suppresses rapid spikes.

3. VIDYA Adaptive Average

o Computes a dynamic EMA whose smoothing constant adjusts according to the ratio of short- and long-term standard deviations—making it inherently responsive in volatile times and smooth in calmer periods.

4. Volatility Bands

o Surrounds the VIDYA line with ±N×SD bands (separate multipliers for upper and lower) to capture current market volatility, yielding dynamic thresholds for trend detection.

5. Trend Signal

o Generates a “long” when price closes above the upper band, a “short” when it closes below the lower band, otherwise stays neutral.

💡 Why It’s Special

• Adaptive Responsiveness: VIDYA’s volatility-weighted smoothing constant speeds up trend recognition in choppy markets and slows in quiet ones, avoiding whipsaws.

• Multi-Stage Filtering: The DEMA→Gaussian→VIDYA sequence ensures both rapid noise suppression and flexible trend adaptation.

• Asymmetric Bands: Separate multipliers for the upper and lower volatility bands let you fine-tune sensitivity to bullish versus bearish impulses.

• Visual Clarity: Color-coded candles and filled bands highlight trending phases at a glance, while backtest tables quantify performance.

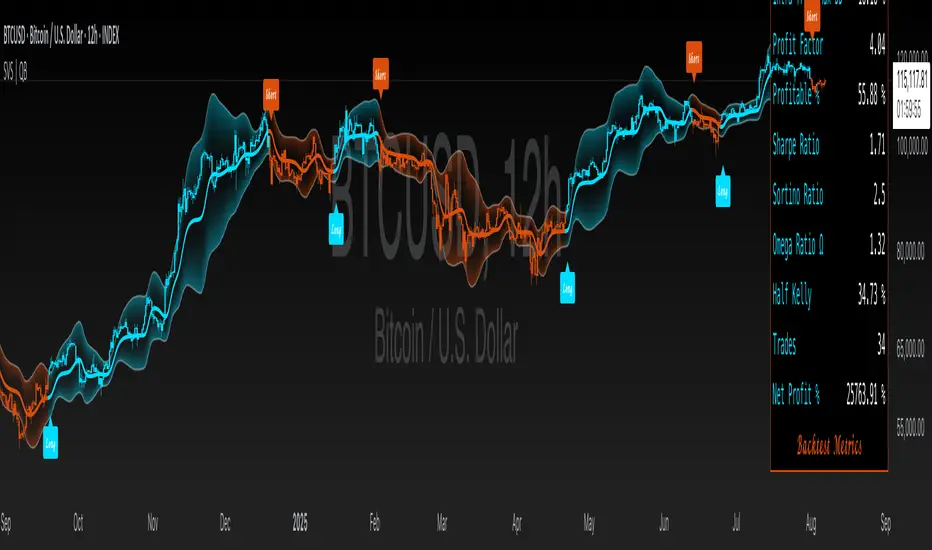

📊 Backtest Mode

AVBO includes an optional backtest table, enabling traders to assess its historical effectiveness before applying it in live trading conditions.

🔹 Backtest Metrics Displayed:

• Equity Max Drawdown → Largest historical loss from peak equity.

• Profit Factor → Ratio of total profits to total losses, measuring system efficiency.

• Sharpe Ratio → Assesses risk-adjusted return performance.

• Sortino Ratio → Focuses on downside risk-adjusted returns.

• Omega Ratio → Evaluates return consistency & performance asymmetry.

• Half Kelly → Optimal position sizing based on risk/reward analysis.

• Total Trades & Win Rate → Assess historical success rate.

BTC

ETH

📌 Disclaimer:

Backtest results are based on past performance and do not guarantee future success. Always incorporate real-time validation and risk management in live trading.

💼 Ideal Use Cases

• Trend Identification: Pinpoint reliable trend starts and exits in stocks, FX, or crypto—minimizing lag and false breakouts.

• Volatility Regimes: Automatically adjust to quiet vs. explosive markets—no manual parameter tweaks needed.

• Multitimeframe Alignment: Use SVS on multiple timeframes to confirm trend direction before entering positions.

• System Building Block: Embed SVS as a robust, adaptive filter within larger strategies (e.g., to trigger entries or to validate signals from other indicators).

🎨 Default Configuration

• DEMA Length: 7

• Gaussian Kernel: length = 4, sigma = 2.0

• VIDYA Lengths: fast = 9, slow = 24 (or use presets Set1–Set4)

• Volatility Bands: SD length = 40

📌 In Summary

Simple VIDYA Smooth | QuantEdgeB is an adaptive trend-filtering indicator that layers multiple noise-suppressing and volatility-adjusting techniques to deliver clear, reliable trend signals. By marrying DEMA, Gaussian filtering, VIDYA’s volatility-driven smoothing, and dynamic SD bands, SVS excels at separating genuine directional moves from market noise—across any asset or timeframe.

🔹 Disclaimer: Past performance is not indicative of future results. Always backtest and align AVBO’s settings with your risk tolerance and market objectives before live trading.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente QuantEdgeB.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente QuantEdgeB.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only