OPEN-SOURCE SCRIPT

Aggiornato LANZ Strategy 3.0

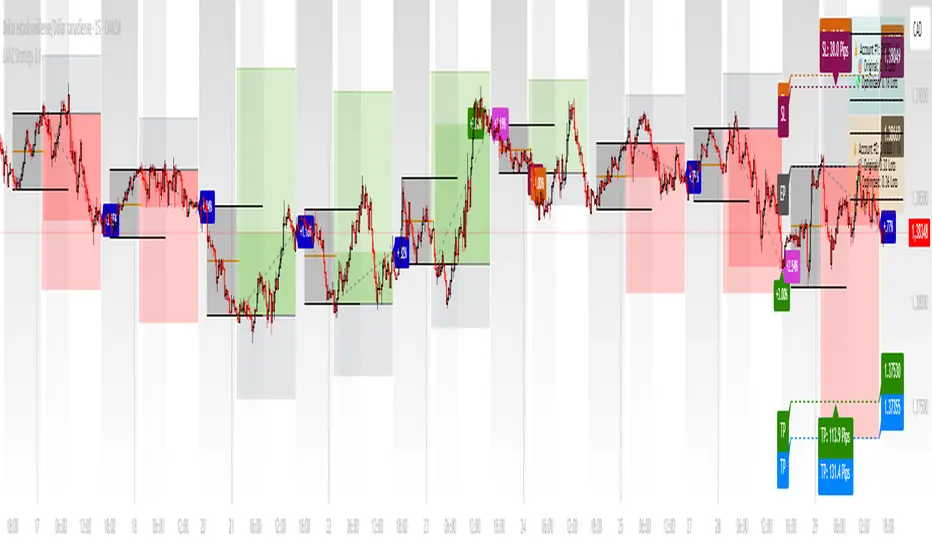

🔷 LANZ Strategy 3.0 — Asian Range Fibonacci Strategy with Execution Window Logic

LANZ Strategy 3.0 is a rule-based trading system that utilizes the Asian session range to project Fibonacci levels and manage entries during a defined execution window. Designed for Forex and index traders, this strategy focuses on structured price behavior around key levels before the New York session.

🧠 Core Components:

📊 Visual Features:

⚙️ How It Works:

🔔 Alerts:

📝 Notes:

Credits:

Developed by LANZ, this script merges traditional session-based analysis with Fibonacci tools and structured execution timing, offering a unique framework for morning volatility plays.

LANZ Strategy 3.0 is a rule-based trading system that utilizes the Asian session range to project Fibonacci levels and manage entries during a defined execution window. Designed for Forex and index traders, this strategy focuses on structured price behavior around key levels before the New York session.

🧠 Core Components:

- Asian Session Range Mapping: Automatically detects the high, low, and midpoint during the Asian session.

- Fibonacci Level Projection: Projects configurable Fibonacci retracement and extension levels based on the Asian range.

- Execution Window Logic: Uses the 01:15 NY candle as a reference to validate potential reversals or continuation setups.

- Conditional Entry System: Includes logic for limit order entries (buy or sell) at specific Fib levels, with reversal logic if price breaks structure before execution.

- Risk Management: Entry orders are paired with dynamic SL and TP based on Fibonacci-based distances, maintaining a risk-reward ratio consistent with intraday strategies.

📊 Visual Features:

- Asian session high/low/mid lines.

- Fibonacci levels: Original (based on raw range) and Optimized (user-adjustable).

- Session background coloring for Asia, Execution Window, and NY session.

- Labels and lines for entry, SL, and TP targets.

- Dynamic deletion of untriggered orders after execution window expires.

⚙️ How It Works:

- The script calculates the Asian session range.

- Projects Fibonacci levels from the range.

- Waits for the 01:15 NY candle to close to validate a signal.

- If valid, a limit entry order (BUY or SELL) is plotted at the selected level.

- If price structure changes (e.g., breaks the high/low), reversal logic may activate.

- If no trade is triggered, orders are cleared before the NY session.

🔔 Alerts:

- Alerts trigger when a valid setup appears after 01:15 NY candle.

- Optional alerts for order activation, SL/TP hit, or trade cancellation.

📝 Notes:

- Intended for semi-automated or discretionary trading.

- Best used on highly liquid markets like Forex majors or indices.

- Script parameters include session times, Fib ratios, SL/TP settings, and reversal logic toggle.

Credits:

Developed by LANZ, this script merges traditional session-based analysis with Fibonacci tools and structured execution timing, offering a unique framework for morning volatility plays.

Note di rilascio

🧮 Multi-Account Lot Size PanelThis update adds a fully customizable multi-account lot size panel that allows you to manage up to five accounts independently, each with adjustable capital, risk percentage, and background color. The script automatically calculates lot size in real-time based on SL in pips and dynamic pip value per Forex pair—just like MyFXBook. The panel is displayed directly on the chart with customizable text color and size, offering a clear and professional visual for managing risk across multiple accounts with precision.

Note di rilascio

💡 LANZ Strategy 3.0 – Fibonacci Execution ValidationThis module ensures that trade outcome labels (TP, SL, or manual close) are only displayed if the Entry Price (EP) was actually reached before 08:00 AM New York time.

✅ Key Features:

- Keeps Fibonacci levels always visible, even if the trade wasn’t triggered.

- Tracks whether price touched the EP before 08:00 NY.

- If price never reached EP, then no SL/TP labels or manual close are shown.

- Validates SL, TP, and forces a session close at 03:45 PM NY only if the trade was triggered.

This logic provides a more accurate and professional simulation of real market behavior, avoiding misleading win/loss labels when trades weren’t actually executed.

Note di rilascio

🥇 LANZ Strategy 3.0 - Update:Is a session-based strategy operating on the 15-minute chart. It analyzes the Asian range (18:00–01:15 NY) and defines limit orders at the High/Low based on the 02:15 NY candle. You can switch between Original or Optimized Fibonacci projections. Updates include cleaner input groups, strict timeframe validation, and full alert system for trade execution, SL, TP, fallback logic, and manual exit at 15:45 NY.

Note di rilascio

🔔 LANZ Strategy 3.0 – Enhanced Alert PrecisionLS3.0 just got smarter. The alert logic has been upgraded to use direct alert() calls, providing real-time feedback on entry execution, SL/TP hits, and manual closes — all with intuitive, motivational messages.

Now you're notified exactly when it matters.

"Asia sets the stage. You decide the outcome."

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.