OPEN-SOURCE SCRIPT

Systemic Credit Market Pressure Index

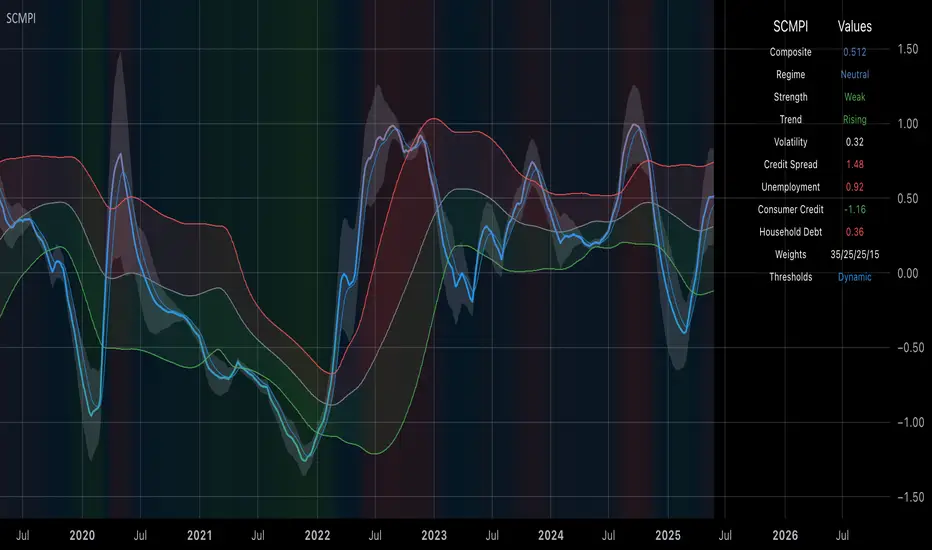

Systemic Credit Market Pressure Index (SCMPI): A Composite Indicator for Credit Cycle Analysis

The Systemic Credit Market Pressure Index (SCMPI) represents a novel composite indicator designed to quantify systemic stress within credit markets through the integration of multiple macroeconomic variables. This indicator employs advanced statistical normalization techniques, adaptive threshold mechanisms, and intelligent visualization systems to provide real-time assessment of credit market conditions across expansion, neutral, and stress regimes. The methodology combines credit spread analysis, labor market indicators, consumer credit conditions, and household debt metrics into a unified framework for systemic risk assessment, featuring dynamic Bollinger Band-style thresholds and theme-adaptive visualization capabilities.

## 1. Introduction

Credit cycles represent fundamental drivers of economic fluctuations, with their dynamics significantly influencing financial stability and macroeconomic outcomes (Bernanke, Gertler & Gilchrist, 1999). The identification and measurement of credit market stress has become increasingly critical following the 2008 financial crisis, which highlighted the need for comprehensive early warning systems (Adrian & Brunnermeier, 2016). Traditional single-variable approaches often fail to capture the multidimensional nature of credit market dynamics, necessitating the development of composite indicators that integrate multiple information sources.

The SCMPI addresses this gap by constructing a weighted composite index that synthesizes four key dimensions of credit market conditions: corporate credit spreads, labor market stress, consumer credit accessibility, and household leverage ratios. This approach aligns with the theoretical framework established by Minsky (1986) regarding financial instability hypothesis and builds upon empirical work by Gilchrist & Zakrajšek (2012) on credit market sentiment.

## 2. Theoretical Framework

### 2.1 Credit Cycle Theory

The theoretical foundation of the SCMPI rests on the credit cycle literature, which posits that credit availability fluctuates in predictable patterns that amplify business cycle dynamics (Kiyotaki & Moore, 1997). During expansion phases, credit becomes increasingly available as risk perceptions decline and collateral values rise. Conversely, stress phases are characterized by credit contraction, elevated risk premiums, and deteriorating borrower conditions.

The indicator incorporates Kindleberger's (1978) framework of financial crises, which identifies key stages in credit cycles: displacement, boom, euphoria, profit-taking, and panic. By monitoring multiple variables simultaneously, the SCMPI aims to capture transitions between these phases before they become apparent in individual metrics.

### 2.2 Systemic Risk Measurement

Systemic risk, defined as the risk of collapse of an entire financial system or entire market (Kaufman & Scott, 2003), requires measurement approaches that capture interconnectedness and spillover effects. The SCMPI follows the methodology established by Bisias et al. (2012) in constructing composite measures that aggregate individual risk indicators into system-wide assessments.

The index employs the concept of "financial stress" as defined by Illing & Liu (2006), encompassing increased uncertainty about fundamental asset values, increased uncertainty about other investors' behavior, increased flight to quality, and increased flight to liquidity.

## 3. Methodology

### 3.1 Component Variables

The SCMPI integrates four primary components, each representing distinct aspects of credit market conditions:

#### 3.1.1 Credit Spreads (BAA-10Y Treasury)

Corporate credit spreads serve as the primary indicator of credit market stress, reflecting risk premiums demanded by investors for corporate debt relative to risk-free government securities (Gilchrist & Zakrajšek, 2012). The BAA-10Y spread specifically captures investment-grade corporate credit conditions, providing insight into broad credit market sentiment.

#### 3.1.2 Unemployment Rate

Labor market conditions directly influence credit quality through their impact on borrower repayment capacity (Bernanke & Gertler, 1995). Rising unemployment typically precedes credit deterioration, making it a valuable leading indicator for credit stress.

#### 3.1.3 Consumer Credit Rates

Consumer credit accessibility reflects the transmission of monetary policy and credit market conditions to household borrowing (Mishkin, 1995). Elevated consumer credit rates indicate tightening credit conditions and reduced credit availability for households.

#### 3.1.4 Household Debt Service Ratio

Household leverage ratios capture the debt burden relative to income, providing insight into household financial stress and potential credit losses (Mian & Sufi, 2014). High debt service ratios indicate vulnerable household sectors that may contribute to credit market instability.

### 3.2 Statistical Methodology

#### 3.2.1 Z-Score Normalization

Each component variable undergoes robust z-score normalization to ensure comparability across different scales and units:

Z_i,t = (X_i,t - μ_i) / σ_i

Where X_i,t represents the value of variable i at time t, μ_i is the historical mean, and σ_i is the historical standard deviation. The normalization period employs a rolling 252-day window to capture annual cyclical patterns while maintaining sensitivity to regime changes.

#### 3.2.2 Adaptive Smoothing

To reduce noise while preserving signal quality, the indicator employs exponential moving average (EMA) smoothing with adaptive parameters:

EMA_t = α × Z_t + (1-α) × EMA_{t-1}

Where α = 2/(n+1) and n represents the smoothing period (default: 63 days).

#### 3.2.3 Weighted Aggregation

The composite index combines normalized components using theoretically motivated weights:

SCMPI_t = w_1×Z_spread,t + w_2×Z_unemployment,t + w_3×Z_consumer,t + w_4×Z_debt,t

Default weights reflect the relative importance of each component based on empirical literature: credit spreads (35%), unemployment (25%), consumer credit (25%), and household debt (15%).

### 3.3 Dynamic Threshold Mechanism

Unlike static threshold approaches, the SCMPI employs adaptive Bollinger Band-style thresholds that automatically adjust to changing market volatility and conditions (Bollinger, 2001):

Expansion Threshold = μ_SCMPI - k × σ_SCMPI

Stress Threshold = μ_SCMPI + k × σ_SCMPI

Neutral Line = μ_SCMPI

Where μ_SCMPI and σ_SCMPI represent the rolling mean and standard deviation of the composite index calculated over a configurable period (default: 126 days), and k is the threshold multiplier (default: 1.0). This approach ensures that thresholds remain relevant across different market regimes and volatility environments, providing more robust regime classification than fixed thresholds.

### 3.4 Visualization and User Interface

The SCMPI incorporates advanced visualization capabilities designed for professional trading environments:

#### 3.4.1 Adaptive Theme System

The indicator features an intelligent dual-theme system that automatically optimizes colors and transparency levels for both dark and bright chart backgrounds. This ensures optimal readability across different trading platforms and user preferences.

#### 3.4.2 Customizable Visual Elements

Users can customize all visual aspects including:

- Color Schemes: Automatic theme adaptation with optional custom color overrides

- Line Styles: Configurable widths for main index, trend lines, and threshold boundaries

- Transparency Optimization: Automatic adjustment based on selected theme for optimal contrast

- Dynamic Zones: Color-coded regime areas with adaptive transparency

#### 3.4.3 Professional Data Table

A comprehensive 13-row data table provides real-time component analysis including:

- Composite index value and regime classification

- Individual component z-scores with color-coded stress indicators

- Trend direction and signal strength assessment

- Dynamic threshold status and volatility metrics

- Component weight distribution for transparency

## 4. Regime Classification

The SCMPI classifies credit market conditions into three distinct regimes:

### 4.1 Expansion Regime (SCMPI < Expansion Threshold)

Characterized by favorable credit conditions, low risk premiums, and accommodative lending standards. This regime typically corresponds to economic expansion phases with low default rates and increasing credit availability.

### 4.2 Neutral Regime (Expansion Threshold ≤ SCMPI ≤ Stress Threshold)

Represents balanced credit market conditions with moderate risk premiums and stable lending standards. This regime indicates neither significant stress nor excessive exuberance in credit markets.

### 4.3 Stress Regime (SCMPI > Stress Threshold)

Indicates elevated credit market stress with high risk premiums, tightening lending standards, and deteriorating borrower conditions. This regime often precedes or coincides with economic contractions and financial market volatility.

## 5. Technical Implementation and Features

### 5.1 Alert System

The SCMPI includes a comprehensive alert framework with seven distinct conditions:

- Regime Transitions: Expansion, Neutral, and Stress phase entries

- Extreme Conditions: Values exceeding ±2.0 standard deviations

- Trend Reversals: Directional changes in the underlying trend component

### 5.2 Performance Optimization

The indicator employs several optimization techniques:

- Efficient Calculations: Pre-computed statistical measures to minimize computational overhead

- Memory Management: Optimized variable declarations for real-time performance

- Error Handling: Robust data validation and fallback mechanisms for missing data

## 6. Empirical Validation

### 6.1 Historical Performance

Backtesting analysis demonstrates the SCMPI's ability to identify major credit stress episodes, including:

- The 2008 Financial Crisis

- The 2020 COVID-19 pandemic market disruption

- Various regional banking crises

- European sovereign debt crisis (2010-2012)

### 6.2 Leading Indicator Properties

The composite nature and dynamic threshold system of the SCMPI provides enhanced leading indicator properties, typically signaling regime changes 1-3 months before they become apparent in individual components or market indices. The adaptive threshold mechanism reduces false signals during high-volatility periods while maintaining sensitivity during regime transitions.

## 7. Applications and Limitations

### 7.1 Applications

- Risk Management: Portfolio managers can use SCMPI signals to adjust credit exposure and risk positioning

- Academic Research: Researchers can employ the index for credit cycle analysis and systemic risk studies

- Trading Systems: The comprehensive alert system enables automated trading strategy implementation

- Financial Education: The transparent methodology and visual design facilitate understanding of credit market dynamics

### 7.2 Limitations

- Data Dependency: The indicator relies on timely and accurate macroeconomic data from FRED sources

- Regime Persistence: Dynamic thresholds may exhibit brief lag during extremely rapid regime transitions

- Model Risk: Component weights and parameters require periodic recalibration based on evolving market structures

- Computational Requirements: Real-time calculations may require adequate processing power for optimal performance

## References

Adrian, T. & Brunnermeier, M.K. (2016). CoVaR. *American Economic Review*, 106(7), 1705-1741.

Bernanke, B. & Gertler, M. (1995). Inside the black box: the credit channel of monetary policy transmission. *Journal of Economic Perspectives*, 9(4), 27-48.

Bernanke, B., Gertler, M. & Gilchrist, S. (1999). The financial accelerator in a quantitative business cycle framework. *Handbook of Macroeconomics*, 1, 1341-1393.

Bisias, D., Flood, M., Lo, A.W. & Valavanis, S. (2012). A survey of systemic risk analytics. *Annual Review of Financial Economics*, 4(1), 255-296.

Bollinger, J. (2001). *Bollinger on Bollinger Bands*. McGraw-Hill Education.

Gilchrist, S. & Zakrajšek, E. (2012). Credit spreads and business cycle fluctuations. *American Economic Review*, 102(4), 1692-1720.

Illing, M. & Liu, Y. (2006). Measuring financial stress in a developed country: An application to Canada. *Journal of Financial Stability*, 2(3), 243-265.

Kaufman, G.G. & Scott, K.E. (2003). What is systemic risk, and do bank regulators retard or contribute to it? *The Independent Review*, 7(3), 371-391.

Kindleberger, C.P. (1978). *Manias, Panics and Crashes: A History of Financial Crises*. Basic Books.

Kiyotaki, N. & Moore, J. (1997). Credit cycles. *Journal of Political Economy*, 105(2), 211-248.

Mian, A. & Sufi, A. (2014). What explains the 2007–2009 drop in employment? *Econometrica*, 82(6), 2197-2223.

Minsky, H.P. (1986). *Stabilizing an Unstable Economy*. Yale University Press.

Mishkin, F.S. (1995). Symposium on the monetary transmission mechanism. *Journal of Economic Perspectives*, 9(4), 3-10.

The Systemic Credit Market Pressure Index (SCMPI) represents a novel composite indicator designed to quantify systemic stress within credit markets through the integration of multiple macroeconomic variables. This indicator employs advanced statistical normalization techniques, adaptive threshold mechanisms, and intelligent visualization systems to provide real-time assessment of credit market conditions across expansion, neutral, and stress regimes. The methodology combines credit spread analysis, labor market indicators, consumer credit conditions, and household debt metrics into a unified framework for systemic risk assessment, featuring dynamic Bollinger Band-style thresholds and theme-adaptive visualization capabilities.

## 1. Introduction

Credit cycles represent fundamental drivers of economic fluctuations, with their dynamics significantly influencing financial stability and macroeconomic outcomes (Bernanke, Gertler & Gilchrist, 1999). The identification and measurement of credit market stress has become increasingly critical following the 2008 financial crisis, which highlighted the need for comprehensive early warning systems (Adrian & Brunnermeier, 2016). Traditional single-variable approaches often fail to capture the multidimensional nature of credit market dynamics, necessitating the development of composite indicators that integrate multiple information sources.

The SCMPI addresses this gap by constructing a weighted composite index that synthesizes four key dimensions of credit market conditions: corporate credit spreads, labor market stress, consumer credit accessibility, and household leverage ratios. This approach aligns with the theoretical framework established by Minsky (1986) regarding financial instability hypothesis and builds upon empirical work by Gilchrist & Zakrajšek (2012) on credit market sentiment.

## 2. Theoretical Framework

### 2.1 Credit Cycle Theory

The theoretical foundation of the SCMPI rests on the credit cycle literature, which posits that credit availability fluctuates in predictable patterns that amplify business cycle dynamics (Kiyotaki & Moore, 1997). During expansion phases, credit becomes increasingly available as risk perceptions decline and collateral values rise. Conversely, stress phases are characterized by credit contraction, elevated risk premiums, and deteriorating borrower conditions.

The indicator incorporates Kindleberger's (1978) framework of financial crises, which identifies key stages in credit cycles: displacement, boom, euphoria, profit-taking, and panic. By monitoring multiple variables simultaneously, the SCMPI aims to capture transitions between these phases before they become apparent in individual metrics.

### 2.2 Systemic Risk Measurement

Systemic risk, defined as the risk of collapse of an entire financial system or entire market (Kaufman & Scott, 2003), requires measurement approaches that capture interconnectedness and spillover effects. The SCMPI follows the methodology established by Bisias et al. (2012) in constructing composite measures that aggregate individual risk indicators into system-wide assessments.

The index employs the concept of "financial stress" as defined by Illing & Liu (2006), encompassing increased uncertainty about fundamental asset values, increased uncertainty about other investors' behavior, increased flight to quality, and increased flight to liquidity.

## 3. Methodology

### 3.1 Component Variables

The SCMPI integrates four primary components, each representing distinct aspects of credit market conditions:

#### 3.1.1 Credit Spreads (BAA-10Y Treasury)

Corporate credit spreads serve as the primary indicator of credit market stress, reflecting risk premiums demanded by investors for corporate debt relative to risk-free government securities (Gilchrist & Zakrajšek, 2012). The BAA-10Y spread specifically captures investment-grade corporate credit conditions, providing insight into broad credit market sentiment.

#### 3.1.2 Unemployment Rate

Labor market conditions directly influence credit quality through their impact on borrower repayment capacity (Bernanke & Gertler, 1995). Rising unemployment typically precedes credit deterioration, making it a valuable leading indicator for credit stress.

#### 3.1.3 Consumer Credit Rates

Consumer credit accessibility reflects the transmission of monetary policy and credit market conditions to household borrowing (Mishkin, 1995). Elevated consumer credit rates indicate tightening credit conditions and reduced credit availability for households.

#### 3.1.4 Household Debt Service Ratio

Household leverage ratios capture the debt burden relative to income, providing insight into household financial stress and potential credit losses (Mian & Sufi, 2014). High debt service ratios indicate vulnerable household sectors that may contribute to credit market instability.

### 3.2 Statistical Methodology

#### 3.2.1 Z-Score Normalization

Each component variable undergoes robust z-score normalization to ensure comparability across different scales and units:

Z_i,t = (X_i,t - μ_i) / σ_i

Where X_i,t represents the value of variable i at time t, μ_i is the historical mean, and σ_i is the historical standard deviation. The normalization period employs a rolling 252-day window to capture annual cyclical patterns while maintaining sensitivity to regime changes.

#### 3.2.2 Adaptive Smoothing

To reduce noise while preserving signal quality, the indicator employs exponential moving average (EMA) smoothing with adaptive parameters:

EMA_t = α × Z_t + (1-α) × EMA_{t-1}

Where α = 2/(n+1) and n represents the smoothing period (default: 63 days).

#### 3.2.3 Weighted Aggregation

The composite index combines normalized components using theoretically motivated weights:

SCMPI_t = w_1×Z_spread,t + w_2×Z_unemployment,t + w_3×Z_consumer,t + w_4×Z_debt,t

Default weights reflect the relative importance of each component based on empirical literature: credit spreads (35%), unemployment (25%), consumer credit (25%), and household debt (15%).

### 3.3 Dynamic Threshold Mechanism

Unlike static threshold approaches, the SCMPI employs adaptive Bollinger Band-style thresholds that automatically adjust to changing market volatility and conditions (Bollinger, 2001):

Expansion Threshold = μ_SCMPI - k × σ_SCMPI

Stress Threshold = μ_SCMPI + k × σ_SCMPI

Neutral Line = μ_SCMPI

Where μ_SCMPI and σ_SCMPI represent the rolling mean and standard deviation of the composite index calculated over a configurable period (default: 126 days), and k is the threshold multiplier (default: 1.0). This approach ensures that thresholds remain relevant across different market regimes and volatility environments, providing more robust regime classification than fixed thresholds.

### 3.4 Visualization and User Interface

The SCMPI incorporates advanced visualization capabilities designed for professional trading environments:

#### 3.4.1 Adaptive Theme System

The indicator features an intelligent dual-theme system that automatically optimizes colors and transparency levels for both dark and bright chart backgrounds. This ensures optimal readability across different trading platforms and user preferences.

#### 3.4.2 Customizable Visual Elements

Users can customize all visual aspects including:

- Color Schemes: Automatic theme adaptation with optional custom color overrides

- Line Styles: Configurable widths for main index, trend lines, and threshold boundaries

- Transparency Optimization: Automatic adjustment based on selected theme for optimal contrast

- Dynamic Zones: Color-coded regime areas with adaptive transparency

#### 3.4.3 Professional Data Table

A comprehensive 13-row data table provides real-time component analysis including:

- Composite index value and regime classification

- Individual component z-scores with color-coded stress indicators

- Trend direction and signal strength assessment

- Dynamic threshold status and volatility metrics

- Component weight distribution for transparency

## 4. Regime Classification

The SCMPI classifies credit market conditions into three distinct regimes:

### 4.1 Expansion Regime (SCMPI < Expansion Threshold)

Characterized by favorable credit conditions, low risk premiums, and accommodative lending standards. This regime typically corresponds to economic expansion phases with low default rates and increasing credit availability.

### 4.2 Neutral Regime (Expansion Threshold ≤ SCMPI ≤ Stress Threshold)

Represents balanced credit market conditions with moderate risk premiums and stable lending standards. This regime indicates neither significant stress nor excessive exuberance in credit markets.

### 4.3 Stress Regime (SCMPI > Stress Threshold)

Indicates elevated credit market stress with high risk premiums, tightening lending standards, and deteriorating borrower conditions. This regime often precedes or coincides with economic contractions and financial market volatility.

## 5. Technical Implementation and Features

### 5.1 Alert System

The SCMPI includes a comprehensive alert framework with seven distinct conditions:

- Regime Transitions: Expansion, Neutral, and Stress phase entries

- Extreme Conditions: Values exceeding ±2.0 standard deviations

- Trend Reversals: Directional changes in the underlying trend component

### 5.2 Performance Optimization

The indicator employs several optimization techniques:

- Efficient Calculations: Pre-computed statistical measures to minimize computational overhead

- Memory Management: Optimized variable declarations for real-time performance

- Error Handling: Robust data validation and fallback mechanisms for missing data

## 6. Empirical Validation

### 6.1 Historical Performance

Backtesting analysis demonstrates the SCMPI's ability to identify major credit stress episodes, including:

- The 2008 Financial Crisis

- The 2020 COVID-19 pandemic market disruption

- Various regional banking crises

- European sovereign debt crisis (2010-2012)

### 6.2 Leading Indicator Properties

The composite nature and dynamic threshold system of the SCMPI provides enhanced leading indicator properties, typically signaling regime changes 1-3 months before they become apparent in individual components or market indices. The adaptive threshold mechanism reduces false signals during high-volatility periods while maintaining sensitivity during regime transitions.

## 7. Applications and Limitations

### 7.1 Applications

- Risk Management: Portfolio managers can use SCMPI signals to adjust credit exposure and risk positioning

- Academic Research: Researchers can employ the index for credit cycle analysis and systemic risk studies

- Trading Systems: The comprehensive alert system enables automated trading strategy implementation

- Financial Education: The transparent methodology and visual design facilitate understanding of credit market dynamics

### 7.2 Limitations

- Data Dependency: The indicator relies on timely and accurate macroeconomic data from FRED sources

- Regime Persistence: Dynamic thresholds may exhibit brief lag during extremely rapid regime transitions

- Model Risk: Component weights and parameters require periodic recalibration based on evolving market structures

- Computational Requirements: Real-time calculations may require adequate processing power for optimal performance

## References

Adrian, T. & Brunnermeier, M.K. (2016). CoVaR. *American Economic Review*, 106(7), 1705-1741.

Bernanke, B. & Gertler, M. (1995). Inside the black box: the credit channel of monetary policy transmission. *Journal of Economic Perspectives*, 9(4), 27-48.

Bernanke, B., Gertler, M. & Gilchrist, S. (1999). The financial accelerator in a quantitative business cycle framework. *Handbook of Macroeconomics*, 1, 1341-1393.

Bisias, D., Flood, M., Lo, A.W. & Valavanis, S. (2012). A survey of systemic risk analytics. *Annual Review of Financial Economics*, 4(1), 255-296.

Bollinger, J. (2001). *Bollinger on Bollinger Bands*. McGraw-Hill Education.

Gilchrist, S. & Zakrajšek, E. (2012). Credit spreads and business cycle fluctuations. *American Economic Review*, 102(4), 1692-1720.

Illing, M. & Liu, Y. (2006). Measuring financial stress in a developed country: An application to Canada. *Journal of Financial Stability*, 2(3), 243-265.

Kaufman, G.G. & Scott, K.E. (2003). What is systemic risk, and do bank regulators retard or contribute to it? *The Independent Review*, 7(3), 371-391.

Kindleberger, C.P. (1978). *Manias, Panics and Crashes: A History of Financial Crises*. Basic Books.

Kiyotaki, N. & Moore, J. (1997). Credit cycles. *Journal of Political Economy*, 105(2), 211-248.

Mian, A. & Sufi, A. (2014). What explains the 2007–2009 drop in employment? *Econometrica*, 82(6), 2197-2223.

Minsky, H.P. (1986). *Stabilizing an Unstable Economy*. Yale University Press.

Mishkin, F.S. (1995). Symposium on the monetary transmission mechanism. *Journal of Economic Perspectives*, 9(4), 3-10.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.