TradeX Labs PriceAction

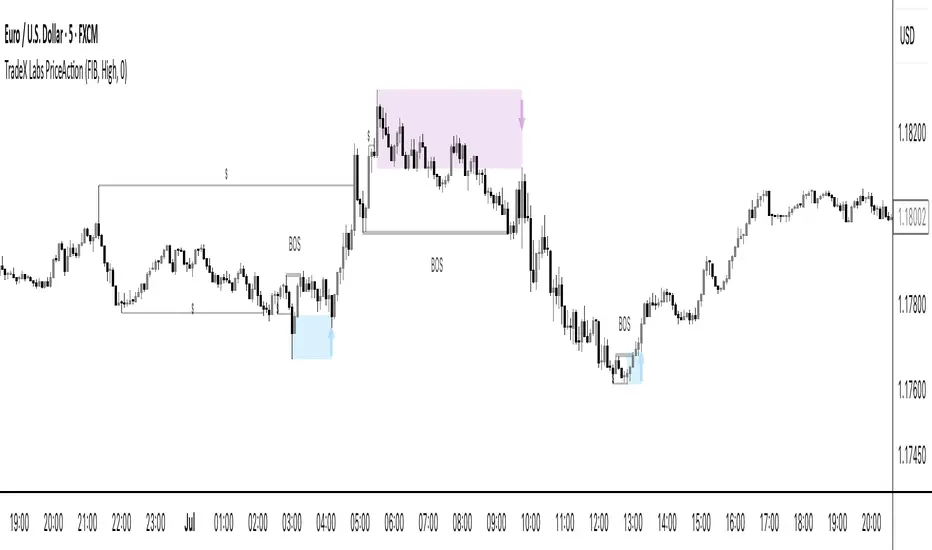

This invite-only script is a unified price-action framework for traders who want a clear, multi-timeframe visual map of structure, liquidity events, and execution zones. It is not a simple combination of existing tools — all modules are custom-built in-house and designed to work from a shared data model, ensuring every feature interacts seamlessly with the others.

Purpose & Core Design

The script’s foundation is a fractal-based swing engine that detects high-quality structural pivots. These pivots form the anchor points for:

BOS (Break of Structure) and structural shift detection

Liquidity sweep identification for stop hunts and inducements

Session range mapping (e.g., Asian high/low)

Rule-based zone projection using displacement and retracement logic

Rather than plotting isolated indicators, every detection method feeds into a single structure model so that BOS, liquidity events, and zones are all derived from the same underlying market map.

Zone Generation & Entry Mapping

Zones are calculated from swing-to-swing displacement legs and projected using Fibonacci presets (50 %, 61.8 %, 78.6 %). Users can select:

Calculation method: Fibonacci, Point of Interest (POI), or both

Zone frequency: High (wider), Medium (balanced), or Low (deeper) retracement levels

Extension length: Forward projection in bars to match chart timeframe

This ensures zones are consistent, structurally relevant, and adaptable to different styles.

Inducement & Liquidity Filters

For refined context, setups can be filtered by inducement type:

Minor: Sweeps of current day/session highs or lows

Medium: Sweeps of previous day’s highs/lows

Major: Sweeps of weekly highs/lows

Filters may run independently or in combination, hiding zones that lack interaction with key liquidity levels.

QuickStrikes Session Filter

QuickStrikes is an optional filter that checks BOS and/or entry levels against the Asian session high/low:

V1 (BOS validation): BOS position relative to session range

V2 (Entry validation): Entry zone position relative to session range

V3 (Combined): Both BOS and entry must meet positional criteria

Multiple modes can be active simultaneously, and all selected conditions must pass for a setup to display.

Custom Visuals & Usability

Every plotted element — zones, BOS labels, inducement levels, arrows, risk/reward boxes — can be styled to match any chart theme. The optional visual panel provides an at-a-glance risk-to-reward display.

Disclaimer

This is an original, closed-source TradeX Labs tool built entirely from proprietary logic referencing known concepts (e.g., Fibonacci ratios, session ranges, swing detection) within a rule-based framework. It produces visual analysis only and does not predict price or guarantee results. Default settings are for illustration; traders should adjust to their instrument and timeframe.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente tradexictsmc.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente tradexictsmc.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.