PROTECTED SOURCE SCRIPT

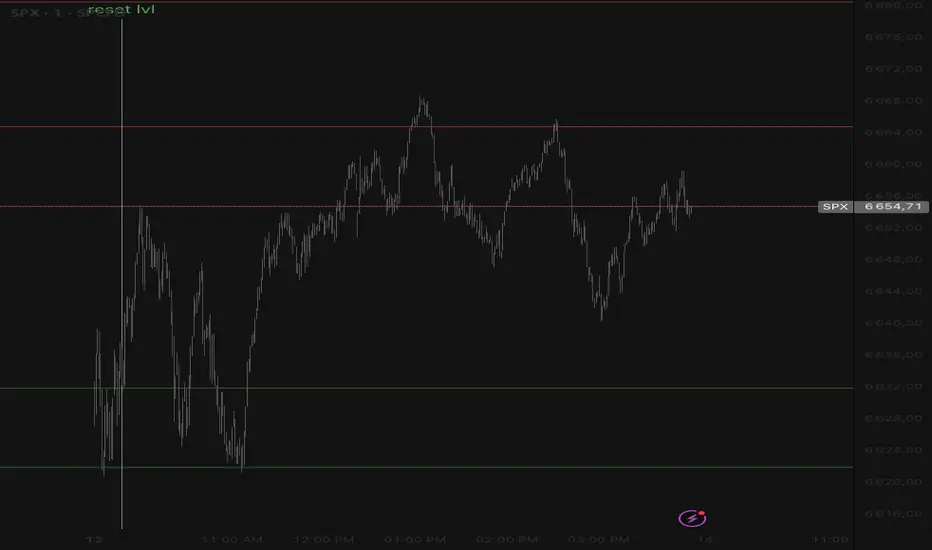

Aggiornato lvl charm

https://www.tradingview.com/x/oJjs7HHF/

Overview

"lvl"is a sophisticated support and resistance indicator that combines mathematical concepts with options market data to identify key price levels.

Key Features

Data-Driven Anchoring: Utilizes real options flow data and peak gamma concentration points

Mathematical Precision: Employs advanced mathematical ratios and distribution patterns to calculate optimal level spacing

Multiple Trading Modes: Optimized for both intraday and large expansion market conditions

Customizable Visualization: Full control over appearance, line styles, and label display

Important Usage Notes

Reset Times: The indicator performs data resets at:

8:30 AM (Pre-market calculation)

Disclaimer

This is a technical analysis tool, not a complete trading strategy. It should be used in conjunction with other forms of analysis, risk management, and your own market understanding. The indicator identifies potential levels of interest based on options market structure but does not provide buy/sell signals or guarantee any specific market outcomes.

Feedback & Development

I welcome constructive criticism and suggestions for improvement. This indicator is continuously being refined based on real market performance and user feedback. Please feel free to share your experiences and ideas in the comments.

Acknowledgments

Special thanks to Gaspard, Adam and Zaiden for their invaluable insights and contributions during the development of this indicator. Their expertise in options market dynamics and mathematical modeling has been instrumental in creating this tool.

PS : I use "large expansion" mode

Overview

"lvl"is a sophisticated support and resistance indicator that combines mathematical concepts with options market data to identify key price levels.

Key Features

Data-Driven Anchoring: Utilizes real options flow data and peak gamma concentration points

Mathematical Precision: Employs advanced mathematical ratios and distribution patterns to calculate optimal level spacing

Multiple Trading Modes: Optimized for both intraday and large expansion market conditions

Customizable Visualization: Full control over appearance, line styles, and label display

Important Usage Notes

Reset Times: The indicator performs data resets at:

8:30 AM (Pre-market calculation)

Disclaimer

This is a technical analysis tool, not a complete trading strategy. It should be used in conjunction with other forms of analysis, risk management, and your own market understanding. The indicator identifies potential levels of interest based on options market structure but does not provide buy/sell signals or guarantee any specific market outcomes.

Feedback & Development

I welcome constructive criticism and suggestions for improvement. This indicator is continuously being refined based on real market performance and user feedback. Please feel free to share your experiences and ideas in the comments.

Acknowledgments

Special thanks to Gaspard, Adam and Zaiden for their invaluable insights and contributions during the development of this indicator. Their expertise in options market dynamics and mathematical modeling has been instrumental in creating this tool.

PS : I use "large expansion" mode

Note di rilascio

reset londonNote di rilascio

reset 8:30Note di rilascio

new one (better imo) PS : je ne peux pas le mettre a jours donc c'est en teste ne l'utilisez pasScript protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarlo liberamente e senza alcuna limitazione – per saperne di più clicca qui.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.