OPEN-SOURCE SCRIPT

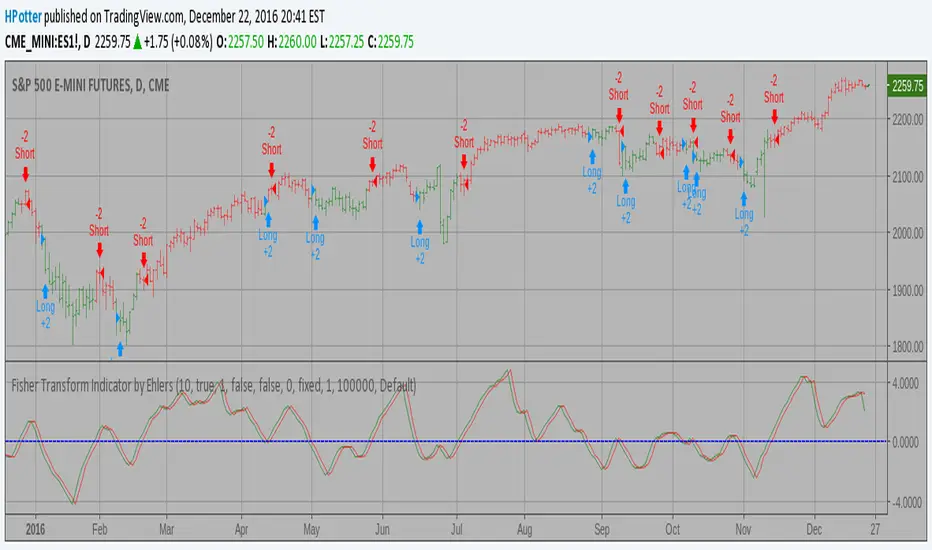

Fisher Transform Indicator by Ehlers Backtest v 2.0

Market prices do not have a Gaussian probability density function

as many traders think. Their probability curve is not bell-shaped.

But trader can create a nearly Gaussian PDF for prices by normalizing

them or creating a normalized indicator such as the relative strength

index and applying the Fisher transform. Such a transformed output

creates the peak swings as relatively rare events.

Fisher transform formula is: y = 0.5 * ln ((1+x)/(1-x))

The sharp turning points of these peak swings clearly and unambiguously

identify price reversals in a timely manner.

For signal used zero.

You can change long to short in the Input Settings

Please, use it only for learning or paper trading. Do not for real trading.

as many traders think. Their probability curve is not bell-shaped.

But trader can create a nearly Gaussian PDF for prices by normalizing

them or creating a normalized indicator such as the relative strength

index and applying the Fisher transform. Such a transformed output

creates the peak swings as relatively rare events.

Fisher transform formula is: y = 0.5 * ln ((1+x)/(1-x))

The sharp turning points of these peak swings clearly and unambiguously

identify price reversals in a timely manner.

For signal used zero.

You can change long to short in the Input Settings

Please, use it only for learning or paper trading. Do not for real trading.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.