PROTECTED SOURCE SCRIPT

Aggiornato HT: Waves Light

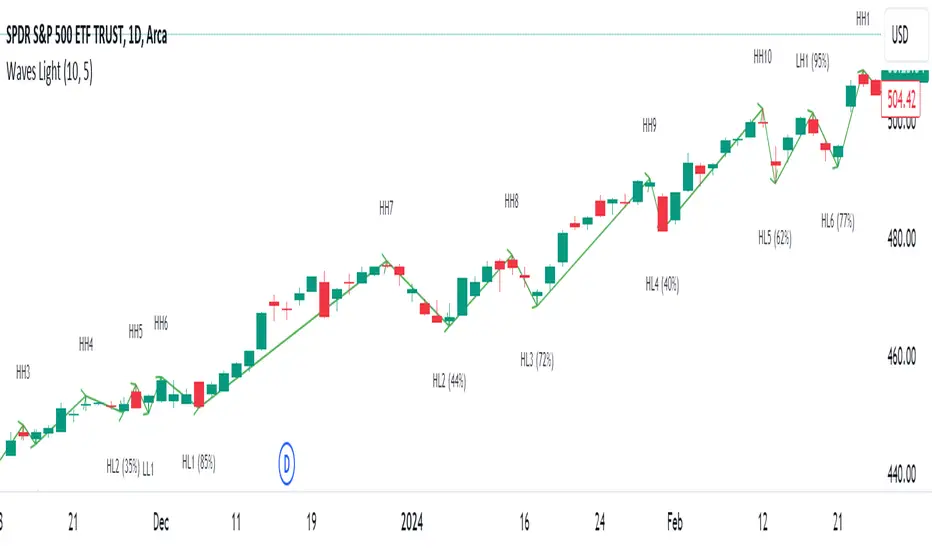

Indicator visualizes waves, based on candlestick analysis (one-time-framing and price action concepts), eliminating subjectivity bias that often plagues manual charting of waves. It also doesn’t require much tuning to adjust for specific ticket unlike zigzag or other volatility-based indicators.

Waves can be used to detect current trend and assess its healthiness. For example, we can compare lengths of bullish and bearish waves to detect shift in power. Also, visualization of waves makes it easy to identify chart patterns such as double tops/bottoms, head-and-shoulders etc…

Another application is using waves’ pv points as reference levels to check for Change of Character. For example, in an uptrend higher low (HL) often acts as major support level. If broken it indicates a major change of character (i.e. possible trend reversal)

How it works?

Waves construction:

• Wave construction depends on the selected timeframe.

• Bullish wave lasts while every new candlestick low is higher than previous candlestick low. Breaking of this rule marks change of direction.

• Bearish wave lasts while every new candlestick high is lower than previous candlestick high. Breaking of this rule marks change of direction.

• Outside bars (when new high is higher than previous and new low is lower than previous) are interpreted as continuation of current direction unless counter-movement is really strong

• There is a time lag, measured in candlesticks, between actual direction change and when this change was detected (small triangle markers on the chart)

• Only confirmed bars are used for calculations.

Trend detection:

• Trend detection is based on price-action principle. Uptrend is marked by rising highs and lows; downtrend - by falling highs and lows. We need at least two highs and two lows to confirm trend.

• There are situations of uncertainty when we have higher low and lower high at the same time. They can resolve into continuation of the current trend or into its reversal. Such situations are drawn in gray color.

Pivot Points

Indicator does marking of pivot points based on their relative position - higher low (HL), lower low (LL), higher high (HH), lower high (LH) – and shows retracement level for correction waves.

Parameters:

• Allowance - allowance in ticks that must be exceeded to trigger direction reversal. E.g. if value = 10, then bullish wave ends when new candle low is 10 ticks lower than previous candle low (except for outside bars). Low values are recommended for lower timeframes and/or low volatility tickets; higher values – for higher timeframes and/or high volatility.

• Periods Back – number of candles back from the direction change signal to look for pivot low/high. In 90% of cases 5 is the optimal value but sometimes you might want to increase it for better fit (e.g. for low timeframes/low volatility)

Disclaimer

This indicator should not be used as a standalone tool to make trading decisions. It should be used in conjunction with other technical analysis methods.

Waves can be used to detect current trend and assess its healthiness. For example, we can compare lengths of bullish and bearish waves to detect shift in power. Also, visualization of waves makes it easy to identify chart patterns such as double tops/bottoms, head-and-shoulders etc…

Another application is using waves’ pv points as reference levels to check for Change of Character. For example, in an uptrend higher low (HL) often acts as major support level. If broken it indicates a major change of character (i.e. possible trend reversal)

How it works?

Waves construction:

• Wave construction depends on the selected timeframe.

• Bullish wave lasts while every new candlestick low is higher than previous candlestick low. Breaking of this rule marks change of direction.

• Bearish wave lasts while every new candlestick high is lower than previous candlestick high. Breaking of this rule marks change of direction.

• Outside bars (when new high is higher than previous and new low is lower than previous) are interpreted as continuation of current direction unless counter-movement is really strong

• There is a time lag, measured in candlesticks, between actual direction change and when this change was detected (small triangle markers on the chart)

• Only confirmed bars are used for calculations.

Trend detection:

• Trend detection is based on price-action principle. Uptrend is marked by rising highs and lows; downtrend - by falling highs and lows. We need at least two highs and two lows to confirm trend.

• There are situations of uncertainty when we have higher low and lower high at the same time. They can resolve into continuation of the current trend or into its reversal. Such situations are drawn in gray color.

Pivot Points

Indicator does marking of pivot points based on their relative position - higher low (HL), lower low (LL), higher high (HH), lower high (LH) – and shows retracement level for correction waves.

Parameters:

• Allowance - allowance in ticks that must be exceeded to trigger direction reversal. E.g. if value = 10, then bullish wave ends when new candle low is 10 ticks lower than previous candle low (except for outside bars). Low values are recommended for lower timeframes and/or low volatility tickets; higher values – for higher timeframes and/or high volatility.

• Periods Back – number of candles back from the direction change signal to look for pivot low/high. In 90% of cases 5 is the optimal value but sometimes you might want to increase it for better fit (e.g. for low timeframes/low volatility)

Disclaimer

This indicator should not be used as a standalone tool to make trading decisions. It should be used in conjunction with other technical analysis methods.

Note di rilascio

UPD 1.1: minor fixesNote di rilascio

UPD 1.2: added auto candle allowance calculationNote di rilascio

UPD1.3: added counters for pivot points: higher highs, higher lows, lower highs, lower lowsNote di rilascio

UPD 1.4: Added an option to construct waves based on the Heikin Ashi (HA) algorithm. Bullish waves correspond to the "green" close of HA candles, while bearish waves correspond to the "red" close. HA candles are calculated behind the scenes, allowing the plotting of waves on a standard candlestick chart. If the “Heikin Ashi” parameter is checked, the "Allowance" parameter will be ignored, meaning highs and lows no longer matter; only the close of the HA candle is considered. Additionally, visualization of the developing wave has been added.Note di rilascio

UPD 1.41: minor fixNote di rilascio

UPD 1.42: minor fixNote di rilascio

UPD 1.5: added alerts functionality. now, it is possible to set alerts for highs and lowsNote di rilascio

UPD 1.51: minor fixesNote di rilascio

UPD 1.52: minor fixes. removed "Periods back" setting (made it constant) for simplicityScript protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.