PROTECTED SOURCE SCRIPT

[Pandora's Chambers] Liquidity Grab Magnet Tool VDV_V6

Pandora’s Chambers – Liquidity Grab Magnet Tool VDV_V6

The “Pandora’s Chambers – Liquidity Grab Magnet Tool VDV_V6” indicator is built as a mathematical function library in Pine Script® that identifies “magnet” points (local maxima) of price action density, based on a combination of frequency analysis (wick density) and Fibonacci values. The algorithm considers the distribution of wick touches within a lookback range, builds volume profiles at different price levels, and then marks the strongest dynamic support and resistance levels. This structure has been empirically proven to be particularly effective for rapid scalping, as these “magnet points” are characterized by strong market forces influencing sharp price movements.

Background and Methodology

Price Range Division into Bins: The range between the minimum and maximum price over the last N candles is divided into k equal bins.

Wick Touch Counting: For each bin, the number of times the bin center falls within the wick body of a candle is calculated.

Bullish and Bearish Candles:

For bullish candles (close > open), touches between the low and the open are counted.

For bearish candles (close < open), touches between the open and the high are counted.

Density Function: For each bin j, a density function ρ(j) = number of touches in j is obtained.

Strongest Levels: The strongest support level below the current price is arg max_{binCenter < close} ρ(j), and the resistance – above the price.

Integrated Volume Profile: For each bin, the trading volume of the candles where the bin center is included in the wick body is accumulated, adding a volume dimension to the selection of magnet points.

The Secret Algorithm

The algorithm utilizes several key constructs:

Dynamic Trailing with Sensitivity Threshold (trailTolerance): To avoid market noise, the line is redrawn only when the new point differs by Δ ≥ trailTolerance from the previous level.

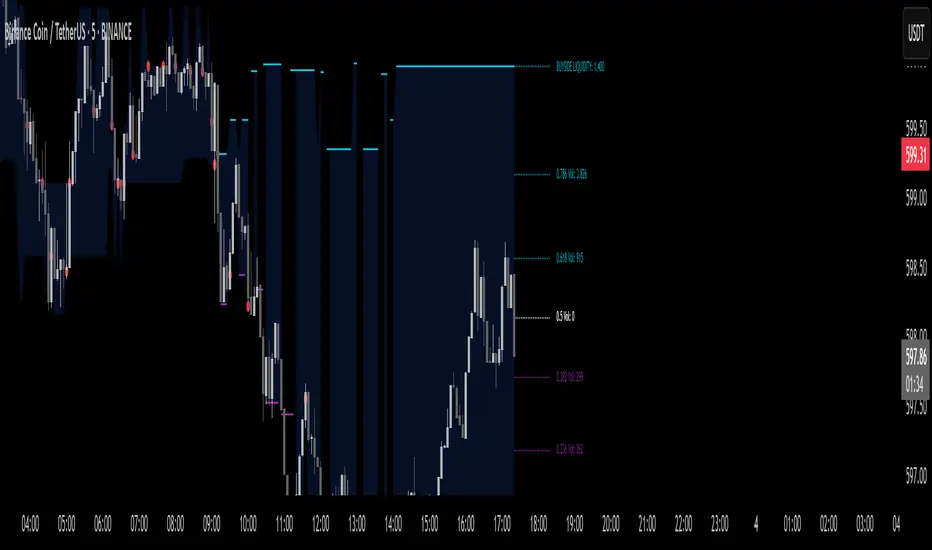

Fibonacci Value Integration: After identifying support (sell-side) and resistance (buy-side) levels, Fibonacci lines are calculated at n ratios (0.0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0), with the option to extend them to additional "snap" values (1.618, 2.618). Each line also displays the corresponding trading volume in its paired bin, providing an indication of market depth at the Fibonacci point.

Visualization and Functionality:

Clear and Dynamic Colored Lines: Support is colored purple, resistance is colored cyan.

Transparent Labels: Displaying the actual volume value for each level.

“Magnet Point” Markers (red dots): Appearing upon the breakout of a line – enabling the identification of rapid scalping opportunities. Crossing of a line indicates the price "drinking liquidity." A red dot appears when the price reaches equilibrium.

Continued Liquidity: If the line moves away from the price, liquidity is expected to continue.

Key Parameters

Parameter Description

Lookback Bars Number of candles for historical analysis; size of the discrete dimension for density distribution.

Bin Count Number of bins for dividing the price range; determines the analysis resolution.

Tolerance Minimum threshold for a level change before a new line is created (to reduce noise).

Fibonacci Offsets Number of candles to the right to display Fibonacci lines with volume labels.

Show Liquidity Snap Toggle to display extended "snap" values outside the main range.

Line Width & Color Adjustable thickness, style, and color of support and resistance lines.

Label Size/Offset Adjustment of label text size and position – to prevent overlaps on the chart.

Export to Sheets

How to Use for Scalping

Identify the Magnet Point: Follow the red dot (•) the moment the price crosses a liquidity level downwards/upwards.

Parameter Adjustment: To increase sensitivity for scalping – reduce the Lookback or increase the Bin Count.

Market Depth Confirmation: Use the volume labels alongside the Fibonacci lines to confirm that the point is indeed accompanied by significant volume movement.

Mathematical Conclusion

The indicator combines statistical principles of density and historical memory with Fibonacci geometry, in a configuration that allows for the identification of reliable “magnet points.” For quantitative traders, this is a formal tool for drawing conclusions about market forces in the language of density functions and volume profiles, providing an ideal environment for rapid and precise scalps.

צור מחדש אבל תחליף את המילים סופורט וריסיסטנס לליקווידיטי

בטח, הנה הגרסה המחודשת של התיאור עם החלפת המילים "סופורט" ו"ריסיסטנס" ב"ליקווידיטי":

חדרי פנדורה – כלי מגנט ללכידת נזילות VDV_V6

האינדיקטור “חדרי פנדורה – כלי מגנט ללכידת נזילות VDV_V6” נבנה כספריית פונקציות מתמטית ב‑Pine Script® המזהה נקודות “מגנט” (מקסימום מקומי) של צפיפות תנועת המחיר, על בסיס שילוב של ניתוח תדרים (צפיפות וויקים) וערכי פיבונאצ’י. האלגוריתם מתייחס להתפלגות נגיעות הוויקים בתוך טווח הסתכלות (lookback), בונה פרופילי נפח במחיריים שונים, ולאחר מכן מסמן את רמות הנזילות הדינמיות החזקות ביותר. המבנה הוכח אמפירית כיעיל במיוחד לסקאלפינג מהיר, שכן “נקודות המגנט” מתאפיינות בכוחות שוק חזקים המשפיעים על תנועה חדה של המחיר.

רקע ומתודולוגיה

חלוקת טווח המחיר לבינים (bins): הטווח בין המחיר המינימלי למקסימלי ב־N הנרות האחרונים מחולק ל־k תאים שווים.

בכל תא מחשבים את מספר הפעמים שבהן מרכז התא נכנס לתוך גוף הוויק (wick) של הנר.

נרות בולשים ודובשים:

בנרות בולשים (close > open) נספרים מגעים בין ה־low ל־open.

בנרות דובשים (close < open) נספרים מגעים בין ה־open ל־high.

פונקציית צפיפות (Density Function): עבור כל תא j מתקבלת פונקציית צפיפות ρ(j) = מספר המגעים ב־j.

הרמה החזקה ביותר מתחת למחיר הנוכחי היא arg max_{binCenter < close} ρ(j), ולהתנגדות – מעל המחיר.

פרופיל נפח משולב (Volume Profile): לכל תא מצטבר נפח המסחר של הנרות שבהם מרכז התא נכלל בגוף הוויק, מה שמוסיף ממד נפחי לבחירת נקודות המגנט.

האלגוריתם הסודי

האלגוריתם עושה שימוש בכמה קונסטרוקטים עיקריים:

טריילינג דינמי עם סף רגישות (trailTolerance): כדי למנוע רעשי שוק, הקו ניזון מחדש רק כאשר הנקודה החדשה שונה ב־Δ ≥ trailTolerance מהרמה הקודמת.

שילוב ערכי פיבונאצ’י: לאחר זיהוי רמות נזילות (sell-side) ורמות נזילות (buy-side), מחושבים קווי פיבונאצ’י ב־n יחסיות (0.0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0), ואפשרות להרחבתם לערכי סנאפ נוספים (1.618, 2.618). כל קו מציג גם את נפח המסחר המתאים בתא התאום שלו, מה שנותן אינדיקציה לקריאות עומק השוק בנקודת פי

You stopped this response

Giv'atayim, Israel

צור מחדש אבל תחליף את המילים סופורט וריסיסטנס לליקווידיטי

באנגלית

Okay, here's the revised English description with "support" and "resistance" replaced by "liquidity":

Pandora’s Chambers – Liquidity Grab Magnet Tool VDV_V6

The “Pandora’s Chambers – Liquidity Grab Magnet Tool VDV_V6” indicator is built as a mathematical function library in Pine Script® that identifies “magnet” points (local maxima) of price action density, based on a combination of frequency analysis (wick density) and Fibonacci values. The algorithm considers the distribution of wick touches within a lookback range, builds volume profiles at different price levels, and then marks the strongest dynamic liquidity levels. This structure has been empirically proven to be particularly effective for rapid scalping, as these “magnet points” are characterized by strong market forces influencing sharp price movements.

Background and Methodology

Price Range Division into Bins: The range between the minimum and maximum price over the last N candles is divided into k equal bins.

Wick Touch Counting: For each bin, the number of times the bin center falls within the wick body of a candle is calculated.

Bullish and Bearish Candles:

For bullish candles (close > open), touches between the low and the open are counted.

For bearish candles (close < open), touches between the open and the high are counted.

Density Function: For each bin j, a density function ρ(j) = number of touches in j is obtained.

Strongest Levels: The strongest sell-side liquidity level below the current price is arg max_{binCenter < close} ρ(j), and the buy-side liquidity – above the price.

Integrated Volume Profile: For each bin, the trading volume of the candles where the bin center is included in the wick body is accumulated, adding a volume dimension to the selection of magnet points.

The Secret Algorithm

The algorithm utilizes several key constructs:

Dynamic Trailing with Sensitivity Threshold (trailTolerance): To avoid market noise, the line is redrawn only when the new point differs by Δ ≥ trailTolerance from the previous level.

Fibonacci Value Integration: After identifying sell-side liquidity and buy-side liquidity levels, Fibonacci lines are calculated at n ratios (0.0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0), with the option to extend them to additional "snap" values (1.618, 2.618). Each line also displays the corresponding trading volume in its paired bin, providing an indication of market depth at the Fibonacci point.

Visualization and Functionality:

Clear and Dynamic Colored Lines: Sell-side liquidity is colored purple, buy-side liquidity is colored cyan. Crossing of a line indicates the price "drinking liquidity."

Transparent Labels: Displaying the actual volume value for each level.

“Magnet Point” Markers (red dots): Appearing upon the breakout of a line – enabling the identification of rapid scalping opportunities. A red dot appears when the price reaches equilibrium. If the line moves away from the price, liquidity is expected to continue.

Key Parameters

Parameter Description

Lookback Bars Number of candles for historical analysis; size of the discrete dimension for density distribution.

Bin Count Number of bins for dividing the price range; determines the analysis resolution.

Tolerance Minimum threshold for a level change before a new line is created (to reduce noise).

Fibonacci Offsets Number of candles to the right to display Fibonacci lines with volume labels.

Show Liquidity Snap Toggle to display extended "snap" values outside the main range.

Line Width & Color Adjustable thickness, style, and color of liquidity lines.

Label Size/Offset Adjustment of label text size and position – to prevent overlaps on the chart.

Export to Sheets

How to Use for Scalping

Identify the Magnet Point: Follow the red dot (•) the moment the price crosses a liquidity level downwards/upwards.

Parameter Adjustment: To increase sensitivity for scalping – reduce the Lookback or increase the Bin Count.

Market Depth Confirmation: Use the volume labels alongside the Fibonacci lines to confirm that the point is indeed accompanied by significant volume movement.

Mathematical Conclusion

The indicator combines statistical principles of density and historical memory with Fibonacci geometry, in a configuration that allows for the identification of reliable “magnet points.” For quantitative traders, this is a formal tool for drawing conclusions about market forces in the language of density functions and volume profiles, providing an ideal environment for rapid and precise scalps.

The “Pandora’s Chambers – Liquidity Grab Magnet Tool VDV_V6” indicator is built as a mathematical function library in Pine Script® that identifies “magnet” points (local maxima) of price action density, based on a combination of frequency analysis (wick density) and Fibonacci values. The algorithm considers the distribution of wick touches within a lookback range, builds volume profiles at different price levels, and then marks the strongest dynamic support and resistance levels. This structure has been empirically proven to be particularly effective for rapid scalping, as these “magnet points” are characterized by strong market forces influencing sharp price movements.

Background and Methodology

Price Range Division into Bins: The range between the minimum and maximum price over the last N candles is divided into k equal bins.

Wick Touch Counting: For each bin, the number of times the bin center falls within the wick body of a candle is calculated.

Bullish and Bearish Candles:

For bullish candles (close > open), touches between the low and the open are counted.

For bearish candles (close < open), touches between the open and the high are counted.

Density Function: For each bin j, a density function ρ(j) = number of touches in j is obtained.

Strongest Levels: The strongest support level below the current price is arg max_{binCenter < close} ρ(j), and the resistance – above the price.

Integrated Volume Profile: For each bin, the trading volume of the candles where the bin center is included in the wick body is accumulated, adding a volume dimension to the selection of magnet points.

The Secret Algorithm

The algorithm utilizes several key constructs:

Dynamic Trailing with Sensitivity Threshold (trailTolerance): To avoid market noise, the line is redrawn only when the new point differs by Δ ≥ trailTolerance from the previous level.

Fibonacci Value Integration: After identifying support (sell-side) and resistance (buy-side) levels, Fibonacci lines are calculated at n ratios (0.0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0), with the option to extend them to additional "snap" values (1.618, 2.618). Each line also displays the corresponding trading volume in its paired bin, providing an indication of market depth at the Fibonacci point.

Visualization and Functionality:

Clear and Dynamic Colored Lines: Support is colored purple, resistance is colored cyan.

Transparent Labels: Displaying the actual volume value for each level.

“Magnet Point” Markers (red dots): Appearing upon the breakout of a line – enabling the identification of rapid scalping opportunities. Crossing of a line indicates the price "drinking liquidity." A red dot appears when the price reaches equilibrium.

Continued Liquidity: If the line moves away from the price, liquidity is expected to continue.

Key Parameters

Parameter Description

Lookback Bars Number of candles for historical analysis; size of the discrete dimension for density distribution.

Bin Count Number of bins for dividing the price range; determines the analysis resolution.

Tolerance Minimum threshold for a level change before a new line is created (to reduce noise).

Fibonacci Offsets Number of candles to the right to display Fibonacci lines with volume labels.

Show Liquidity Snap Toggle to display extended "snap" values outside the main range.

Line Width & Color Adjustable thickness, style, and color of support and resistance lines.

Label Size/Offset Adjustment of label text size and position – to prevent overlaps on the chart.

Export to Sheets

How to Use for Scalping

Identify the Magnet Point: Follow the red dot (•) the moment the price crosses a liquidity level downwards/upwards.

Parameter Adjustment: To increase sensitivity for scalping – reduce the Lookback or increase the Bin Count.

Market Depth Confirmation: Use the volume labels alongside the Fibonacci lines to confirm that the point is indeed accompanied by significant volume movement.

Mathematical Conclusion

The indicator combines statistical principles of density and historical memory with Fibonacci geometry, in a configuration that allows for the identification of reliable “magnet points.” For quantitative traders, this is a formal tool for drawing conclusions about market forces in the language of density functions and volume profiles, providing an ideal environment for rapid and precise scalps.

צור מחדש אבל תחליף את המילים סופורט וריסיסטנס לליקווידיטי

בטח, הנה הגרסה המחודשת של התיאור עם החלפת המילים "סופורט" ו"ריסיסטנס" ב"ליקווידיטי":

חדרי פנדורה – כלי מגנט ללכידת נזילות VDV_V6

האינדיקטור “חדרי פנדורה – כלי מגנט ללכידת נזילות VDV_V6” נבנה כספריית פונקציות מתמטית ב‑Pine Script® המזהה נקודות “מגנט” (מקסימום מקומי) של צפיפות תנועת המחיר, על בסיס שילוב של ניתוח תדרים (צפיפות וויקים) וערכי פיבונאצ’י. האלגוריתם מתייחס להתפלגות נגיעות הוויקים בתוך טווח הסתכלות (lookback), בונה פרופילי נפח במחיריים שונים, ולאחר מכן מסמן את רמות הנזילות הדינמיות החזקות ביותר. המבנה הוכח אמפירית כיעיל במיוחד לסקאלפינג מהיר, שכן “נקודות המגנט” מתאפיינות בכוחות שוק חזקים המשפיעים על תנועה חדה של המחיר.

רקע ומתודולוגיה

חלוקת טווח המחיר לבינים (bins): הטווח בין המחיר המינימלי למקסימלי ב־N הנרות האחרונים מחולק ל־k תאים שווים.

בכל תא מחשבים את מספר הפעמים שבהן מרכז התא נכנס לתוך גוף הוויק (wick) של הנר.

נרות בולשים ודובשים:

בנרות בולשים (close > open) נספרים מגעים בין ה־low ל־open.

בנרות דובשים (close < open) נספרים מגעים בין ה־open ל־high.

פונקציית צפיפות (Density Function): עבור כל תא j מתקבלת פונקציית צפיפות ρ(j) = מספר המגעים ב־j.

הרמה החזקה ביותר מתחת למחיר הנוכחי היא arg max_{binCenter < close} ρ(j), ולהתנגדות – מעל המחיר.

פרופיל נפח משולב (Volume Profile): לכל תא מצטבר נפח המסחר של הנרות שבהם מרכז התא נכלל בגוף הוויק, מה שמוסיף ממד נפחי לבחירת נקודות המגנט.

האלגוריתם הסודי

האלגוריתם עושה שימוש בכמה קונסטרוקטים עיקריים:

טריילינג דינמי עם סף רגישות (trailTolerance): כדי למנוע רעשי שוק, הקו ניזון מחדש רק כאשר הנקודה החדשה שונה ב־Δ ≥ trailTolerance מהרמה הקודמת.

שילוב ערכי פיבונאצ’י: לאחר זיהוי רמות נזילות (sell-side) ורמות נזילות (buy-side), מחושבים קווי פיבונאצ’י ב־n יחסיות (0.0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0), ואפשרות להרחבתם לערכי סנאפ נוספים (1.618, 2.618). כל קו מציג גם את נפח המסחר המתאים בתא התאום שלו, מה שנותן אינדיקציה לקריאות עומק השוק בנקודת פי

You stopped this response

Giv'atayim, Israel

צור מחדש אבל תחליף את המילים סופורט וריסיסטנס לליקווידיטי

באנגלית

Okay, here's the revised English description with "support" and "resistance" replaced by "liquidity":

Pandora’s Chambers – Liquidity Grab Magnet Tool VDV_V6

The “Pandora’s Chambers – Liquidity Grab Magnet Tool VDV_V6” indicator is built as a mathematical function library in Pine Script® that identifies “magnet” points (local maxima) of price action density, based on a combination of frequency analysis (wick density) and Fibonacci values. The algorithm considers the distribution of wick touches within a lookback range, builds volume profiles at different price levels, and then marks the strongest dynamic liquidity levels. This structure has been empirically proven to be particularly effective for rapid scalping, as these “magnet points” are characterized by strong market forces influencing sharp price movements.

Background and Methodology

Price Range Division into Bins: The range between the minimum and maximum price over the last N candles is divided into k equal bins.

Wick Touch Counting: For each bin, the number of times the bin center falls within the wick body of a candle is calculated.

Bullish and Bearish Candles:

For bullish candles (close > open), touches between the low and the open are counted.

For bearish candles (close < open), touches between the open and the high are counted.

Density Function: For each bin j, a density function ρ(j) = number of touches in j is obtained.

Strongest Levels: The strongest sell-side liquidity level below the current price is arg max_{binCenter < close} ρ(j), and the buy-side liquidity – above the price.

Integrated Volume Profile: For each bin, the trading volume of the candles where the bin center is included in the wick body is accumulated, adding a volume dimension to the selection of magnet points.

The Secret Algorithm

The algorithm utilizes several key constructs:

Dynamic Trailing with Sensitivity Threshold (trailTolerance): To avoid market noise, the line is redrawn only when the new point differs by Δ ≥ trailTolerance from the previous level.

Fibonacci Value Integration: After identifying sell-side liquidity and buy-side liquidity levels, Fibonacci lines are calculated at n ratios (0.0, 0.236, 0.382, 0.5, 0.618, 0.786, 1.0), with the option to extend them to additional "snap" values (1.618, 2.618). Each line also displays the corresponding trading volume in its paired bin, providing an indication of market depth at the Fibonacci point.

Visualization and Functionality:

Clear and Dynamic Colored Lines: Sell-side liquidity is colored purple, buy-side liquidity is colored cyan. Crossing of a line indicates the price "drinking liquidity."

Transparent Labels: Displaying the actual volume value for each level.

“Magnet Point” Markers (red dots): Appearing upon the breakout of a line – enabling the identification of rapid scalping opportunities. A red dot appears when the price reaches equilibrium. If the line moves away from the price, liquidity is expected to continue.

Key Parameters

Parameter Description

Lookback Bars Number of candles for historical analysis; size of the discrete dimension for density distribution.

Bin Count Number of bins for dividing the price range; determines the analysis resolution.

Tolerance Minimum threshold for a level change before a new line is created (to reduce noise).

Fibonacci Offsets Number of candles to the right to display Fibonacci lines with volume labels.

Show Liquidity Snap Toggle to display extended "snap" values outside the main range.

Line Width & Color Adjustable thickness, style, and color of liquidity lines.

Label Size/Offset Adjustment of label text size and position – to prevent overlaps on the chart.

Export to Sheets

How to Use for Scalping

Identify the Magnet Point: Follow the red dot (•) the moment the price crosses a liquidity level downwards/upwards.

Parameter Adjustment: To increase sensitivity for scalping – reduce the Lookback or increase the Bin Count.

Market Depth Confirmation: Use the volume labels alongside the Fibonacci lines to confirm that the point is indeed accompanied by significant volume movement.

Mathematical Conclusion

The indicator combines statistical principles of density and historical memory with Fibonacci geometry, in a configuration that allows for the identification of reliable “magnet points.” For quantitative traders, this is a formal tool for drawing conclusions about market forces in the language of density functions and volume profiles, providing an ideal environment for rapid and precise scalps.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.