PROTECTED SOURCE SCRIPT

Aggiornato CoffeeShopCrypto High Timeframe Dynamic Order Blocks

This indicator automates the detection of significant order blocks in real time, from higher timeframes (Daily, Weekly, Monthly) and dynamically adapts their zone boundaries to your current chart timeframe regardless of what you change it to. By analyzing market structure across multiple time horizons, it identifies institutional-level supply/demand zones and precisely recalculates their parameters to match your active chart's resolution - whether you're viewing 1-minute or 4-hour candles or even higher.

Key Technical Features:

*Adaptive Zone Calculation: Automatically recalculates zone boundaries when you change timeframes, maintaining accurate price levels and candle formations specific to your chart

*Smart Price Action Filtering: Isolates only the relevant candles that formed each order block within your current timeframe's context

*Structural Precision: Adjusts zone width and position based on the actual candle wicks/bodies that created the order block in your active timeframe.

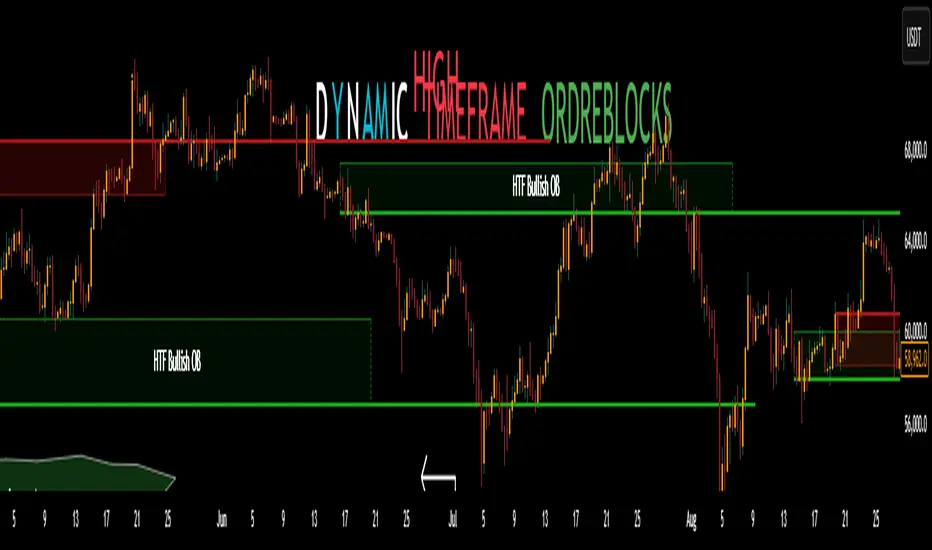

What they look like when calculated instantly.

About Order Blocks (Market Structure Perspective):

Order blocks represent concentrated areas where institutional traders executed significant positions, creating imbalances in market structure.

These zones become:

Bullish Order Blocks: Demand areas where aggressive buying overwhelmed sellers, often appearing as consolidation before strong upward movements.

Bearish Order Blocks: Supply zones where distribution activity preceded substantial downward moves.

How It Works Differently:

The indicator identifies these critical areas by analyzing the relationship between consecutive candles' opens, highs, lows, and closes - particularly focusing on break-of-structure patterns that confirm zone validity.

Traditional order block indicators simply copy higher timeframe zones to lower charts. These common orderblocks are said be found as the candle before the candle that caused a huge market swing. In a break long, you would look backwards to find the first previous bearish candle. The opposite find would be for a break short.

This is a most unreliable method in finding orderblocks and simply is not true.

Zone Extensions. Choose how far into the future you want your zone to go to. There is no wrong number but you don't want to go too far.

This scripts performs true multi-timeframe analysis by:

*Detecting the original order block formation conditions on HTFs

*Drilling down to find the exact "candle sequence" that created the zone in your current timeframe.

*Continuously monitoring for structural breaks that invalidate zones

*Automatically adjusting all visual elements when you switch timeframes

Usage Benefits:

*Eliminates manual timeframe switching to identify significant zones

*Maintains visual consistency when changing chart resolutions

*Provides cleaner charts by only showing relevant order blocks

*Adapts to any market (Forex, Stocks, Crypto) and any timeframe combination

Breached Zones. The zone becomes invalidated but the Supply or Demand line is still relevant.

Note on Trading:

While this indicator precisely identifies order block locations, trading methodologies using these zones depend on individual strategy preferences. The tool focuses exclusively on accurate technical detection and adaptive visualization across timeframes.

How to Use Them:

As long as you don't have price action breach of a Bullish Zone Demand Floor you can keep using that zone as a bullish orderblock until its Demand Floor has been breached.

This also means you can still use its Demand Floor as a support level while the Zone itself is no longer relevant. This eliminates the orderblock ZONE as being an orderblock and now you only have a supply floor left to use as support.

As long as you don't have price action breach of a Bearish Zone Supply Wall you can keep using that zone as a bearish orderblock until its Supply Wall has been breached.

This also means you can still use its Supply Wall as a resistance level while the Zone itself is no longer relevant. This eliminates the orderblock ZONE as being an orderblock and now you only have a resistance level.

Once either has been breached, you would find liquidity behind the zone of the ordreblock. This is where price will seek support or resistance depending on the zone type.

Orderblocks has a BODY and who knew they could be so cute. I mean look at this structure.

This is how they are built and what their levels represent.

Key Technical Features:

- Multi-Timeframe Analysis: Scans daily/weekly/monthly data to identify the most significant order blocks that influence all lower timeframes

*Adaptive Zone Calculation: Automatically recalculates zone boundaries when you change timeframes, maintaining accurate price levels and candle formations specific to your chart

*Smart Price Action Filtering: Isolates only the relevant candles that formed each order block within your current timeframe's context

*Structural Precision: Adjusts zone width and position based on the actual candle wicks/bodies that created the order block in your active timeframe.

What they look like when calculated instantly.

About Order Blocks (Market Structure Perspective):

Order blocks represent concentrated areas where institutional traders executed significant positions, creating imbalances in market structure.

These zones become:

Bullish Order Blocks: Demand areas where aggressive buying overwhelmed sellers, often appearing as consolidation before strong upward movements.

Bearish Order Blocks: Supply zones where distribution activity preceded substantial downward moves.

How It Works Differently:

The indicator identifies these critical areas by analyzing the relationship between consecutive candles' opens, highs, lows, and closes - particularly focusing on break-of-structure patterns that confirm zone validity.

Traditional order block indicators simply copy higher timeframe zones to lower charts. These common orderblocks are said be found as the candle before the candle that caused a huge market swing. In a break long, you would look backwards to find the first previous bearish candle. The opposite find would be for a break short.

This is a most unreliable method in finding orderblocks and simply is not true.

Zone Extensions. Choose how far into the future you want your zone to go to. There is no wrong number but you don't want to go too far.

This scripts performs true multi-timeframe analysis by:

*Detecting the original order block formation conditions on HTFs

*Drilling down to find the exact "candle sequence" that created the zone in your current timeframe.

*Continuously monitoring for structural breaks that invalidate zones

*Automatically adjusting all visual elements when you switch timeframes

Usage Benefits:

*Eliminates manual timeframe switching to identify significant zones

*Maintains visual consistency when changing chart resolutions

*Provides cleaner charts by only showing relevant order blocks

*Adapts to any market (Forex, Stocks, Crypto) and any timeframe combination

Breached Zones. The zone becomes invalidated but the Supply or Demand line is still relevant.

Note on Trading:

While this indicator precisely identifies order block locations, trading methodologies using these zones depend on individual strategy preferences. The tool focuses exclusively on accurate technical detection and adaptive visualization across timeframes.

How to Use Them:

As long as you don't have price action breach of a Bullish Zone Demand Floor you can keep using that zone as a bullish orderblock until its Demand Floor has been breached.

This also means you can still use its Demand Floor as a support level while the Zone itself is no longer relevant. This eliminates the orderblock ZONE as being an orderblock and now you only have a supply floor left to use as support.

As long as you don't have price action breach of a Bearish Zone Supply Wall you can keep using that zone as a bearish orderblock until its Supply Wall has been breached.

This also means you can still use its Supply Wall as a resistance level while the Zone itself is no longer relevant. This eliminates the orderblock ZONE as being an orderblock and now you only have a resistance level.

Once either has been breached, you would find liquidity behind the zone of the ordreblock. This is where price will seek support or resistance depending on the zone type.

Orderblocks has a BODY and who knew they could be so cute. I mean look at this structure.

This is how they are built and what their levels represent.

Note di rilascio

Orderblock Calculations were Updated to give much better refined results for orderblock Zones.There is still more adjusting to do but future backtesting will decide if its needed.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Discord = discord.gg/EAncX5TpfB

coffeeshopcrypto3@gmail.com

coffeeshopcrypto3@gmail.com

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Discord = discord.gg/EAncX5TpfB

coffeeshopcrypto3@gmail.com

coffeeshopcrypto3@gmail.com

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.