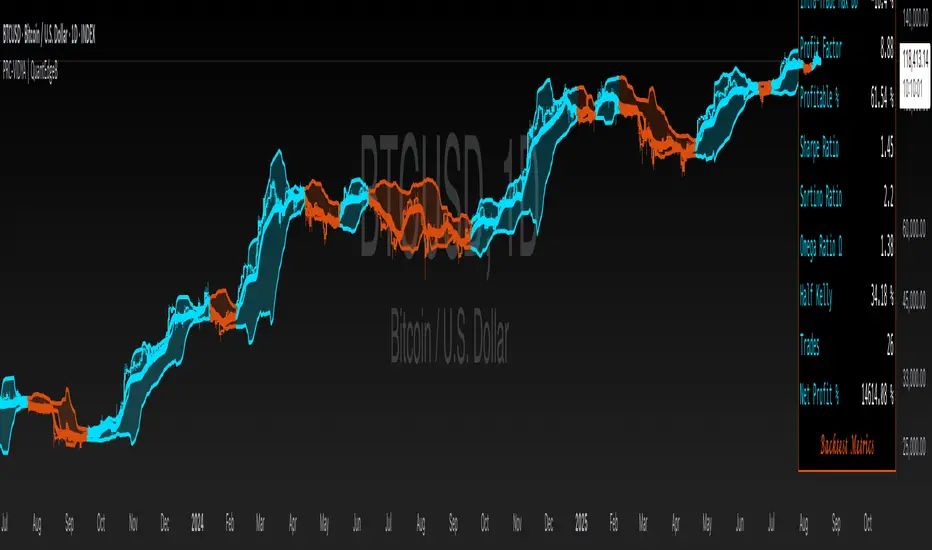

PRC-VIDYA | QuantEdgeB

Overview

The PRC-VIDYA(Volatility–Indexed Dynamic Average) is a sophisticated trading indicator developed for traders looking to capitalize on trend shifts with enhanced filtering mechanisms. It blends an Endpoint VIDYA filter—an adaptive, volatility-scaled moving average with percentile-based thresholds and a median-absolute-deviation buffer to craft a dynamic entry/exit envelope. Price thrusts beyond the upper or lower band generate crisp long/short signals, complete with colored fills, candle tinting, alerts and optional backtest stats

____

Key Features

🔹VIDYA(Volatility–Indexed Dynamic Average):

- Adaptive Moving Average that adjusts its responsiveness based on market volatility.

- Uses a dynamic smoothing constant based on standard deviations.

- Allows for better trend detection compared to static moving averages.

🔹2. Percentile Rank-Based Dynamic Levels:

- Identifies overbought (75th percentile) and oversold (25th percentile) zones.

- Dynamically adjusts based on historical data, making it robust across different market conditions.

🔹3. Median Absolute Deviation (MAD) Filtering:

- An advanced volatility filter that refines entry and exit points.

- Reduces noise by filtering out weak signals, focusing only on meaningful trend shifts.

- Uses two multipliers (long and short) to fine-tune sensitivity.

🔹4. Signal Generation:

- 📈Long Signal: Triggered when price closes above the upper dynamic threshold.

- 📉Short Signal: Triggered when price closes below the lower dynamic threshold.

- Uses color-coded candles to visually indicate trend shifts.

- Optional signal labels can be enabled for clear entry/exit indications.

🔹5. Customizable Visualization:

- Multiple color themes to match user preferences.

- Ability to overlay signals on price charts.

- Alerts available for long & short crossovers.

_____

How It Works

1. The script calculates VIDYA based on a user-defined period.

2. It computes the 75th and 25th percentile ranks of the moving average.

3. Median Absolute Deviation (MAD) Filtering is applied to reduce false breakouts.

4. A buy (long) or sell (short) signal is triggered when price crosses the respective filtered percentile levels.

5. Alerts and labels can be used to notify traders of new signals.

_____

Behavior across Crypto Majors

BTC

ETH

SOL

Note: Past behaviour is not indicative of future results. Always conduct thorough testing and risk management before making trading decisions.

_____

Best Use Cases

📌 Trend Confirmation – Use VIDYA to confirm if a trend is strengthening or weakening.

📌 Noise Reduction – MAD filtering prevents reacting to minor fluctuations, focusing on stronger trend shifts.

📌 Multi-Timeframe Scalability – Works across multiple timeframes (1H, 4H, Daily, etc.), depending on the trader’s strategy.

🧬 Default Settings

• Endpoint VIDYA Mode: “Mid” (9 bar, 24 bar hist)

• Percentile Length: 21 bars

• Upper/Lower Percentiles: 75% / 25%

• MAD Window: 21 bars

• Upper/Lower MAD Multipliers: 1.8 / 0.9

• Visuals: Candle coloring on, labels off, “Strategy” palette

• Backtest Table: off by default

_____

📌 Conclusion

PRC-VIDYA fuses a volatility-aware adaptive average with percentile boundaries and a robust deviation buffer, yielding a self-adjusting channel that captures genuine breakouts and breakdowns. Its clear regime coloring, alerts and optional backtest table make it a turnkey solution for traders who want signals that breathe with the market.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente QuantEdgeB.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente QuantEdgeB.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

whop.com/quantedgeb/ 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only