PROTECTED SOURCE SCRIPT

Aggiornato Apex Squeeze Breakout Strategy (v1.0 by SKC)

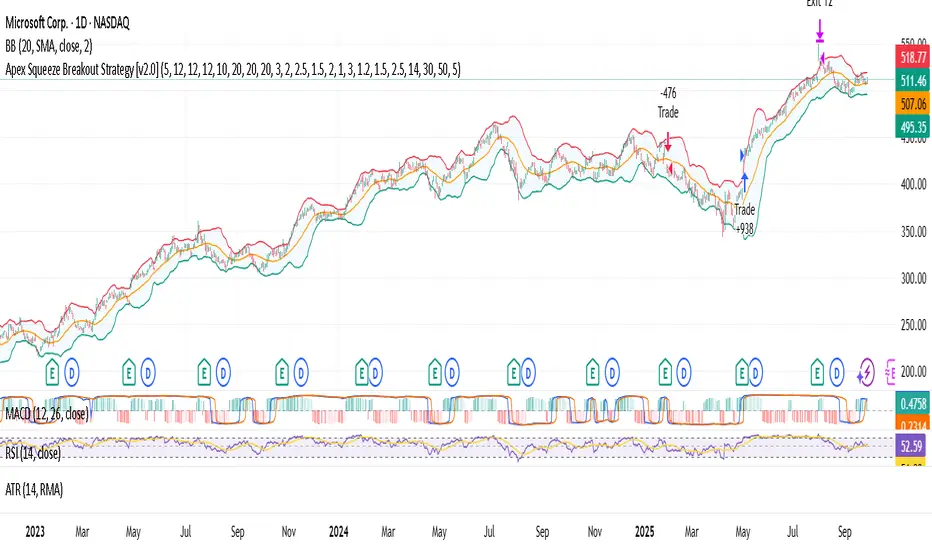

The Apex Squeeze Breakout Strategy is a powerful momentum-based system designed to capture explosive price moves following periods of low volatility compression (squeeze). It combines five key conditions to validate high-probability breakouts:

🔵 TTM Squeeze Detection using Bollinger Bands and Keltner Channels

🔊 Volume Spike Confirmation relative to a moving average

📈 Breakout Trigger above/below a recent high/low range

💪 Momentum Acceleration using percentage change over time

♻️ RSI Recovery / Overbought Logic to confirm shift in strength

The strategy includes:

Configurable swing/day trading modes

Dynamic ATR-based Stop Loss and TP1/TP2 system

Modular input structure for easy customization

Clear entry/exit visual markers and trade zones

It’s designed for disciplined traders who want to catch high-energy moves after consolidation, suitable for both intraday and swing setups.

🔵 TTM Squeeze Detection using Bollinger Bands and Keltner Channels

🔊 Volume Spike Confirmation relative to a moving average

📈 Breakout Trigger above/below a recent high/low range

💪 Momentum Acceleration using percentage change over time

♻️ RSI Recovery / Overbought Logic to confirm shift in strength

The strategy includes:

Configurable swing/day trading modes

Dynamic ATR-based Stop Loss and TP1/TP2 system

Modular input structure for easy customization

Clear entry/exit visual markers and trade zones

It’s designed for disciplined traders who want to catch high-energy moves after consolidation, suitable for both intraday and swing setups.

Note di rilascio

This strategy detects squeeze breakouts using volume spikes, volatility compression, and momentum filters.It auto-manages entries, stop-loss, and targets, while plotting clean horizontal trade lines only during active trades.

Works on both day trading (5m/15m) and swing trading (4H/D).

Use with backtesting and forward-testing before applying live.

⚠️ Educational only. Not financial advice.

Note di rilascio

his strategy detects squeeze breakouts using volume spikes, volatility compression, and momentum filters.It auto-manages entries, stop-loss, and targets, while plotting clean horizontal trade lines only during active trades.

Works on both day trading (5m/15m) and swing trading (4H/D).

Use with backtesting and forward-testing before applying live.

⚠️ Educational only. Not financial advice.

Note di rilascio

Apex Squeeze Breakout Strategy (v1.0) — Strategy Version of the Official IndicatorThis is the official strategy version of the Apex Squeeze Breakout Trading System (v2.5 by SKC) indicator.

🔍 This script replicates the exact logic and trade behavior of the indicator, including:

Multi-factor scoring system (volume spike, squeeze, RSI recovery, momentum breakout, gap)

Supertrend-based trend bias and override logic

ATR-based dynamic SL/TP

Breakeven stop-loss shift after T1 hit

Trade logic works for both swing and day trading styles via a toggle

📈 Settings:

Use isDayTrading = true for 5m/15m charts

Use isDayTrading = false for 1H–Daily swing setups

⚠️ This strategy does not use repainting or offset entries. Backtest results are directly aligned with real-time signals from the original indicator.

✅ Use this strategy to backtest ticker performance, identify high-confidence symbols, and create forward trade plans based on proven edge.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.