OPEN-SOURCE SCRIPT

Robot eVe Colorbox

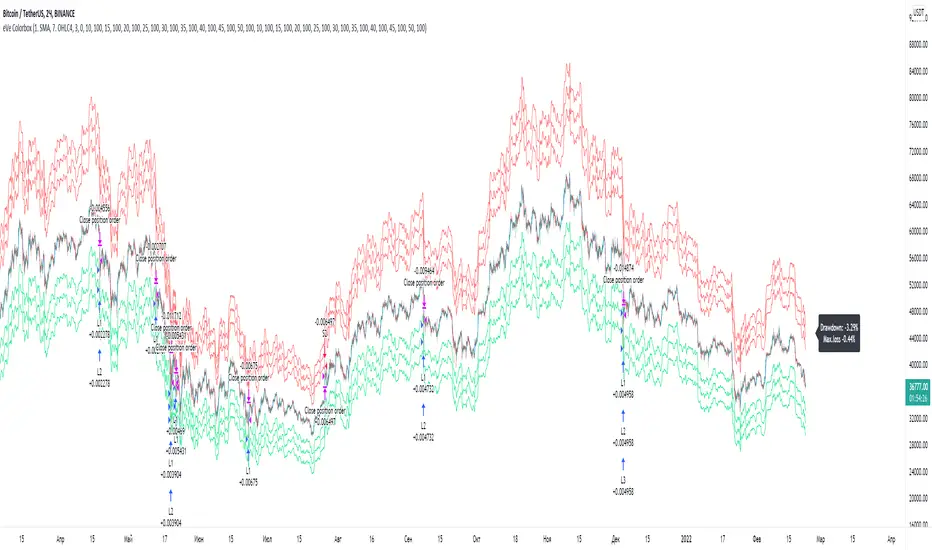

A script to test the Colorbox strategy of the trading robot eVe.

Lines

The blue line is the moving average and the reference point for the other lines.

Lime lines - a shifted moving average for opening a long position using a limit order.

Red lines - a shifted moving average for opening a short position using a limit order.

Strategy

Long positions are opened by a limit order at the price of the lime line.

Short positions shall be opened by a limit order at the price of the red line.

Any positions shall be closed by a market order.

If a long position is open, the position shall be exited upon the occurrence of any rising bar (green bar).

If a position is short, the position is exited on any falling bar (red bar).

This is a counter-trend strategy.

Exchange fees

A maker is used to enter.

A taker is used to exit.

The amounts for a maker and a taker are always equal.

For the backtest, the average commission = (maker_fee + taker_fee) / 2

Symbols

This is a very versatile strategy. It can be profitable on any trading pairs, on any asset class, and on any timeframe. But it requires the right parameters to perform well (see recommendations below).

Recommendations

The more volatile the asset, the better the strategy will work.

The more volatility , the more you need to set a slider for your orders.

The larger the time frame, the greater the number of slots required for orders.

Short positions are less profitable and more risky.

Short positions can be disabled altogether, it can be useful.

The strategy works very well for Crypto/Crypto trading pairs (e.g. ETH/BTC , DOGE/ETH, etc)

Lines

The blue line is the moving average and the reference point for the other lines.

Lime lines - a shifted moving average for opening a long position using a limit order.

Red lines - a shifted moving average for opening a short position using a limit order.

Strategy

Long positions are opened by a limit order at the price of the lime line.

Short positions shall be opened by a limit order at the price of the red line.

Any positions shall be closed by a market order.

If a long position is open, the position shall be exited upon the occurrence of any rising bar (green bar).

If a position is short, the position is exited on any falling bar (red bar).

This is a counter-trend strategy.

Exchange fees

A maker is used to enter.

A taker is used to exit.

The amounts for a maker and a taker are always equal.

For the backtest, the average commission = (maker_fee + taker_fee) / 2

Symbols

This is a very versatile strategy. It can be profitable on any trading pairs, on any asset class, and on any timeframe. But it requires the right parameters to perform well (see recommendations below).

Recommendations

The more volatile the asset, the better the strategy will work.

The more volatility , the more you need to set a slider for your orders.

The larger the time frame, the greater the number of slots required for orders.

Short positions are less profitable and more risky.

Short positions can be disabled altogether, it can be useful.

The strategy works very well for Crypto/Crypto trading pairs (e.g. ETH/BTC , DOGE/ETH, etc)

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.