PROTECTED SOURCE SCRIPT

Aggiornato Global ETF Capital Flows

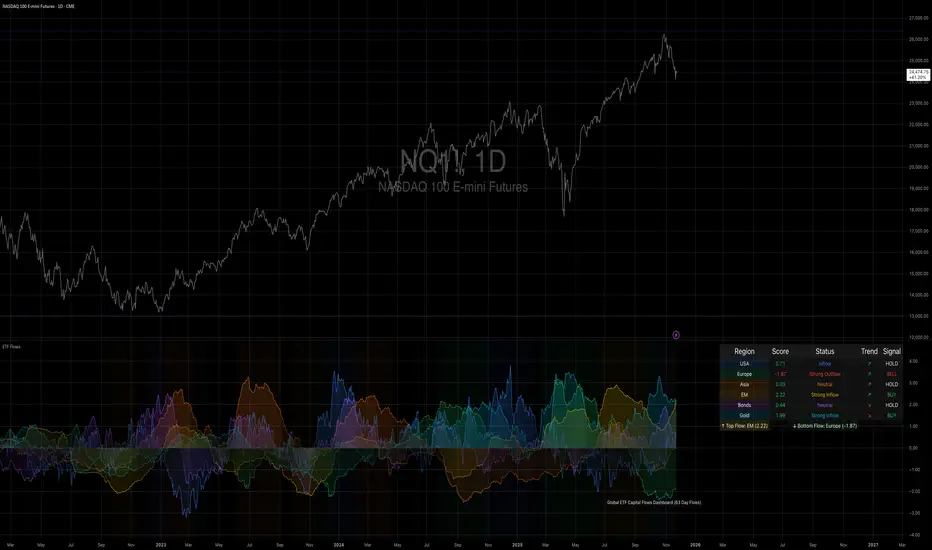

The Global ETF Capital Flows indicator is designed as a research and monitoring tool for identifying capital allocation trends across major global exchange-traded funds (ETFs). It provides standardized fund flow data for regional equity markets (including the United States, Europe, Asia, and Emerging Markets), as well as alternative asset classes such as bonds and gold.

Fund flows into and out of ETFs are increasingly recognized as a leading indicator of investor behavior, particularly in the context of tactical asset allocation and risk appetite (Ben-David et al., 2017). By tracking aggregated ETF flows, the script enables the user to detect shifts in global investment preferences, which may precede price action and influence broader macro trends (Bank of International Settlements, 2018). For example, consistent inflows into U.S. large-cap ETFs such as SPY or QQQ may signal heightened investor confidence in domestic equities, whereas rising flows into bond ETFs such as TLT may suggest a flight to safety or expectations of declining interest rates (Israeli et al., 2017).

The visualization aspect of the script uses standardized z-scores to represent cumulative flows over a specified period. This normalization allows users to compare fund flows across regions and asset classes on a relative basis, filtering out scale differences and allowing for more effective cross-market analysis. According to Coates and Herbert (2008), normalization techniques such as z-scores are crucial in behavioral finance research, as they help detect anomalies and emotional extremes in investor activity.

Practically, this indicator is suited for top-down macro analysis, sector rotation strategies, and confirmation of technical signals. For instance, significant positive deviations in the standardized flow data for European ETFs may support a bullish bias on regional equities, especially if corroborated by technical breakouts or improving economic indicators. Conversely, elevated inflows into gold ETFs may be interpreted as hedging behavior against geopolitical uncertainty or inflationary pressure, consistent with historical patterns of gold’s role as a safe haven (Baur and Lucey, 2010).

Additionally, the tool allows for visual alerts when flow anomalies exceed a user-defined threshold, thereby supporting more responsive and data-driven decision-making. This feature aligns with findings from the CFA Institute (2019), which emphasize the growing importance of alternative data and automated alert systems in modern portfolio management.

From a research perspective, the indicator facilitates empirical study into capital mobility, intermarket relationships, and ETF investor psychology. It offers real-time monitoring of region-specific investment flows, thus serving as a proxy for investor conviction, liquidity trends, and cross-border risk-on/risk-off sentiment. Several recent studies have demonstrated the predictive power of ETF flows on future returns and volatility, particularly during periods of market stress or structural dislocations (Madhavan, 2016; Pan and Zeng, 2019).

References

• Baur, D.G. and Lucey, B.M., 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), pp.217-229.

• Ben-David, I., Franzoni, F. and Moussawi, R., 2017. Exchange-traded funds (ETFs). Annual Review of Financial Economics, 9, pp.169–189.

• Bank of International Settlements (BIS), 2018. ETFs – growing popularity, growing risks? BIS Quarterly Review, March 2018.

• CFA Institute, 2019. Investment Professional of the Future. [online] Available at: cfainstitute.org/en/research/survey-reports/future-finance [Accessed 3 May 2025].

• Coates, J.M. and Herbert, J., 2008. Endogenous steroids and financial risk taking on a London trading floor. Proceedings of the National Academy of Sciences, 105(16), pp.6167–6172.

• Israeli, D., Lee, C.M. and Sridharan, S.A., 2017. Is there a dark side to ETF trading? Evidence from corporate bond ETFs. SSRN Working Paper. Available at SSRN: ssrn.com/abstract=2840716

• Madhavan, A., 2016. Exchange-Traded Funds and the New Dynamics of Investing. Oxford University Press.

• Pan, K. and Zeng, Y., 2019. ETF Arbitrage Under Liquidity Mismatch. Journal of Finance, 74(6), pp.2731–2783.

Fund flows into and out of ETFs are increasingly recognized as a leading indicator of investor behavior, particularly in the context of tactical asset allocation and risk appetite (Ben-David et al., 2017). By tracking aggregated ETF flows, the script enables the user to detect shifts in global investment preferences, which may precede price action and influence broader macro trends (Bank of International Settlements, 2018). For example, consistent inflows into U.S. large-cap ETFs such as SPY or QQQ may signal heightened investor confidence in domestic equities, whereas rising flows into bond ETFs such as TLT may suggest a flight to safety or expectations of declining interest rates (Israeli et al., 2017).

The visualization aspect of the script uses standardized z-scores to represent cumulative flows over a specified period. This normalization allows users to compare fund flows across regions and asset classes on a relative basis, filtering out scale differences and allowing for more effective cross-market analysis. According to Coates and Herbert (2008), normalization techniques such as z-scores are crucial in behavioral finance research, as they help detect anomalies and emotional extremes in investor activity.

Practically, this indicator is suited for top-down macro analysis, sector rotation strategies, and confirmation of technical signals. For instance, significant positive deviations in the standardized flow data for European ETFs may support a bullish bias on regional equities, especially if corroborated by technical breakouts or improving economic indicators. Conversely, elevated inflows into gold ETFs may be interpreted as hedging behavior against geopolitical uncertainty or inflationary pressure, consistent with historical patterns of gold’s role as a safe haven (Baur and Lucey, 2010).

Additionally, the tool allows for visual alerts when flow anomalies exceed a user-defined threshold, thereby supporting more responsive and data-driven decision-making. This feature aligns with findings from the CFA Institute (2019), which emphasize the growing importance of alternative data and automated alert systems in modern portfolio management.

From a research perspective, the indicator facilitates empirical study into capital mobility, intermarket relationships, and ETF investor psychology. It offers real-time monitoring of region-specific investment flows, thus serving as a proxy for investor conviction, liquidity trends, and cross-border risk-on/risk-off sentiment. Several recent studies have demonstrated the predictive power of ETF flows on future returns and volatility, particularly during periods of market stress or structural dislocations (Madhavan, 2016; Pan and Zeng, 2019).

References

• Baur, D.G. and Lucey, B.M., 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), pp.217-229.

• Ben-David, I., Franzoni, F. and Moussawi, R., 2017. Exchange-traded funds (ETFs). Annual Review of Financial Economics, 9, pp.169–189.

• Bank of International Settlements (BIS), 2018. ETFs – growing popularity, growing risks? BIS Quarterly Review, March 2018.

• CFA Institute, 2019. Investment Professional of the Future. [online] Available at: cfainstitute.org/en/research/survey-reports/future-finance [Accessed 3 May 2025].

• Coates, J.M. and Herbert, J., 2008. Endogenous steroids and financial risk taking on a London trading floor. Proceedings of the National Academy of Sciences, 105(16), pp.6167–6172.

• Israeli, D., Lee, C.M. and Sridharan, S.A., 2017. Is there a dark side to ETF trading? Evidence from corporate bond ETFs. SSRN Working Paper. Available at SSRN: ssrn.com/abstract=2840716

• Madhavan, A., 2016. Exchange-Traded Funds and the New Dynamics of Investing. Oxford University Press.

• Pan, K. and Zeng, Y., 2019. ETF Arbitrage Under Liquidity Mismatch. Journal of Finance, 74(6), pp.2731–2783.

Note di rilascio

Fixed Bond line displaying constant zero value: Replaced non-functional bond ETFs (TLT, IEF, SHY, BND, TMF, UBT) with verified ETFs that provide FUND_FLOWS data (AGG, LQD, TIP, HYG, JNK). Bond flows now display correctly.Reduced security request count from 42 to 37: Removed leveraged ETFs (SPXL, TQQQ, SSO, UGL) which had unreliable data and caused exceeding the 40 request limit. Script now complies with TradingView limitations while maintaining coverage of all major markets through high-liquidity core ETFs.

Note di rilascio

Dashboard now fully customizable with nine position options and four text sizes including mobile mode. Eight professional color themes added (EdgeTools, Gold, Behavioral, Quant, Ocean, Fire, Matrix, Arctic) with dark/light mode support. Region column backgrounds now match chart line colors for better visual correlation. Signal logic documented in code header. Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Where others speculate, we systematize.

edgetools.org

edgetools.org

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.