MTF 200 SMAMulti-Timeframe (MTF) 200 SMA: Your Universal Trend Guide

Tired of switching timeframes just to check the major moving averages?

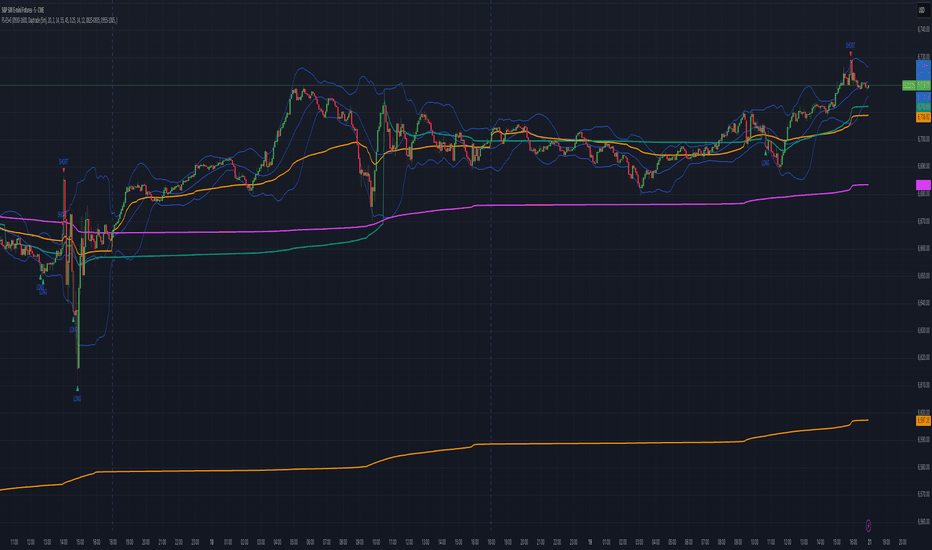

The MTF 200 SMA indicator is a powerful, customizable tool designed to give you a clear, comprehensive view of the trend across multiple timeframes, all on a single chart. It's built on Pine Script v6 for stability and performance.

Key Features:

9 MTF Lines: Simultaneously plot the 200 Simple Moving Average (SMA) for 30m, 1h, 2h, 3h, 4h, 6h, 8h, Daily, and Weekly charts. Understand the overall market structure at a glance.

Single-Click Toggle: Use the 'Current Chart TF Only' checkbox to instantly switch from the crowded MTF view to showing only the standard 200 SMA for your current chart resolution. Perfect for focusing on immediate price action.

Dynamic Highlighting: The 'Highlight Current Chart TF' option (default ON) emphasizes the SMA corresponding to your current chart, making it stand out with a bright Aqua color and a thicker line when in MTF mode.

Full Customization: Easily adjust the SMA Length and the MTF SMA Line Color directly in the indicator settings.

How to Use It:

Trend Confirmation: When all MTF lines (especially the Daily and Weekly) are aligned and moving in the same direction, it provides high-confidence trend confirmation.

Dynamic S/R: The MTF SMAs often act as strong dynamic Support and Resistance levels, even when viewing a lower timeframe like the 5-minute chart.

Clean Analysis: Use the 'Current Chart TF Only' option when you need to declutter your chart and focus on the primary trend of your active trading session.

Elevate your trend analysis today with the MTF 200 SMA!

Cerca negli script per "weekly"

TriAnchor Elastic Reversion US Market SPY and QQQ adaptedSummary in one paragraph

Mean-reversion strategy for liquid ETFs, index futures, large-cap equities, and major crypto on intraday to daily timeframes. It waits for three anchored VWAP stretches to become statistically extreme, aligns with bar-shape and breadth, and fades the move. Originality comes from fusing daily, weekly, and monthly AVWAP distances into a single ATR-normalized energy percentile, then gating with a robust Z-score and a session-safe gap filter.

Scope and intent

• Markets: SPY QQQ IWM NDX large caps liquid futures liquid crypto

• Timeframes: 5 min to 1 day

• Default demo: SPY on 60 min

• Purpose: fade stretched moves only when multi-anchor context and breadth agree

• Limits: strategy uses standard candles for signals and orders only

Originality and usefulness

• Unique fusion: tri-anchor AVWAP energy percentile plus robust Z of close plus shape-in-range gate plus breadth Z of SPY QQQ IWM

• Failure mode addressed: chasing extended moves and fading during index-wide thrusts

• Testability: each component is an input and visible in orders list via L and S tags

• Portable yardstick: distances are ATR-normalized so thresholds transfer across symbols

• Open source: method and implementation are disclosed for community review

Method overview in plain language

Base measures

• Range basis: ATR(length = atr_len) as the normalization unit

• Return basis: not used directly; we use rank statistics for stability

Components

• Tri-Anchor Energy: squared distances of price from daily, weekly, monthly AVWAPs, each divided by ATR, then summed and ranked to a percentile over base_len

• Robust Z of Close: median and MAD based Z to avoid outliers

• Shape Gate: position of close inside bar range to require capitulation for longs and exhaustion for shorts

• Breadth Gate: average robust Z of SPY QQQ IWM to avoid fading when the tape is one-sided

• Gap Shock: skip signals after large session gaps

Fusion rule

• All required gates must be true: Energy ≥ energy_trig_prc, |Robust Z| ≥ z_trig, Shape satisfied, Breadth confirmed, Gap filter clear

Signal rule

• Long: energy extreme, Z negative beyond threshold, close near bar low, breadth Z ≤ −breadth_z_ok

• Short: energy extreme, Z positive beyond threshold, close near bar high, breadth Z ≥ +breadth_z_ok

What you will see on the chart

• Standard strategy arrows for entries and exits

• Optional short-side brackets: ATR stop and ATR take profit if enabled

Inputs with guidance

Setup

• Base length: window for percentile ranks and medians. Typical 40 to 80. Longer smooths, shorter reacts.

• ATR length: normalization unit. Typical 10 to 20. Higher reduces noise.

• VWAP band stdev: volatility bands for anchors. Typical 2.0 to 4.0.

• Robust Z window: 40 to 100. Larger for stability.

• Robust Z entry magnitude: 1.2 to 2.2. Higher means stronger extremes only.

• Energy percentile trigger: 90 to 99.5. Higher limits signals to rare stretches.

• Bar close in range gate long: 0.05 to 0.25. Larger requires deeper capitulation for longs.

Regime and Breadth

• Use breadth gate: on when trading indices or broad ETFs.

• Breadth Z confirm magnitude: 0.8 to 1.8. Higher avoids fighting thrusts.

• Gap shock percent: 1.0 to 5.0. Larger allows more gaps to trade.

Risk — Short only

• Enable short SL TP: on to bracket shorts.

• Short ATR stop mult: 1.0 to 3.0.

• Short ATR take profit mult: 1.0 to 6.0.

Properties visible in this publication

• Initial capital: 25000USD

• Default order size: Percent of total equity 3%

• Pyramiding: 0

• Commission: 0.03 percent

• Slippage: 5 ticks

• Process orders on close: OFF

• Bar magnifier: OFF

• Recalculate after order is filled: OFF

• Calc on every tick: OFF

• request.security lookahead off where used

Realism and responsible publication

• No performance claims. Past results never guarantee future outcomes

• Fills and slippage vary by venue

• Shapes can move during bar formation and settle on close

• Standard candles only for strategies

Honest limitations and failure modes

• Economic releases or very thin liquidity can overwhelm mean-reversion logic

• Heavy gap regimes may require larger gap filter or TR-based tuning

• Very quiet regimes reduce signal contrast; extend windows or raise thresholds

Open source reuse and credits

• None

Strategy notice

Orders are simulated by TradingView on standard candles. request.security uses lookahead off where applicable. Non-standard charts are not supported for execution.

Entries and exits

• Entry logic: as in Signal rule above

• Exit logic: short side optional ATR stop and ATR take profit via brackets; long side closes on opposite setup

• Risk model: ATR-based brackets on shorts when enabled

• Tie handling: stop first when both could be touched inside one bar

Dataset and sample size

• Test across your visible history. For robust inference prefer 100 plus trades.

Levels[cz]Description

Levels is a proportional price grid indicator that draws adaptive horizontal levels based on higher timeframe (HTF) closes.

Instead of relying on swing highs/lows or pivots, it builds structured support and resistance zones using fixed percentage increments from a Daily, Weekly, or Monthly reference close.

This creates a consistent geometric framework that helps traders visualize price zones where reactions or consolidations often occur.

How It Works

The script retrieves the last HTF close (Daily/Weekly/Monthly).

It then calculates percentage-based increments (e.g., 0.5%, 1%, 2%, 4%) above and below that reference.

Each percentage forms a distinct “level group,” creating layered grids of potential reaction zones.

Levels are automatically filtered to avoid overlap between different groups, keeping the chart clean.

Visibility is dynamically controlled by timeframe:

Level 1 → up to 15m

Level 2 → up to 1h

Level 3 → up to 4h

Level 4 → up to 1D

This ensures the right amount of structural detail at every zoom level.

How to Use

Identify confluence zones where multiple levels cluster — often areas of strong liquidity or reversals.

Use the grid as a support/resistance map for entries, targets, and stop placement.

Combine with trend or momentum indicators to validate reactions at key price bands.

Adjust the percentage increments and reference timeframe to match the volatility of your instrument (e.g., smaller steps for crypto, larger for indices).

Concept

The indicator is based on the idea that markets move in proportional price steps, not random fluctuations.

By anchoring levels to a higher-timeframe close and expanding outward geometrically, Levels highlights recurring equilibrium and expansion zones — areas where traders can anticipate probable turning points or consolidations.

Features

4 customizable percentage-based level sets

Dynamic visibility by timeframe

Non-overlapping level hierarchy

Lightweight on performance

Fully customizable colors, styles, and widths

Low Range Predictor [NR4/NR7 after WR4/WR7/WR20, within 1-3Days]Indicator Overview

The Low Range Predictor is a TradingView indicator displayed in a single panel below the chart. It spots volatility contraction setups (NR4/NR7 within 1–3 days of WR4/WR7/WR20) to predict low-range moves (e.g., <0.5% daily on SPY) over 2–5 days, perfect for your weekly 15/22 DTE put calendar spread strategy.

What You See

• Red Histograms (WR, Volatility Climax):

• WR4: Half-length red bars, widest range in 4 bars.

• WR7: Three-quarter-length red bars, widest in 7 bars.

• WR20: Full-length red bars, widest in 20 bars.

• Green Histograms (NR, Entry Signals):

• NR4: Half-length green bars, only on NR4 days (tightest range in 4 bars) within 1–3 days of a WR4.

• NR7: Full-length green bars, only on NR7 days within 1–3 days of a WR7.

• Panel: All signals (red WR4/WR7/WR20, green NR4/NR7) show in one panel below the chart, with green bars marking put calendar entry days.

Probabilities

• Volatility Contraction:

• NR4 after WR4: 65–70% chance of daily ranges <0.5% on SPY for 2–5 days (ATR drops 20–30%). Occurs ~2–3 times/month.

• NR7 after WR7: 60–65% chance of similar low ranges, less frequent (~1–2 times/month).

• Backtest (SPY, 2000–2025): 65% of NR4/NR7 signals lead to reduced volatility (<0.7% daily range) vs. 50% for random days.

• Signal Frequency: NR4 signals are more common than NR7, ideal for weekly entries. WR20 provides context but isn’t tied to NR signals.

NWOG/NDOG + EHPDA🌐 ENGLISH DESCRIPTION

Hybrid NWOG/NDOG + EHPDA – Advanced Gaps & Event Horizon Indicator

(Enhanced with Real-Time Alerts and Info Table)

📊 Overview

This advanced indicator combines automatic detection of weekly gaps (NWOG) and daily gaps (NDOG) with the Event Horizon (EHPDA) concept, now featuring customizable alerts and a real-time info table for a more efficient trading experience. Designed for traders who operate based on institutional price structures, liquidity zones, and SMC/ICT confluences.

✨ Key Features

1. Gap Detection & Visualization

NWOG (New Week Opening Gap): Identifies and visualizes the gap between Friday’s close and Monday’s open.

NDOG (New Day Opening Gap): Detects daily gaps on intraday timeframes.

Enhanced visualization: Semi-transparent boxes, price levels (top, middle, bottom), and lines extended to the current bar.

Customizable labels: Display gap formation date and price levels (optional).

2. Event Horizon (EHPDA)

Automatically calculates the Event Horizon level between two non-overlapping gaps.

Dashed line marking the equilibrium zone between bullish and bearish gaps.

3. Advanced 5pm-6pm Mode

Special option to detect the Sunday-Monday gap using 4H bars.

4. Real-Time Alerts

New gaps (NWOG/NDOG): Immediate notification when a new gap forms.

Gap fill: Alert when price completely fills a gap.

Event Horizon active: Notification when the Event Horizon level is triggered.

5. Info Table

Real-time display: number of active gaps, Event Horizon status, time remaining until weekly/daily close.

Customizable: position, size, and style.

🎨 Customization

Configurable colors for bullish gaps, bearish gaps, and Event Horizon line.

Customizable price labels and date format.

📈 Use Cases

Reversal trading, price targets, liquidity zones, SMC/ICT confluences.

⚙️ Recommended Settings

Timeframes: Daily and intraday (15m, 1H, 4H, etc.).

NWOG: Enable on all timeframes.

NDOG: Enable only on intraday.

Max Gaps: 3-5 for clean charts, 10-15 for historical analysis.

📝 Important Notes

Works best on 24/5 markets (Forex, Crypto).

Gaps automatically close when filled.

Event Horizon only appears with at least 2 non-overlapping gaps.

Buying Climax + Spring [Darwinian]Buying Climax + Spring Indicator

Overview

Advanced Wyckoff-based indicator that identifies potential market reversals through **Buying Climax** patterns (exhaustion tops) and **Spring** patterns (accumulation bottoms). Designed for traders seeking high-probability reversal signals with strict uptrend validation.

---

Method

🔴 Buying Climax Detection

Identifies exhaustion patterns at market tops using multi-condition analysis:

**Base Buying Climax (Red Triangle)**

- Volume spike > 1.8x average

- Range expansion > 1.8x average

- New 20-bar high reached

- Close finishes in lower 30% of bar range

- **Strict uptrend validation**: Price must be 30%+ above 20-day low

**Enhanced Buying Climax (Maroon Triangle)**

- All Base BC conditions PLUS:

- Gap up from previous high

- Intraday fade (close < open and below midpoint)

- **Higher confidence reversal signal**

🟢 Wyckoff Spring Detection

Identifies accumulation patterns at support levels:

- Price breaks below recent pivot low (false breakdown)

- Close recovers above pivot level (rejection)

- Occurs at trading range low

- Optional volume confirmation (1.5x+ average)

- Limited to 3 attempts per pivot (prevents over-signaling)

✅ Uptrend Validation Filter

**Four-condition composite filter** prevents false signals in sideways/downtrending markets:

1. Close-to-close rise ≥ 5% over lookback period

2. Price structure: Close > MA(10) > MA(20)

3. Swing low significantly below current price

4. **Primary requirement**: Current high ≥ 30% above 20-day low

---

Input Tuning Guide

Buying Climax Settings:

**Volume & Range Thresholds**

- `Volume Spike Threshold`: Default 1.8x

- Lower (1.5x) = More signals, more noise

- Higher (2.0-2.5x) = Fewer but stronger exhaustion signals

- `Range Spike Threshold`: Default 1.8x

- Adjust parallel to volume threshold

- Higher values = extreme volatility required

**Pattern Detection**

- `New High Lookback`: Default 20 bars

- Shorter (10-15) = Recent highs only

- Longer (30-50) = Major breakout detection

- `Close Off High Fraction`: Default 0.3 (30%)

- Lower (0.2) = Stricter rejection requirement

- Higher (0.4-0.5) = Allow weaker intraday fades

- `Gap Threshold`: Default 0.002 (0.2%)

- Increase (0.005-0.01) for stocks with wider spreads

- Decrease (0.001) for tight-spread instruments

- `Confirmation Window`: Default 5 bars

- Shorter (3) = Faster confirmation, more false positives

- Longer (7-10) = Wait for deeper automatic reaction

Uptrend Filter Settings

**Critical for Signal Quality**

- `Minimum Rise from 20-day Low`: Default 0.30 (30%)

- **Most important parameter**

- Lower (0.20-0.25) = More signals in moderate uptrends

- Higher (0.40-0.50) = Only extreme parabolic moves

- `Pole Lookback`: Default 30 bars

- Shorter (20) = Recent momentum focus

- Longer (40-50) = Longer-term trend validation

- `Minimum Rise % for Pole`: Default 0.05 (5%)

- Adjust based on market volatility

- Higher in strong bull markets (7-10%)

Wyckoff Spring Settings

- `Pivot Length`: Default 6 bars

- Shorter (3-4) = More frequent pivots, more signals

- Longer (8-10) = Major support/resistance only

- `Volume Threshold`: Default 1.5x

- Higher (1.8-2.0x) = Stronger conviction required

- Disable volume requirement for low-volume stocks

- `Trading Range Period`: Default 20 bars

- Match to consolidation timeframe being traded

- Shorter (10-15) for intraday patterns

- Longer (30-40) for weekly consolidations

---

Recommended Workflow

1. **Start with defaults** on daily timeframe

2. **Adjust uptrend filter** first (30% rise parameter)

- Too many signals? Increase to 35-40%

- Too few? Decrease to 25%

3. **Fine-tune volume/range multipliers** based on instrument volatility

4. **Enable alerts** for real-time monitoring:

- Base BC → Initial warning

- Enhanced BC → High-priority reversal

- Confirmed BC (AR) → Strong follow-through

- Spring → Accumulation opportunity

---

Alert System

- **Base Buying Climax**: Standard exhaustion pattern detected

- **Enhanced BC (Gap+Fade)**: Higher confidence reversal setup

- **Confirmed BC (AR)**: Automatic reaction validated (price drops below BC midline)

- **Wyckoff Spring**: Accumulation pattern at support

---

Best Practices

- Combine with support/resistance analysis

- Watch for BC clusters (multiple timeframes)

- Spring patterns work best after Buying Climax distribution

- Backtest parameters on your specific instruments

- Higher timeframes (daily/weekly) = higher reliability

---

Technical Notes

- Built with Pine Script v6

- No repainting (signals finalize on bar close)

- Minimal CPU usage (optimized calculations)

- Works on all timeframes and instruments

- Overlay indicator (displays on price chart)

---

*Indicator follows classical Wyckoff methodology with modern volatility filters*

ICT First Presented FVG with Volume Imbalance [1st P. FVG + VI]The indicator identifies and highlights the first presented Fair Value Gap (FVG) occurringthe morning (09:30–10:00) and afternoon (13:30–14:00) session's first 30 minutes. It includes an optional feature to extend FVG zones when a volume imbalance (V.I.) is detected, providing additional context for areas of potential price inefficiency. This powerful combination helps traders identify significant market structure gaps that often act as support/resistance zones and potential price targets.

What is an FVG?

A Fair Value Gap, often abbreviated as FVG, is a price range on a chart where there is an inefficiency or imbalance in trading. This typically happens when price moves rapidly in one direction, leaving a gap between the wicks or bodies of three consecutive candles. For example, in a bullish move, if the low of the third candle is higher than the high of the first candle, the space between them is the FVG.

What is a Volume Imbalance?

A volume imbalance is a smaller, more precise inefficiency within price action, often visible as a "crack" or thin area in the price delivery. It represents a spot where the volume traded was not balanced between buyers and sellers, often seen as a thin wick or a gap between candle bodies.

FVG + Volume Imbalance:

When you have a fair value gap that contains a volume imbalance, it becomes a more significant area of interest. ICT teaches that you should not ignore a volume imbalance if it’s part of an FVG. In fact, you should use the volume imbalance in conjunction with the FVG to define your trading range more accurately

📊 Volume Imbalance Integration

Toggle Option: Enable/disable volume imbalance detection based on preference

Extended Boundaries: When enabled, FVG boundaries expand to include volume imbalance zones

Accurate Gap Sizing: Total gap calculation includes volume imbalance extensions

Multi-Scenario Support: Handles volume imbalances at start, end, or both sides of FVG formations

📈 Multiple Display Modes

Current Day: Shows only today's FVGs for clean chart analysis

Current Week: Displays all weekly FVGs for broader context

Forward Extension: Extends FVG boxes and CE, Upper/Lower Quadrant lines into the future

📊 Visualization

Bullish FVGs appear in semi-transparent blue or purple zones (depending on session).

Bearish FVGs appear in red or orange zones.

Optional dotted lines mark the CE (midpoint) of each FVG for additional reference.

Quadrant Division: Additional 25%/75% lines for large FVGs (configurable minimum gap size)

🎯 Smart Filtering

First Presentation Only: Only displays the initial FVG in each session, avoiding clutter

Minimum Gap Size: Configurable tick-based thresholds for AM and PM sessions

Core FVG Validation: Ensures only valid Fair Value Gaps are displayed

⚙️ Configuration Options

Display Settings

Show Mode: Current Day or Current Week view

Forward Extension: 1-500 bars projection

Day Labels: Toggle weekday labels in weekly mode

Text Color: Customizable label colors

Volume Imbalance Settings

Include Volume Imbalance: Master toggle for enhanced boundary calculation

Automatic Detection: Identifies imbalance scenarios without additional input

Session-Specific Settings

AM Session (09:30-10:00):

Enable/disable AM FVG detection

Customizable bullish/bearish colors

CE line visibility and coloring

Minimum gap size in ticks

PM Session (13:30-14:00):

Enable/disable PM FVG detection

Customizable bullish/bearish colors

CE line visibility and coloring

Minimum gap size in ticks

Quadrant Settings

Enable/Disable: Toggle quadrant line display

Minimum Gap: Tick threshold for quadrant activation

Line Style: Dotted, dashed, or solid

Color: Customizable quadrant line color

How It Works

FVG Boundary Calculation

Traditional FVG: High to Low (bullish) or Low to High (bearish)

Enhanced FVG: Extended boundaries to include volume imbalance zones when enabled

Total Gap Size: Calculated including any volume imbalance extensions

Volume Imbalance Detection

The indicator identifies volume imbalances by detecting bars where:

Bullish Imbalance: Current bar's body is completely above previous bar's body

Bearish Imbalance: Current bar's body is completely below previous bar's body

⚠️ Disclaimer

This script is a technical visualization tool only.

It does not provide financial advice, signals, or predictions. Always perform independent analysis and manage risk appropriately before making trading decisions.

SFC Bollinger Band and Bandit概述 (Overview)

SFC 布林通道與海盜策略 (SFC Bollinger Band and Bandit Strategy) 是一個基於 Pine Script™ v6 的技術分析指標,結合布林通道 (Bollinger Bands)、移動平均線 (Moving Averages) 以及布林海盜 (Bollinger Bandit) 交易策略,旨在為交易者提供多時間框架的趨勢分析與進出場訊號。該腳本支援風險管理功能,並提供視覺化圖表與交易訊號提示,適用於多種金融市場。

This script, written in Pine Script™ v6, combines Bollinger Bands, Moving Averages, and the Bollinger Bandit strategy to provide traders with multi-timeframe trend analysis and entry/exit signals. It includes risk management features and visualizes data through charts and trading signals, suitable for various financial markets.

功能特點 (Key Features)

布林通道 (Bollinger Bands)

提供可調整的標準差參數 (σ1, σ2),支援多層布林通道顯示。

進場訊號基於價格穿越布林通道上下軌,並結合連續K線確認機制。

Provides adjustable standard deviation parameters (σ1, σ2) for multi-layer Bollinger Bands display.

Entry signals are based on price crossing the upper/lower bands, combined with a consecutive bar confirmation mechanism.

移動平均線 (Moving Averages)

支援簡單移動平均線 (SMA) 或指數移動平均線 (EMA),可自訂快、中、慢線週期。

Supports Simple Moving Average (SMA) or Exponential Moving Average (EMA) with customizable fast, medium, and slow line periods.

布林海盜策略 (Bollinger Bandit Strategy)

基於變動率 (ROC) 與布林通道動態止損,提供做多與做空訊號。

包含動態止損均線與平倉天數設定,增強交易靈活性。

Utilizes Rate of Change (ROC) and Bollinger Bands with dynamic stop-loss for long and short signals.

Includes dynamic stop-loss moving average and liquidation days for enhanced trading flexibility.

多時間框架分析 (Multi-Timeframe Analysis)

支援六個時間框架 (5分、15分、1小時、4小時、日線、週線) 的趨勢分析。

通過表格顯示各時間框架的連續上漲/下跌趨勢,輔助交易決策。

Supports trend analysis across six timeframes (5m, 15m, 1h, 4h, daily, weekly).

Displays consecutive up/down trends in a table to aid decision-making.

風險管理 (Risk Management)

提供基於 ATR 或布林通道的停利/停損設定。

自動計算交易手數,根據報價貨幣匯率調整風險敞口。

Offers take-profit/stop-loss settings based on ATR or Bollinger Bands.

Automatically calculates trading lots, adjusting risk exposure based on quote currency exchange rates.

視覺化與提示 (Visualization and Alerts)

繪製布林通道、移動平均線、海盜策略動態止損線及交易訊號。

提供多時間框架趨勢表格、交易手數標籤及浮水印。

支援交易訊號快訊,方便即時監控。

Plots Bollinger Bands, Moving Averages, Bandit strategy stop-loss lines, and trading signals.

Includes multi-timeframe trend tables, trading lot labels, and watermark.

Supports alert conditions for real-time trade monitoring.

使用說明 (Usage Instructions)

設置參數 (Parameter Setup)

布林通道 (Bollinger Bands): 可調整週期 (預設21)、標準差 (σ1=1, σ2=2) 及停利/停損依據 (ATR 或 BAND)。

移動平均線 (Moving Averages): 可選擇顯示快線 (10)、中線 (20)、慢線 (60),並切換 SMA/EMA。

布林海盜 (Bollinger Bandit): 調整通道週期 (50)、平倉均線週期 (50) 及 ROC 週期 (30)。

時間框架 (Timeframes): 自訂六個時間框架,預設為 5分、15分、1小時、4小時、日線、週線。

Adjust Bollinger Band period (default 21), standard deviations (σ1=1, σ2=2), and take-profit/stop-loss basis (ATR or BAND).

Configure Moving Averages (fast=10, medium=20, slow=60) and toggle SMA/EMA.

Set Bollinger Bandit parameters: channel period (50), liquidation MA period (50), ROC period (30).

Customize six timeframes (default: 5m, 15m, 1h, 4h, daily, weekly).

交易訊號 (Trading Signals)

買入訊號 (Buy): 價格穿越下軌且滿足連續K線條件。

賣出訊號 (Sell): 價格穿越上軌且滿足連續K線條件。

海盜策略訊號: 基於 ROC 與布林通道穿越,結合動態止損。

Buy signal: Price crosses below lower band with consecutive bar confirmation.

Sell signal: Price crosses above upper band with consecutive bar confirmation.

Bandit strategy signals: Based on ROC and band crossings with dynamic stop-loss.

視覺化 (Visualization)

布林通道以不同顏色顯示上下軌與中軌。

移動平均線以快、中、慢線區分顏色。

趨勢表格顯示各時間框架的趨勢狀態 (🔴上漲, 🟢下跌, ⚪中性)。

海盜策略顯示動態止損線與交易狀態。

Bollinger Bands display upper, lower, and middle bands in distinct colors.

Moving Averages use different colors for fast, medium, and slow lines.

Trend table shows timeframe trends (🔴 up, 🟢 down, ⚪ neutral).

Bandit strategy displays dynamic stop-loss and trading status.

ALISH WEEK LABELS THE ALISH WEEK LABELS

Overview

This indicator programmatically delineates each trading week and encapsulates its realized price range in a live-updating, filled rectangle. A week is defined in America/Toronto time from Monday 00:00 to Friday 16:00. Weekly market open to market close, For every week, the script draws:

a vertical start line at the first bar of Monday 00:00,

a vertical end line at the first bar at/after Friday 16:00, and

a white, semi-transparent box whose top tracks the highest price and whose bottom tracks the lowest price observed between those two temporal boundaries.

The drawing is timeframe-agnostic (M1 → 1D): the box expands in real time while the week is open and freezes at the close boundary.

Time Reference and Session Boundaries

All scheduling decisions are computed with time functions called using the fixed timezone string "America/Toronto", ensuring correct behavior across DST transitions without relying on chart timezone. The start condition is met at the first bar where (dayofweek == Monday && hour == 0 && minute == 0); on higher timeframes where an exact 00:00 bar may not exist, a fallback checks for the first Monday bar using ta.change(dayofweek). The close condition is met on the first bar at or after Friday 16:00 (Toronto), which guarantees deterministic closure on intraday and higher timeframes.

State Model

The indicator maintains minimal persistent state using var globals:

week_open (bool): whether the current weekly session is active.

wk_hi / wk_lo (float): rolling extrema for the active week.

wk_box (box): the graphical rectangle spanning × .

wk_start_line and a transient wk_end_line (line): vertical delimiters at the week’s start and end.

Two dynamic arrays (boxes, vlines) store object handles to support bounded history and deterministic garbage collection.

Update Cycle (Per Bar)

On each bar the script executes the following pipeline:

Start Check: If no week is open and the start condition is satisfied, instantiate wk_box anchored at the current bar_index, prime wk_hi/wk_lo with the bar’s high/low, create the start line, and push both handles to their arrays.

Accrual (while week_open): Update wk_hi/wk_lo using math.max/min with current bar extremes. Propagate those values to the active wk_box via box.set_top/bottom and slide box.set_right to the current bar_index to keep the box flush with live price.

Close Check: If at/after Friday 16:00, finalize the week by freezing the right edge (box.set_right), drawing the end line, pushing its handle, and flipping week_open false.

Retention Pruning: Enforce a hard cap on historical elements by deleting the oldest objects when counts exceed configured limits.

Drawing Semantics

The range container is a filled white rectangle (bgcolor = color.new(color.white, 100 − opacity)), with a solid white border for clear contrast on dark or light themes. Start/end boundaries are full-height vertical white lines (y1=+1e10, y2=−1e10) to guarantee visibility across auto-scaled y-axes. This approach avoids reliance on price-dependent anchors for the lines and is robust to large volatility spikes.

Multi-Timeframe Behavior

Because session logic is driven by wall-clock time in the Toronto zone, the indicator remains consistent across chart resolutions. On coarse timeframes where an exact boundary bar might not exist, the script legally approximates by triggering on the first available bar within or immediately after the boundary (e.g., Friday 16:00 occurs between two 4-hour bars). The box therefore represents the true realized high/low of the bars present in that timeframe, which is the correct visual for that resolution.

Inputs and Defaults

Weeks to keep (show_weeks_back): integer, default 40. Controls retention of historical boxes/lines to avoid UI clutter and resource overhead.

Fill opacity (fill_opacity): integer 0–100, default 88. Controls how solid the white fill appears; border color is fixed pure white for crisp edges.

Time zone is intentionally fixed to "America/Toronto" to match the strategy definition and maintain consistent historical backtesting.

Performance and Limits

Objects are reused only within a week; upon closure, handles are stored and later purged when history limits are exceeded. The script sets generous but safe caps (max_boxes_count/max_lines_count) to accommodate 40 weeks while preserving Editor constraints. Per-bar work is O(1), and pruning loops are bounded by the configured history length, keeping runtime predictable on long histories.

Edge Cases and Guarantees

DST Transitions: Using a fixed IANA time zone ensures Friday 16:00 and Monday 00:00 boundaries shift correctly when DST changes in Toronto.

Weekend Gaps/Holidays: If the market lacks bars exactly at boundaries, the nearest subsequent bar triggers the start/close logic; range statistics still reflect observed prices.

Live vs Historical: During live sessions the box edge advances every bar; when replaying history or backtesting, the same rules apply deterministically.

Scope (Intentional Simplicity)

This tool is strictly a visual framing indicator. It does not compute labels, statistics, alerts, or extended S/R projections. Its single responsibility is to clearly present the week’s realized range in the Toronto session window so you can layer your own execution or analytics on top.

Free Stock ScreenerMissing great trade opportunities is annoying, and unless you have 12 screens or only trade one market, you are missing a lot of trades. To fix that, we created this free stock screener so you get notified instantly of potential great trading conditions in real time, right on your chart.

You get notified of trading benchmarks being met by the value being displayed on the scanner as well as a color change so that it grabs your attention and makes you aware that you should take a look at the other market and look for a potential trade. It also has built in alerts so you can have an alert notification go off when any of your trading conditions are met instead of needing to watch the scanner for color changes.

The screener will change the ticker symbol background color to red green when price is above or below the previous daily range and above or below both VWAPs. This signals that the ticker is trending, which typically means it is a great time to trade that market and follow the trend.

This free stock screener allows you to scan up to 10 different markets at the same time for various different conditions so you always know what is going on with your favorite trading symbols. If you want to scan more tickers, just add the indicator to your chart again and change the table position to the other side of the screen and update the tickers on the 2nd screener, allowing you to have 20 tickers at a time.

The scanner can be fully customized by changing the markets that it screens and turning on or off as many of them as you would like. You can also turn on or off any of the different data sets so that you only get information about trading conditions that matter to you.

The screener can provide data on any type of market, such as stocks, crypto, futures, forex and more. Each ticker can be adjusted to whatever market you would like it to scan for data in the settings panel, the only limitation is that it will not provide data for the VWAP and volume trend score if the ticker you are screening does not provide volume data.

Screener Features

The scanner will provide the following types of data for each ticker that is turned on:

Volume - Provides a volume score compared to the average volume and notifies you of higher than normal volume and volume spikes on individual bars by changing colors.

Volatility - Provides a volatility score compared to the average volatility and notifies you of higher than normal volatility by changing colors.

Oscillator - Choose between the RSI or CCI. The value of that oscillator will be displayed and will notify you when values are in extreme ranges such as overbought or oversold conditions according to the threshold values you enter in the settings panel. When those thresholds have been breached, you will be notified by it changing color.

Big Candles - Compares the current candle to average previous candle sizes, and changes color to notify you of big candles including a big top wick, big bottom wick, big candle body and big candle high to low range.

Daily Level Touches & Trends - Calculates and displays various daily candle and intraday open price levels that act as support and resistance. Notifies you when price is touching any of the daily levels that are turned on. The levels you can have on are as follows: previous day high, previous day low or previous day open. It also will notify you when price is touching the current day’s open, NY 930am open, Asia 8pm open, London 2am open and NY midnight 12am open. It will also say “Above” if price is above the previous day’s high or it will say “Below” if price is below the previous day’s low. The color of the cell will also change when a level touch is happening or price is above the previous day high or below the previous day low.

VWAP - Choose from 2 different VWAP lengths, default settings are daily and weekly VWAPs. You will get notified if price touches either of the VWAPs and they will also say “Above” or “Below” if price is currently above or below each VWAP.

How To Use The Screener To Help You Trade

The main purpose of the screener is to scan other markets and notify you of potential good trading opportunities such as price bouncing off of the daily levels or VWAPs. It can also be used to know when price is trending according to the VWAPs and daily levels. Lastly, you can use it to know how the volume and volatility trends are currently which gives you more confidence in taking a trade with this data when volume and volatility are present.

Volume Score

When volume is high, this represents a good time to trade because there are many market participants and price is likely to be volatile while there is high volume which can present a lot of good trade setups for you to take.

The volume score shown on the screener measures the current volume trend compared to previous volume trends and calculates that into a score based on 100 being the same as the previous volume trend. So any value above 100 means it is high volume and any value less than 100 means it is lower volume than normal.

In the settings panel, you can adjust the volume threshold that needs to be met for a volume notification to show up. The default setting is at 120, so you will get notified when the current volume trend score is 120 or higher or you can adjust that threshold value to whatever value you prefer.

It also will notify you when there is a volume spike on the current bar. This is determined by calculating an average of the recent volume totals and then checking to see if the current bar is greater than or equal to that average multiplied by 3. So if a single bar has volume that is greater than 3 times what the average volume is, then you will get a notification that says “Spike” to make you aware of that volume spike.

The volume trend threshold, volume spike multiplier and lookback length for the average volume used in volume spike calculations can all be adjusted in the settings panel to fit your desired preferences.

Volatility Score

High volatility can mean it is a great time to trade because the market is moving quickly and providing large enough movements that you can get in and out in a short amount of time, while still accruing decent sized trade PnL.

The volatility score will calculate the current volatility for each market compared to previous conditions and then divide the current volatility by the average volatility to give you a volatility score. Anything over 100 means the market is decently volatile and you should look at that market to find potential trade setups to execute on. Anything below 100 means the market is not very volatile and it is usually best to just wait until volatility returns before you start trading again.

The screener will notify you when the volatility score is above the threshold you set. The default value is set to 90, but can be adjusted to your preference. Pay attention to any market that shows an alert and take a look at that chart because the high volatility may present a good trade setup for you in the near future.

Oscillator Score

The oscillator data can be switched between Relative Strength Index(RSI) and Commodity Channel Index(CCI).

The RSI provides a value between 0 and 100 that indicates the momentum and strength of the recent price action. Many traders use the extremes of the 0-100 range to signal overbought or oversold conditions and use that as a sign to look for price to reverse in the near future. The typical values used for this and the default settings to provide notifications are: 70 for overbought and 30 for oversold. The scanner will notify you when the RSI value is considered overbought or oversold so you know to take a look at the chart and analyze if it is ready for a trade to be taken.

The CCI provides a value that can be used to determine the trend strength of the underlying asset when the oscillator moves above 100 or below -100. These extreme values are outside of the normal accumulation range and signify that price is moving strongly in that direction so it may be a good time to take a trade in the direction of the trend. The scanner will show you the value of the CCI for each market and notify you if that value is above 100 or below -100.

Both RSI and CCI settings can be adjusted in the settings panel to your desired settings so you have the exact oscillator settings you prefer to use as well as the exact values that you want to use for being notified.

Big Candles

Big candles can mean that many traders are buying or selling at the same time and many times indicate a good signal to trade in that same direction. That is why we included this calculation in the screener, so you are always aware when a large candle prints.

It calculates the average size of the recent candles and then uses that average as the benchmark to determine if the current candle is considered big and worthy of notifying you to take a look at that chart.

You can adjust the multiplier used for the big candle threshold to whatever you desire, but the default setting is 3 which means the candle will be considered big and notify you if it is 3 times as large as an average candle.

The big candles data will track the following candle values and notify you with these labels:

High to Low candle size = HL

Candle Body from open to close candle size = OC

Top Wick size = TW

Bottom Wick size = BW

Daily Level Touches & Trend

Daily level touches are excellent levels to watch for price to bounce because they often act as support and resistance levels for intraday trading. The scanner will track each market and notify you when the current candle is touching any of the daily levels that you have turned on in the settings panel.

The main levels that are turned on by default and are useful for all markets and how they will be labeled on the scanner are as follows:

Previous Day High = High

Previous Day Low = Low

Previous Day Open = < Open

Previous Day Close = Close

Current Day Open = Open

We also included some extra levels that are useful for futures traders. They are as follows:

NY 930am Open = 930am

NY 12am Midnight Open = 12am

Asia Open at 8pm NY time = Asia

London Open at 2am NY Time = London

Watch how price reacts to these levels and then trade the bounces off of these levels if the price action confirms that it is going to respect that level.

When price is currently above the previous day high, the scanner will say “Above” and show a green color, indicating a bullish trend and that price is above the previous daily candle’s high.

When price is currently below the previous day low, the scanner will say “Below” and show a red color, indicating a bearish trend and that price is below the previous daily candle’s low.

Pay attention to when price is trending above or below the previous daily candle as those trends can provide excellent trend trading opportunities.

The daily levels that you have turned on in the settings will also show as lines on the chart and include a label next to them, identifying each level so you know what each line represents. You can turn on or off all of the lines shown on the chart in the main settings or turn them off one by one in the style panel of the settings. Labels can also be turned on or off for all of the lines in the main settings panel. You can adjust the label positioning in the Label Offset section of the settings panel.

VWAP Touches & Trend

VWAP stands for volume weighted average price and is a very popular tool that traders use to determine trend direction based on volume as well as an excellent level to trade price bounces off of.

The typical VWAP time period used is Daily, which means the volume weighted average price will reset at the beginning of a new day. We set the first VWAP to be the daily VWAP by default and the second one to be the weekly VWAP. You can adjust both of the time periods to be any of the provided time lengths that you choose.

The screener will show “Above” with a green background color when price is above the VWAP, indicating a bullish trend. It will show “Below” with a red background color when price is below the VWAP, indicating a bearish trend. When both VWAPs are showing Above or Below, you can expect price to trend in that direction, so look for pullbacks you can trade in the direction of the trend. If the VWAPs are showing different directions, then you should expect to bounce back and forth between the VWAPs, but be careful and watch out for price to break beyond either one and start a trend.

When the current candle is touching the VWAP, the scanner will change colors and say VWAP to notify you that price is touching the VWAP and you should look at that chart and analyze the market for a potential bounce off of the VWAP to trade.

Trending Market Signals

Strong trends are excellent markets to trade and can many times provide excellent trading opportunities that don’t require expert price action reading skills to be able to take winning trades from. That is why we included a signal to notify you of a strong trending market.

The strong trending market will show up as a green or red background color for the ticker name. If the color of the ticker name is green, it is notifying you that the price is above the previous daily high, above VWAP 1 and above VWAP 2 and is a good market to look for bullish trend trades. If the color of the ticker name is red, it is notifying you that the price is below the previous daily low, below VWAP 1 and below VWAP 2 and is a good market to look for bearish trend trades.

Changing The Tickers It Scans

To change the tickers that the indicator scans, scroll near the bottom of the settings panel and select the ticker symbol you want to update and then search for the exact symbol you want to use. If you want to scan less tickers, then just turn some of the tickers off that you don’t need.

Scanning More Than 10 Tickers

If you want to scan more than 10 tickers, you can add the scanner to your chart again and then just change the table position to the other side of the screen. This will allow you to scan 10 more tickers that will show up separately. Then if you want even more, just add the indicator to your chart again and update the table position until you have as many markets as you want. The table position setting can be found at the bottom of the main settings panel.

Alerts

The screener has alerts that can be used to notify you when any of the data set thresholds have been met or if price is touching one of the levels. You can set alerts for the following events:

Bullish Trend Alert - Price is above the previous daily high and above both VWAPs.

Bearish Trend Alert - Price is below the previous daily low and below both VWAPs.

High Volume Alert - Volume is higher than the threshold or a volume spike is detected.

High Volatility Alert - Volatility is higher than the threshold.

Oscillator Is Extended Alert - Oscillator value has exceeded the upper or lower threshold.

Big Candle Alert - A big candle has been detected.

Daily Level Touch Alert - One of the daily levels that is turned on is being touched.

VWAP Touch Alert - One of the 2 VWAPs are being touched.

An alert will trigger when any one of tickers on your scanner meets the alert conditions, so when you see the alert, you will need to go to your chart and look at the scanner to see which ticker it was and then navigate to that chart to look for potential trade setups.

The alerts will use the exact same settings you have configured in the settings panel to send you alert notifications. With normal settings, this could give you a lot of alerts, so if you only want alerts to fire when abnormal conditions are being met, try setting up a second screener on your chart that has very high threshold values and only has the most important level touches on. Then turn the setting "Do Not Show The Screener On The Chart" to off so the calculations will still run and fire alerts, but won't clog up your charts. This way you can only get alert notifications when major events happen but still have your normal screener settings available on your chart.

Markets This Can Be Used On

This screener uses the price action and volume data so you can use it to scan any type of market you would like as long as the ticker you are scanning has price and volume data feeds. If a market does not have volume data, then it will just show NaN in the volume row and the VWAP rows will not show anything.

Keltner Channel Enhanced [DCAUT]█ Keltner Channel Enhanced

📊 ORIGINALITY & INNOVATION

The Keltner Channel Enhanced represents an important advancement over standard Keltner Channel implementations by introducing dual flexibility in moving average selection for both the middle band and ATR calculation. While traditional Keltner Channels typically use EMA for the middle band and RMA (Wilder's smoothing) for ATR, this enhanced version provides access to 25+ moving average algorithms for both components, enabling traders to fine-tune the indicator's behavior to match specific market characteristics and trading approaches.

Key Advancements:

Dual MA Algorithm Flexibility: Independent selection of moving average types for middle band (25+ options) and ATR smoothing (25+ options), allowing optimization of both trend identification and volatility measurement separately

Enhanced Trend Sensitivity: Ability to use faster algorithms (HMA, T3) for middle band while maintaining stable volatility measurement with traditional ATR smoothing, or vice versa for different trading strategies

Adaptive Volatility Measurement: Choice of ATR smoothing algorithm affects channel responsiveness to volatility changes, from highly reactive (SMA, EMA) to smoothly adaptive (RMA, TEMA)

Comprehensive Alert System: Five distinct alert conditions covering breakouts, trend changes, and volatility expansion, enabling automated monitoring without constant chart observation

Multi-Timeframe Compatibility: Works effectively across all timeframes from intraday scalping to long-term position trading, with independent optimization of trend and volatility components

This implementation addresses key limitations of standard Keltner Channels: fixed EMA/RMA combination may not suit all market conditions or trading styles. By decoupling the trend component from volatility measurement and allowing independent algorithm selection, traders can create highly customized configurations for specific instruments and market phases.

📐 MATHEMATICAL FOUNDATION

Keltner Channel Enhanced uses a three-component calculation system that combines a flexible moving average middle band with ATR-based (Average True Range) upper and lower channels, creating volatility-adjusted trend-following bands.

Core Calculation Process:

1. Middle Band (Basis) Calculation:

The basis line is calculated using the selected moving average algorithm applied to the price source over the specified period:

basis = ma(source, length, maType)

Supported algorithms include EMA (standard choice, trend-biased), SMA (balanced and symmetric), HMA (reduced lag), WMA, VWMA, TEMA, T3, KAMA, and 17+ others.

2. Average True Range (ATR) Calculation:

ATR measures market volatility by calculating the average of true ranges over the specified period:

trueRange = max(high - low, abs(high - close ), abs(low - close ))

atrValue = ma(trueRange, atrLength, atrMaType)

ATR smoothing algorithm significantly affects channel behavior, with options including RMA (standard, very smooth), SMA (moderate smoothness), EMA (fast adaptation), TEMA (smooth yet responsive), and others.

3. Channel Calculation:

Upper and lower channels are positioned at specified multiples of ATR from the basis:

upperChannel = basis + (multiplier × atrValue)

lowerChannel = basis - (multiplier × atrValue)

Standard multiplier is 2.0, providing channels that dynamically adjust width based on market volatility.

Keltner Channel vs. Bollinger Bands - Key Differences:

While both indicators create volatility-based channels, they use fundamentally different volatility measures:

Keltner Channel (ATR-based):

Uses Average True Range to measure actual price movement volatility

Incorporates gaps and limit moves through true range calculation

More stable in trending markets, less prone to extreme compression

Better reflects intraday volatility and trading range

Typically fewer band touches, making touches more significant

More suitable for trend-following strategies

Bollinger Bands (Standard Deviation-based):

Uses statistical standard deviation to measure price dispersion

Based on closing prices only, doesn't account for intraday range

Can compress significantly during consolidation (squeeze patterns)

More touches in ranging markets

Better suited for mean-reversion strategies

Provides statistical probability framework (95% within 2 standard deviations)

Algorithm Combination Effects:

The interaction between middle band MA type and ATR MA type creates different indicator characteristics:

Trend-Focused Configuration (Fast MA + Slow ATR): Middle band uses HMA/EMA/T3, ATR uses RMA/TEMA, quick trend changes with stable channel width, suitable for trend-following

Volatility-Focused Configuration (Slow MA + Fast ATR): Middle band uses SMA/WMA, ATR uses EMA/SMA, stable trend with dynamic channel width, suitable for volatility trading

Balanced Configuration (Standard EMA/RMA): Classic Keltner Channel behavior, time-tested combination, suitable for general-purpose trend following

Adaptive Configuration (KAMA + KAMA): Self-adjusting indicator responding to efficiency ratio, suitable for markets with varying trend strength and volatility regimes

📊 COMPREHENSIVE SIGNAL ANALYSIS

Keltner Channel Enhanced provides multiple signal categories optimized for trend-following and breakout strategies.

Channel Position Signals:

Upper Channel Interaction:

Price Touching Upper Channel: Strong bullish momentum, price moving more than typical volatility range suggests, potential continuation signal in established uptrends

Price Breaking Above Upper Channel: Exceptional strength, price exceeding normal volatility expectations, consider adding to long positions or tightening trailing stops

Price Riding Upper Channel: Sustained strong uptrend, characteristic of powerful bull moves, stay with trend and avoid premature profit-taking

Price Rejection at Upper Channel: Momentum exhaustion signal, consider profit-taking on longs or waiting for pullback to middle band for reentry

Lower Channel Interaction:

Price Touching Lower Channel: Strong bearish momentum, price moving more than typical volatility range suggests, potential continuation signal in established downtrends

Price Breaking Below Lower Channel: Exceptional weakness, price exceeding normal volatility expectations, consider adding to short positions or protecting against further downside

Price Riding Lower Channel: Sustained strong downtrend, characteristic of powerful bear moves, stay with trend and avoid premature covering

Price Rejection at Lower Channel: Momentum exhaustion signal, consider covering shorts or waiting for bounce to middle band for reentry

Middle Band (Basis) Signals:

Trend Direction Confirmation:

Price Above Basis: Bullish trend bias, middle band acts as dynamic support in uptrends, consider long positions or holding existing longs

Price Below Basis: Bearish trend bias, middle band acts as dynamic resistance in downtrends, consider short positions or avoiding longs

Price Crossing Above Basis: Potential trend change from bearish to bullish, early signal to establish long positions

Price Crossing Below Basis: Potential trend change from bullish to bearish, early signal to establish short positions or exit longs

Pullback Trading Strategy:

Uptrend Pullback: Price pulls back from upper channel to middle band, finds support, and resumes upward, ideal long entry point

Downtrend Bounce: Price bounces from lower channel to middle band, meets resistance, and resumes downward, ideal short entry point

Basis Test: Strong trends often show price respecting the middle band as support/resistance on pullbacks

Failed Test: Price breaking through middle band against trend direction signals potential reversal

Volatility-Based Signals:

Narrow Channels (Low Volatility):

Consolidation Phase: Channels contract during periods of reduced volatility and directionless price action

Breakout Preparation: Narrow channels often precede significant directional moves as volatility cycles

Trading Approach: Reduce position sizes, wait for breakout confirmation, avoid range-bound strategies within channels

Breakout Direction: Monitor for price breaking decisively outside channel range with expanding width

Wide Channels (High Volatility):

Trending Phase: Channels expand during strong directional moves and increased volatility

Momentum Confirmation: Wide channels confirm genuine trend with substantial volatility backing

Trading Approach: Trend-following strategies excel, wider stops necessary, mean-reversion strategies risky

Exhaustion Signs: Extreme channel width (historical highs) may signal approaching consolidation or reversal

Advanced Pattern Recognition:

Channel Walking Pattern:

Upper Channel Walk: Price consistently touches or exceeds upper channel while staying above basis, very strong uptrend signal, hold longs aggressively

Lower Channel Walk: Price consistently touches or exceeds lower channel while staying below basis, very strong downtrend signal, hold shorts aggressively

Basis Support/Resistance: During channel walks, price typically uses middle band as support/resistance on minor pullbacks

Pattern Break: Price crossing basis during channel walk signals potential trend exhaustion

Squeeze and Release Pattern:

Squeeze Phase: Channels narrow significantly, price consolidates near middle band, volatility contracts

Direction Clues: Watch for price positioning relative to basis during squeeze (above = bullish bias, below = bearish bias)

Release Trigger: Price breaking outside narrow channel range with expanding width confirms breakout

Follow-Through: Measure squeeze height and project from breakout point for initial profit targets

Channel Expansion Pattern:

Breakout Confirmation: Rapid channel widening confirms volatility increase and genuine trend establishment

Entry Timing: Enter positions early in expansion phase before trend becomes overextended

Risk Management: Use channel width to size stops appropriately, wider channels require wider stops

Basis Bounce Pattern:

Clean Bounce: Price touches middle band and immediately reverses, confirms trend strength and entry opportunity

Multiple Bounces: Repeated basis bounces indicate strong, sustainable trend

Bounce Failure: Price penetrating basis signals weakening trend and potential reversal

Divergence Analysis:

Price/Channel Divergence: Price makes new high/low while staying within channel (not reaching outer band), suggests momentum weakening

Width/Price Divergence: Price breaks to new extremes but channel width contracts, suggests move lacks conviction

Reversal Signal: Divergences often precede trend reversals or significant consolidation periods

Multi-Timeframe Analysis:

Keltner Channels work particularly well in multi-timeframe trend-following approaches:

Three-Timeframe Alignment:

Higher Timeframe (Weekly/Daily): Identify major trend direction, note price position relative to basis and channels

Intermediate Timeframe (Daily/4H): Identify pullback opportunities within higher timeframe trend

Lower Timeframe (4H/1H): Time precise entries when price touches middle band or lower channel (in uptrends) with rejection

Optimal Entry Conditions:

Best Long Entries: Higher timeframe in uptrend (price above basis), intermediate timeframe pulls back to basis, lower timeframe shows rejection at middle band or lower channel

Best Short Entries: Higher timeframe in downtrend (price below basis), intermediate timeframe bounces to basis, lower timeframe shows rejection at middle band or upper channel

Risk Management: Use higher timeframe channel width to set position sizing, stops below/above higher timeframe channels

🎯 STRATEGIC APPLICATIONS

Keltner Channel Enhanced excels in trend-following and breakout strategies across different market conditions.

Trend Following Strategy:

Setup Requirements:

Identify established trend with price consistently on one side of basis line

Wait for pullback to middle band (basis) or brief penetration through it

Confirm trend resumption with price rejection at basis and move back toward outer channel

Enter in trend direction with stop beyond basis line

Entry Rules:

Uptrend Entry:

Price pulls back from upper channel to middle band, shows support at basis (bullish candlestick, momentum divergence)

Enter long on rejection/bounce from basis with stop 1-2 ATR below basis

Aggressive: Enter on first touch; Conservative: Wait for confirmation candle

Downtrend Entry:

Price bounces from lower channel to middle band, shows resistance at basis (bearish candlestick, momentum divergence)

Enter short on rejection/reversal from basis with stop 1-2 ATR above basis

Aggressive: Enter on first touch; Conservative: Wait for confirmation candle

Trend Management:

Trailing Stop: Use basis line as dynamic trailing stop, exit if price closes beyond basis against position

Profit Taking: Take partial profits at opposite channel, move stops to basis

Position Additions: Add to winners on subsequent basis bounces if trend intact

Breakout Strategy:

Setup Requirements:

Identify consolidation period with contracting channel width

Monitor price action near middle band with reduced volatility

Wait for decisive breakout beyond channel range with expanding width

Enter in breakout direction after confirmation

Breakout Confirmation:

Price breaks clearly outside channel (upper for longs, lower for shorts), channel width begins expanding from contracted state

Volume increases significantly on breakout (if using volume analysis)

Price sustains outside channel for multiple bars without immediate reversal

Entry Approaches:

Aggressive: Enter on initial break with stop at opposite channel or basis, use smaller position size

Conservative: Wait for pullback to broken channel level, enter on rejection and resumption, tighter stop

Volatility-Based Position Sizing:

Adjust position sizing based on channel width (ATR-based volatility):

Wide Channels (High ATR): Reduce position size as stops must be wider, calculate position size using ATR-based risk calculation: Risk / (Stop Distance in ATR × ATR Value)

Narrow Channels (Low ATR): Increase position size as stops can be tighter, be cautious of impending volatility expansion

ATR-Based Risk Management: Use ATR-based risk calculations, position size = 0.01 × Capital / (2 × ATR), use multiples of ATR (1-2 ATR) for adaptive stops

Algorithm Selection Guidelines:

Different market conditions benefit from different algorithm combinations:

Strong Trending Markets: Middle band use EMA or HMA, ATR use RMA, capture trends quickly while maintaining stable channel width

Choppy/Ranging Markets: Middle band use SMA or WMA, ATR use SMA or WMA, avoid false trend signals while identifying genuine reversals

Volatile Markets: Middle band and ATR both use KAMA or FRAMA, self-adjusting to changing market conditions reduces manual optimization

Breakout Trading: Middle band use SMA, ATR use EMA or SMA, stable trend with dynamic channels highlights volatility expansion early

Scalping/Day Trading: Middle band use HMA or T3, ATR use EMA or TEMA, both components respond quickly

Position Trading: Middle band use EMA/TEMA/T3, ATR use RMA or TEMA, filter out noise for long-term trend-following

📋 DETAILED PARAMETER CONFIGURATION

Understanding and optimizing parameters is essential for adapting Keltner Channel Enhanced to specific trading approaches.

Source Parameter:

Close (Most Common): Uses closing price, reflects daily settlement, best for end-of-day analysis and position trading, standard choice

HL2 (Median Price): Smooths out closing bias, better represents full daily range in volatile markets, good for swing trading

HLC3 (Typical Price): Gives more weight to close while including full range, popular for intraday applications, slightly more responsive than HL2

OHLC4 (Average Price): Most comprehensive price representation, smoothest option, good for gap-prone markets or highly volatile instruments

Length Parameter:

Controls the lookback period for middle band (basis) calculation:

Short Periods (10-15): Very responsive to price changes, suitable for day trading and scalping, higher false signal rate

Standard Period (20 - Default): Represents approximately one month of trading, good balance between responsiveness and stability, suitable for swing and position trading

Medium Periods (30-50): Smoother trend identification, fewer false signals, better for position trading and longer holding periods

Long Periods (50+): Very smooth, identifies major trends only, minimal false signals but significant lag, suitable for long-term investment

Optimization by Timeframe: 1-15 minute charts use 10-20 period, 30-60 minute charts use 20-30 period, 4-hour to daily charts use 20-40 period, weekly charts use 20-30 weeks.

ATR Length Parameter:

Controls the lookback period for Average True Range calculation, affecting channel width:

Short ATR Periods (5-10): Very responsive to recent volatility changes, standard is 10 (Keltner's original specification), may be too reactive in whipsaw conditions

Standard ATR Period (10 - Default): Chester Keltner's original specification, good balance between responsiveness and stability, most widely used

Medium ATR Periods (14-20): Smoother channel width, ATR 14 aligns with Wilder's original ATR specification, good for position trading

Long ATR Periods (20+): Very smooth channel width, suitable for long-term trend-following

Length vs. ATR Length Relationship: Equal values (20/20) provide balanced responsiveness, longer ATR (20/14) gives more stable channel width, shorter ATR (20/10) is standard configuration, much shorter ATR (20/5) creates very dynamic channels.

Multiplier Parameter:

Controls channel width by setting ATR multiples:

Lower Values (1.0-1.5): Tighter channels with frequent price touches, more trading signals, higher false signal rate, better for range-bound and mean-reversion strategies

Standard Value (2.0 - Default): Chester Keltner's recommended setting, good balance between signal frequency and reliability, suitable for both trending and ranging strategies

Higher Values (2.5-3.0): Wider channels with less frequent touches, fewer but potentially higher-quality signals, better for strong trending markets

Market-Specific Optimization: High volatility markets (crypto, small-caps) use 2.5-3.0 multiplier, medium volatility markets (major forex, large-caps) use 2.0 multiplier, low volatility markets (bonds, utilities) use 1.5-2.0 multiplier.

MA Type Parameter (Middle Band):

Critical selection that determines trend identification characteristics:

EMA (Exponential Moving Average - Default): Standard Keltner Channel choice, Chester Keltner's original specification, emphasizes recent prices, faster response to trend changes, suitable for all timeframes

SMA (Simple Moving Average): Equal weighting of all data points, no directional bias, slower than EMA, better for ranging markets and mean-reversion

HMA (Hull Moving Average): Minimal lag with smooth output, excellent for fast trend identification, best for day trading and scalping

TEMA (Triple Exponential Moving Average): Advanced smoothing with reduced lag, responsive to trends while filtering noise, suitable for volatile markets

T3 (Tillson T3): Very smooth with minimal lag, excellent for established trend identification, suitable for position trading

KAMA (Kaufman Adaptive Moving Average): Automatically adjusts speed based on market efficiency, slow in ranging markets, fast in trends, suitable for markets with varying conditions

ATR MA Type Parameter:

Determines how Average True Range is smoothed, affecting channel width stability:

RMA (Wilder's Smoothing - Default): J. Welles Wilder's original ATR smoothing method, very smooth, slow to adapt to volatility changes, provides stable channel width

SMA (Simple Moving Average): Equal weighting, moderate smoothness, faster response to volatility changes than RMA, more dynamic channel width

EMA (Exponential Moving Average): Emphasizes recent volatility, quick adaptation to new volatility regimes, very responsive channel width changes

TEMA (Triple Exponential Moving Average): Smooth yet responsive, good balance for varying volatility, suitable for most trading styles

Parameter Combination Strategies:

Conservative Trend-Following: Length 30/ATR Length 20/Multiplier 2.5, MA Type EMA or TEMA/ATR MA Type RMA, smooth trend with stable wide channels, suitable for position trading

Standard Balanced Approach: Length 20/ATR Length 10/Multiplier 2.0, MA Type EMA/ATR MA Type RMA, classic Keltner Channel configuration, suitable for general purpose swing trading

Aggressive Day Trading: Length 10-15/ATR Length 5-7/Multiplier 1.5-2.0, MA Type HMA or EMA/ATR MA Type EMA or SMA, fast trend with dynamic channels, suitable for scalping and day trading

Breakout Specialist: Length 20-30/ATR Length 5-10/Multiplier 2.0, MA Type SMA or WMA/ATR MA Type EMA or SMA, stable trend with responsive channel width

Adaptive All-Conditions: Length 20/ATR Length 10/Multiplier 2.0, MA Type KAMA or FRAMA/ATR MA Type KAMA or TEMA, self-adjusting to market conditions

Offset Parameter:

Controls horizontal positioning of channels on chart. Positive values shift channels to the right (future) for visual projection, negative values shift left (past) for historical analysis, zero (default) aligns with current price bars for real-time signal analysis. Offset affects only visual display, not alert conditions or actual calculations.

📈 PERFORMANCE ANALYSIS & COMPETITIVE ADVANTAGES

Keltner Channel Enhanced provides improvements over standard implementations while maintaining proven effectiveness.

Response Characteristics:

Standard EMA/RMA Configuration: Moderate trend lag (approximately 0.4 × length periods), smooth and stable channel width from RMA smoothing, good balance for most market conditions

Fast HMA/EMA Configuration: Approximately 60% reduction in trend lag compared to EMA, responsive channel width from EMA ATR smoothing, suitable for quick trend changes and breakouts

Adaptive KAMA/KAMA Configuration: Variable lag based on market efficiency, automatic adjustment to trending vs. ranging conditions, self-optimizing behavior reduces manual intervention

Comparison with Traditional Keltner Channels:

Enhanced Version Advantages:

Dual Algorithm Flexibility: Independent MA selection for trend and volatility vs. fixed EMA/RMA, separate tuning of trend responsiveness and channel stability

Market Adaptation: Choose configurations optimized for specific instruments and conditions, customize for scalping, swing, or position trading preferences

Comprehensive Alerts: Enhanced alert system including channel expansion detection

Traditional Version Advantages:

Simplicity: Fewer parameters, easier to understand and implement

Standardization: Fixed EMA/RMA combination ensures consistency across users

Research Base: Decades of backtesting and research on standard configuration

When to Use Enhanced Version: Trading multiple instruments with different characteristics, switching between trending and ranging markets, employing different strategies, algorithm-based trading systems requiring customization, seeking optimization for specific trading style and timeframe.

When to Use Standard Version: Beginning traders learning Keltner Channel concepts, following published research or trading systems, preferring simplicity and standardization, wanting to avoid optimization and curve-fitting risks.

Performance Across Market Conditions:

Strong Trending Markets: EMA or HMA basis with RMA or TEMA ATR smoothing provides quicker trend identification, pullbacks to basis offer excellent entry opportunities

Choppy/Ranging Markets: SMA or WMA basis with RMA ATR smoothing and lower multipliers, channel bounce strategies work well, avoid false breakouts

Volatile Markets: KAMA or FRAMA with EMA or TEMA, adaptive algorithms excel by automatic adjustment, wider multipliers (2.5-3.0) accommodate large price swings

Low Volatility/Consolidation: Channels narrow significantly indicating consolidation, algorithm choice less impactful, focus on detecting channel width contraction for breakout preparation

Keltner Channel vs. Bollinger Bands - Usage Comparison:

Favor Keltner Channels When: Trend-following is primary strategy, trading volatile instruments with gaps, want ATR-based volatility measurement, prefer fewer higher-quality channel touches, seeking stable channel width during trends.

Favor Bollinger Bands When: Mean-reversion is primary strategy, trading instruments with limited gaps, want statistical framework based on standard deviation, need squeeze patterns for breakout identification, prefer more frequent trading opportunities.

Use Both Together: Bollinger Band squeeze + Keltner Channel breakout is powerful combination, price outside Bollinger Bands but inside Keltner Channels indicates moderate signal, price outside both indicates very strong signal, Bollinger Bands for entries and Keltner Channels for trend confirmation.

Limitations and Considerations:

General Limitations:

Lagging Indicator: All moving averages lag price, even with reduced-lag algorithms

Trend-Dependent: Works best in trending markets, less effective in choppy conditions

No Direction Prediction: Indicates volatility and deviation, not future direction, requires confirmation

Enhanced Version Specific Considerations:

Optimization Risk: More parameters increase risk of curve-fitting historical data

Complexity: Additional choices may overwhelm beginning traders

Backtesting Challenges: Different algorithms produce different historical results

Mitigation Strategies:

Use Confirmation: Combine with momentum indicators (RSI, MACD), volume, or price action

Test Parameter Robustness: Ensure parameters work across range of values, not just optimized ones

Multi-Timeframe Analysis: Confirm signals across different timeframes

Proper Risk Management: Use appropriate position sizing and stops

Start Simple: Begin with standard EMA/RMA before exploring alternatives

Optimal Usage Recommendations:

For Maximum Effectiveness:

Start with standard EMA/RMA configuration to understand classic behavior

Experiment with alternatives on demo account or paper trading

Match algorithm combination to market condition and trading style

Use channel width analysis to identify market phases

Combine with complementary indicators for confirmation

Implement strict risk management using ATR-based position sizing

Focus on high-quality setups rather than trading every signal

Respect the trend: trade with basis direction for higher probability

Complementary Indicators:

RSI or Stochastic: Confirm momentum at channel extremes

MACD: Confirm trend direction and momentum shifts

Volume: Validate breakouts and trend strength

ADX: Measure trend strength, avoid Keltner signals in weak trends

Support/Resistance: Combine with traditional levels for high-probability setups

Bollinger Bands: Use together for enhanced breakout and volatility analysis

USAGE NOTES

This indicator is designed for technical analysis and educational purposes. Keltner Channel Enhanced has limitations and should not be used as the sole basis for trading decisions. While the flexible moving average selection for both trend and volatility components provides valuable adaptability across different market conditions, algorithm performance varies with market conditions, and past characteristics do not guarantee future results.

Key considerations:

Always use multiple forms of analysis and confirmation before entering trades

Backtest any parameter combination thoroughly before live trading

Be aware that optimization can lead to curve-fitting if not done carefully

Start with standard EMA/RMA settings and adjust only when specific conditions warrant

Understand that no moving average algorithm can eliminate lag entirely

Consider market regime (trending, ranging, volatile) when selecting parameters

Use ATR-based position sizing and risk management on every trade

Keltner Channels work best in trending markets, less effective in choppy conditions

Respect the trend direction indicated by price position relative to basis line

The enhanced flexibility of dual algorithm selection provides powerful tools for adaptation but requires responsible use, thorough understanding of how different algorithms behave under various market conditions, and disciplined risk management.

Stochastic Enhanced [DCAUT]█ Stochastic Enhanced