Asset: Cardano (ADA) Q3 Forecast: 2025–2026 Distribution Outlook

Ticker Symbol: ADA

Execution Venue: Binance

Overview:

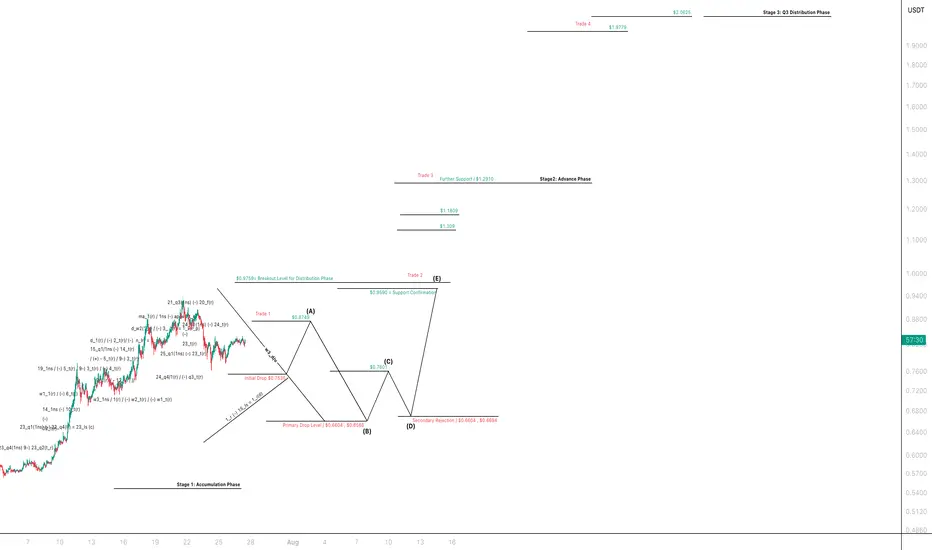

Cardano (Ticker: ADA) is currently navigating a critical support region. The key level of $0.9590 will dictate near-term price action. If this level holds, the primary drop scenario may be invalidated. However, if confirmed as resistance, we anticipate an initial drop to $0.8749, followed by a secondary decline and eventual move toward the primary drop zone between $0.6804 and $0.6894. Once this structure finalises, the path to the Q3 Distribution Phase opens.

Key Phases:

Stage 1: Accumulation Phase: Consolidation within the current range.

Stage 2: Advance Phase: Begins once $0.9759 + is broken and confirmed.

Stage 3: Q3 Distribution Phase: Higher distribution levels activated post- breakout.

2025 Distribution Levels:

$0.8747

$0.9374

$0.9590

$0.9759

$1.1309

$1.1809

$1.2910

$1.1925

$1.2081

$1.3362

$1.3537

$1.6638

$1.8840

$1.9779

$2.0627

2026 Distribution Levels:

$3.1450

This chart-based roadmap offers a detailed view of ADA’s potential price evolution through the accumulation, advance, and eventual distribution phases. Confirmation or invalidation of key structural zones will determine directional bias and opportunities across Q3 and into 2026.

I’ll continue publishing live cycle forecasts across key assets - built with institutional discipline and retail accessibility.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

#ADA #MarketForecast #DistributionCycle #TradingModel #QuantitativeAnalysis #InstitutionalTrading #Stage3Distribution #AssetManagement #TradingStrategy #SymmetryInMarkets #ForecastAccuracy

Ticker Symbol: ADA

Execution Venue: Binance

Overview:

Cardano (Ticker: ADA) is currently navigating a critical support region. The key level of $0.9590 will dictate near-term price action. If this level holds, the primary drop scenario may be invalidated. However, if confirmed as resistance, we anticipate an initial drop to $0.8749, followed by a secondary decline and eventual move toward the primary drop zone between $0.6804 and $0.6894. Once this structure finalises, the path to the Q3 Distribution Phase opens.

Key Phases:

Stage 1: Accumulation Phase: Consolidation within the current range.

Stage 2: Advance Phase: Begins once $0.9759 + is broken and confirmed.

Stage 3: Q3 Distribution Phase: Higher distribution levels activated post- breakout.

2025 Distribution Levels:

$0.8747

$0.9374

$0.9590

$0.9759

$1.1309

$1.1809

$1.2910

$1.1925

$1.2081

$1.3362

$1.3537

$1.6638

$1.8840

$1.9779

$2.0627

2026 Distribution Levels:

$3.1450

This chart-based roadmap offers a detailed view of ADA’s potential price evolution through the accumulation, advance, and eventual distribution phases. Confirmation or invalidation of key structural zones will determine directional bias and opportunities across Q3 and into 2026.

I’ll continue publishing live cycle forecasts across key assets - built with institutional discipline and retail accessibility.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

#ADA #MarketForecast #DistributionCycle #TradingModel #QuantitativeAnalysis #InstitutionalTrading #Stage3Distribution #AssetManagement #TradingStrategy #SymmetryInMarkets #ForecastAccuracy

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.