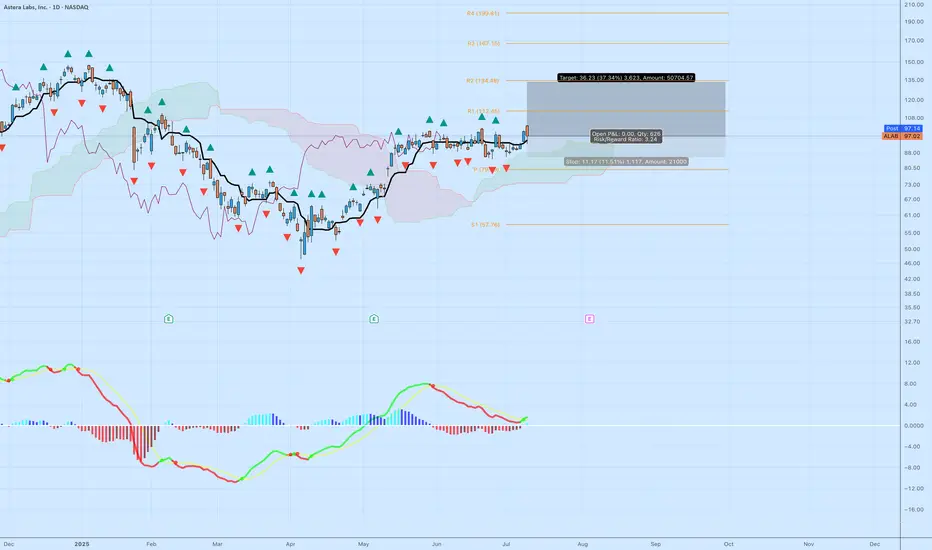

Astera Labs ( ALAB) just delivered a clean technical breakout above multi-week resistance, paired with bullish confirmation from momentum and Ichimoku structure. This isn’t a hype trade — this is what a textbook continuation breakout looks like.

ALAB) just delivered a clean technical breakout above multi-week resistance, paired with bullish confirmation from momentum and Ichimoku structure. This isn’t a hype trade — this is what a textbook continuation breakout looks like.

📊 Key Technical Breakdown

Base Breakout

After weeks of tight consolidation, ALAB just broke above horizontal resistance at ~$95. The breakout candle is strong, with above-average range and a decisive close.

ALAB just broke above horizontal resistance at ~$95. The breakout candle is strong, with above-average range and a decisive close.

Ichimoku Cloud

Price is well above the cloud — this confirms bullish trend.

The Kijun (black line) is sloping upward, and the cloud is thick and rising.

Pullbacks toward $88–90 could act as support if the breakout retests.

MACD Reversal

The MACD has flipped green, signaling a momentum shift.

Histogram is expanding upward again, showing renewed buying pressure.

This is happening as price reclaims the top of the recent range — a great alignment.

🎯 Trade Specs

Entry: $97.02

Target: $133.25 (+37.34%)

Stop: $85.32 (–11.51%)

Risk/Reward: 3.24 — solid skew for a growth name

Context: Strong prior trend, healthy consolidation, and now continuation. This isn’t a bottom-pick — it’s trend-following at a breakout moment.

🧠 Why This Trade Works

Structure: You’re not chasing green candles. This breakout comes after a long base and clears prior congestion.

Asymmetry: A 3.2+ R/R setup means you can be wrong more than half the time and still come out ahead — if you stick to your stops.

Momentum Alignment: Momentum and price are moving together — never fade a breakout with confirmation from both price action and indicators.

📌 Tip for Readers:

If you’re new to swing trading, study how this base formed and what conditions led to the breakout. The goal isn’t prediction — it’s positioning at the right moments with risk defined.

📊 Key Technical Breakdown

Base Breakout

After weeks of tight consolidation,

Ichimoku Cloud

Price is well above the cloud — this confirms bullish trend.

The Kijun (black line) is sloping upward, and the cloud is thick and rising.

Pullbacks toward $88–90 could act as support if the breakout retests.

MACD Reversal

The MACD has flipped green, signaling a momentum shift.

Histogram is expanding upward again, showing renewed buying pressure.

This is happening as price reclaims the top of the recent range — a great alignment.

🎯 Trade Specs

Entry: $97.02

Target: $133.25 (+37.34%)

Stop: $85.32 (–11.51%)

Risk/Reward: 3.24 — solid skew for a growth name

Context: Strong prior trend, healthy consolidation, and now continuation. This isn’t a bottom-pick — it’s trend-following at a breakout moment.

🧠 Why This Trade Works

Structure: You’re not chasing green candles. This breakout comes after a long base and clears prior congestion.

Asymmetry: A 3.2+ R/R setup means you can be wrong more than half the time and still come out ahead — if you stick to your stops.

Momentum Alignment: Momentum and price are moving together — never fade a breakout with confirmation from both price action and indicators.

📌 Tip for Readers:

If you’re new to swing trading, study how this base formed and what conditions led to the breakout. The goal isn’t prediction — it’s positioning at the right moments with risk defined.

Trade attivo

Trade chiuso manualmente

Taking profit here at 122.58If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.