Date 14.09.2025

Axis Bank

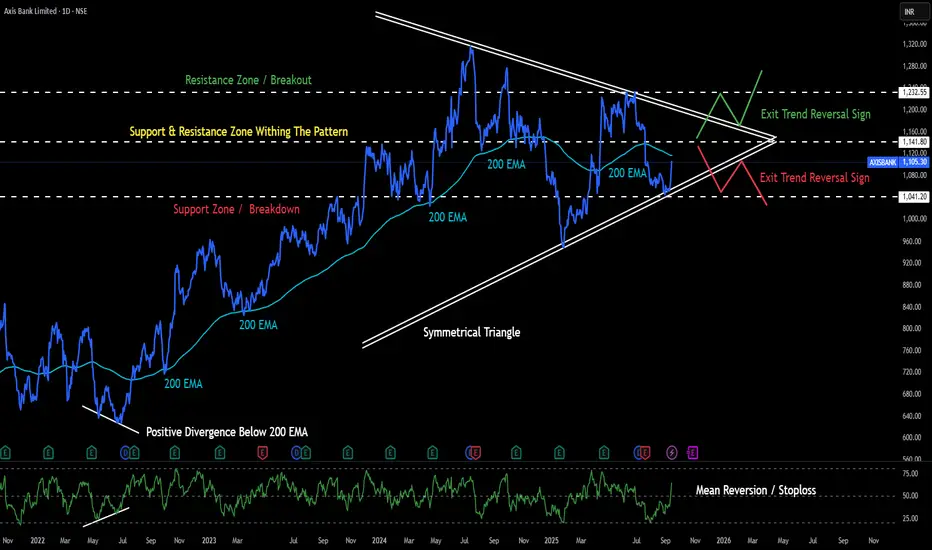

Timeframe : Day Chart

Technical Remarks :

(1) Conformation of Symmetrical Triangle Pattern after recent 2:2 channel confirmation

(2) Major support base at 1041 since forming just below symmetrical triangle

(3) Major resistance zone at 1232 since forming just above symmetrical triangle

(4) Major support/resistance at 1141 since forming at mid point of symmetrical triangle

(5) 200 EMA has shown strong character in the stock, next resistance/breakout is from 200 ema

(6) If breakdown occurs & RSI goes below mean reversion is short term weakness

(7) Upper exit from symmetrical triangle is good intraday/swing BTST opportunity , target 1232

(8) Lower exit from symmetrical triangle is good intraday/swing STBT opportunity , target 1041

Fundamental Remarks :

Market Leadership

(1) 3rd largest private sector bank in India

(2) 4th largest issuer of credit cards

(3) 19.8% market share in FY24

Ratios

(1) Capital Adequacy Ratio 16.63%

(2) Net Interest Margin 4.07%

(3) Gross NPA 1.43 %

(4) Net NPA 0.31%

(5) CASA Ratio 43%

Branch Network

(1) Metro 31%

(2) Semi-urban 29%

(3) Urban 23%

(4) Rural 17%

Revenue Mix

(1) Treasury 15%

(2) Corporate/Wholesale Banking 22%

(3) Retail Banking 61%

(3) Other Banking Business 2%

Loan Book

(1) Retail loans 60%

(2) Corporate 29%

(3) SME loans 11%

Retail Book

(1) Home loans 28%

(2) Rural loans 16%

(3) LAP 11%

(4) Auto loans 10%

(5) Personal loans 12%

(6) Small business banking 10%

(7) Credit cards 7%

(8) Comm Equipment 2%

(9) others 4%

Market Share

(1) 5.5% in Assets

(2) 5% in Deposits

(3) 5.9% in Advances

(4) 14% in Credit cards

(5) 5.2% in Personal loan

(6) 8.4% RTGS

(7) 30% NEFT

(8) 38.9% IMPS (by volume)

(9) 20% in BBPS

(10) 11.4% in Foreign LC

(11) 8.4% MSME credit

Regards,

Ankur

Axis Bank

Timeframe : Day Chart

Technical Remarks :

(1) Conformation of Symmetrical Triangle Pattern after recent 2:2 channel confirmation

(2) Major support base at 1041 since forming just below symmetrical triangle

(3) Major resistance zone at 1232 since forming just above symmetrical triangle

(4) Major support/resistance at 1141 since forming at mid point of symmetrical triangle

(5) 200 EMA has shown strong character in the stock, next resistance/breakout is from 200 ema

(6) If breakdown occurs & RSI goes below mean reversion is short term weakness

(7) Upper exit from symmetrical triangle is good intraday/swing BTST opportunity , target 1232

(8) Lower exit from symmetrical triangle is good intraday/swing STBT opportunity , target 1041

Fundamental Remarks :

Market Leadership

(1) 3rd largest private sector bank in India

(2) 4th largest issuer of credit cards

(3) 19.8% market share in FY24

Ratios

(1) Capital Adequacy Ratio 16.63%

(2) Net Interest Margin 4.07%

(3) Gross NPA 1.43 %

(4) Net NPA 0.31%

(5) CASA Ratio 43%

Branch Network

(1) Metro 31%

(2) Semi-urban 29%

(3) Urban 23%

(4) Rural 17%

Revenue Mix

(1) Treasury 15%

(2) Corporate/Wholesale Banking 22%

(3) Retail Banking 61%

(3) Other Banking Business 2%

Loan Book

(1) Retail loans 60%

(2) Corporate 29%

(3) SME loans 11%

Retail Book

(1) Home loans 28%

(2) Rural loans 16%

(3) LAP 11%

(4) Auto loans 10%

(5) Personal loans 12%

(6) Small business banking 10%

(7) Credit cards 7%

(8) Comm Equipment 2%

(9) others 4%

Market Share

(1) 5.5% in Assets

(2) 5% in Deposits

(3) 5.9% in Advances

(4) 14% in Credit cards

(5) 5.2% in Personal loan

(6) 8.4% RTGS

(7) 30% NEFT

(8) 38.9% IMPS (by volume)

(9) 20% in BBPS

(10) 11.4% in Foreign LC

(11) 8.4% MSME credit

Regards,

Ankur

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.