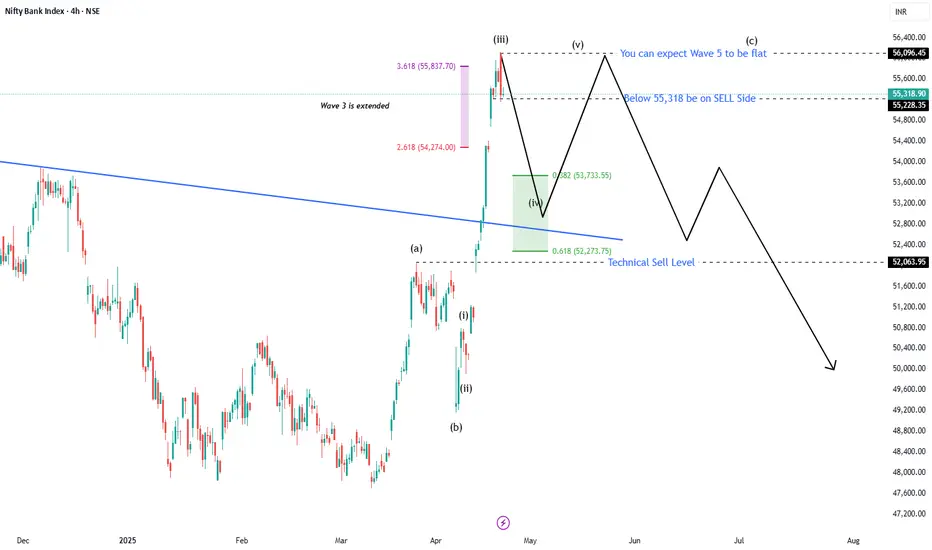

This Elliott Wave analysis on Bank Nifty (4H chart) outlines a classic impulsive wave structure with an extended Wave 3 and projected movement into Wave 4 and Wave 5. Let’s break it down step-by-step:

🌀 Wave Structure Identified:

Wave (i) to (v) – This is the 5-wave impulsive move within Wave C of a larger corrective structure.

Wave 3 is extended – This is confirmed by the 2.618 and 3.618 Fibonacci extensions plotted, showing Wave 3 far exceeds Wave 1 in length.

You're currently in Wave 4, with potential completion near key Fib levels.

📉 Wave 4 Retracement Zone:

Wave 4 has retraced close to:

38.2% (~53,733.55)

61.8% (~52,273.75) of Wave 3

The shaded green box represents the Wave 4 retracement zone, typical for a corrective wave when Wave 3 is extended.

📊 Fibonacci Levels on the Chart:

3.618 ($5,837.70) – Extension of Wave 1, used to project the top of extended Wave 3.

Retracement levels – 0.382 and 0.618 of Wave 3 for Wave 4 correction.

These levels align with potential support areas where Wave 4 might end and Wave 5 may begin.

💡 Projection for Wave 5:

The note: “You can expect Wave 5 to be flat” implies a potential truncation or limited upside – common after an extended Wave 3.

Resistance level marked at 56,096.45 – Possible Wave 5 top or fake breakout zone.

🚨 Action Levels:

Below 55,318 – “Be on SELL Side” → Suggests if price breaks this level, bearish confirmation sets in.

Technical Sell Level: 52,063.95 – Key horizontal support; breach here may trigger stronger downside in a potential larger degree Wave C or corrective move.

🔍 Interpretation Summary:

Element Interpretation

Wave 3 Extended impulsive leg

Wave 4 Currently in progress, retracing into 38.2%-61.8% zone

Wave 5 Expected to be a flatter, possibly truncated move

Sell Triggers Below 55,318 and strong confirmation below 52,063.95

Bias Short-term correction, longer-term bearish if support breaks

🌀 Wave Structure Identified:

Wave (i) to (v) – This is the 5-wave impulsive move within Wave C of a larger corrective structure.

Wave 3 is extended – This is confirmed by the 2.618 and 3.618 Fibonacci extensions plotted, showing Wave 3 far exceeds Wave 1 in length.

You're currently in Wave 4, with potential completion near key Fib levels.

📉 Wave 4 Retracement Zone:

Wave 4 has retraced close to:

38.2% (~53,733.55)

61.8% (~52,273.75) of Wave 3

The shaded green box represents the Wave 4 retracement zone, typical for a corrective wave when Wave 3 is extended.

📊 Fibonacci Levels on the Chart:

3.618 ($5,837.70) – Extension of Wave 1, used to project the top of extended Wave 3.

Retracement levels – 0.382 and 0.618 of Wave 3 for Wave 4 correction.

These levels align with potential support areas where Wave 4 might end and Wave 5 may begin.

💡 Projection for Wave 5:

The note: “You can expect Wave 5 to be flat” implies a potential truncation or limited upside – common after an extended Wave 3.

Resistance level marked at 56,096.45 – Possible Wave 5 top or fake breakout zone.

🚨 Action Levels:

Below 55,318 – “Be on SELL Side” → Suggests if price breaks this level, bearish confirmation sets in.

Technical Sell Level: 52,063.95 – Key horizontal support; breach here may trigger stronger downside in a potential larger degree Wave C or corrective move.

🔍 Interpretation Summary:

Element Interpretation

Wave 3 Extended impulsive leg

Wave 4 Currently in progress, retracing into 38.2%-61.8% zone

Wave 5 Expected to be a flatter, possibly truncated move

Sell Triggers Below 55,318 and strong confirmation below 52,063.95

Bias Short-term correction, longer-term bearish if support breaks

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.