Bitcoin is heading into September after recently printing a new ATH,

historically September is a red month, so expecting further mild losses

heading into September and limited upside, however, once the pattern

and correction is complete, we should see another bull run and mark up.

📊 Bitcoin September Seasonality (Last 10 Years: 2015–2024)

Yearly September Returns

Year 📈 Return

2024 🟢 +7.39%

2023 🟢 +3.99%

2022 🔴 −3.09%

2021 🔴 −7.03%

2020 🔴 −7.66%

2019 🔴 −13.88%

2018 🔴 −5.95%

2017 🔴 −7.72%

2016 🟢 +5.94%

2015 🟢 +2.52%

📌 At-a-glance stats (2015–2024)

📉 Mean (10-yr): −2.55%

⚖️ Median: −4.52%

🔴 Red months: 6 out of 10

❌ Worst September: 2019 (−13.88%)

✅ Best September: 2024 (+7.39%)

📅 Recent Performance (last 3 years)

2024: 🟢 +7.39% → Strongest September in a decade

2023: 🟢 +3.99% → Rare green month, breaking the red-seasonality myth

2022: 🔴 −3.09% → Modest dip during a bearish macro cycle

➡️ Average of last 3 years: 🟢 +2.8%

➡️ Average of last 5 years (2020–2024): 🔴 −1.3%

🔎 Key Insights

September Slump : Historically, September is known as a "red month" for Bitcoin, often averaging −4% to −6% declines. Over the last decade, the median return (−4.5%) aligns with this bearish narrative.

Volatility Factor: The spread between best (+7.39% in 2024) and worst (−13.88% in 2019) September is 21 percentage points, underlining Bitcoin’s volatility even within seasonal patterns.

Changing Trend? The last two years (2023 & 2024) both closed green — suggesting the September slump might be losing strength in the current cycle.

🚀 Macro & Market Context

2019–2020: Heavy red Septembers coincided with global macro uncertainty (trade wars, COVID jitters).

2021: Correction phase post-$64k BTC ATH saw September hit −7%.

2022: Ongoing bear market after Terra/LUNA & 3AC collapses kept September negative.

2023–2024: Renewed momentum, institutional inflows, and ETF speculation helped reverse September’s red streak.

🧭 Takeaway

While September has historically been Bitcoin’s weakest month, the last two years show signs of reversal. The broader trend reminds us that seasonality is a tendency, not a guarantee — macro cycles and catalysts often override calendar effects.

historically September is a red month, so expecting further mild losses

heading into September and limited upside, however, once the pattern

and correction is complete, we should see another bull run and mark up.

📊 Bitcoin September Seasonality (Last 10 Years: 2015–2024)

Yearly September Returns

Year 📈 Return

2024 🟢 +7.39%

2023 🟢 +3.99%

2022 🔴 −3.09%

2021 🔴 −7.03%

2020 🔴 −7.66%

2019 🔴 −13.88%

2018 🔴 −5.95%

2017 🔴 −7.72%

2016 🟢 +5.94%

2015 🟢 +2.52%

📌 At-a-glance stats (2015–2024)

📉 Mean (10-yr): −2.55%

⚖️ Median: −4.52%

🔴 Red months: 6 out of 10

❌ Worst September: 2019 (−13.88%)

✅ Best September: 2024 (+7.39%)

📅 Recent Performance (last 3 years)

2024: 🟢 +7.39% → Strongest September in a decade

2023: 🟢 +3.99% → Rare green month, breaking the red-seasonality myth

2022: 🔴 −3.09% → Modest dip during a bearish macro cycle

➡️ Average of last 3 years: 🟢 +2.8%

➡️ Average of last 5 years (2020–2024): 🔴 −1.3%

🔎 Key Insights

September Slump : Historically, September is known as a "red month" for Bitcoin, often averaging −4% to −6% declines. Over the last decade, the median return (−4.5%) aligns with this bearish narrative.

Volatility Factor: The spread between best (+7.39% in 2024) and worst (−13.88% in 2019) September is 21 percentage points, underlining Bitcoin’s volatility even within seasonal patterns.

Changing Trend? The last two years (2023 & 2024) both closed green — suggesting the September slump might be losing strength in the current cycle.

🚀 Macro & Market Context

2019–2020: Heavy red Septembers coincided with global macro uncertainty (trade wars, COVID jitters).

2021: Correction phase post-$64k BTC ATH saw September hit −7%.

2022: Ongoing bear market after Terra/LUNA & 3AC collapses kept September negative.

2023–2024: Renewed momentum, institutional inflows, and ETF speculation helped reverse September’s red streak.

🧭 Takeaway

While September has historically been Bitcoin’s weakest month, the last two years show signs of reversal. The broader trend reminds us that seasonality is a tendency, not a guarantee — macro cycles and catalysts often override calendar effects.

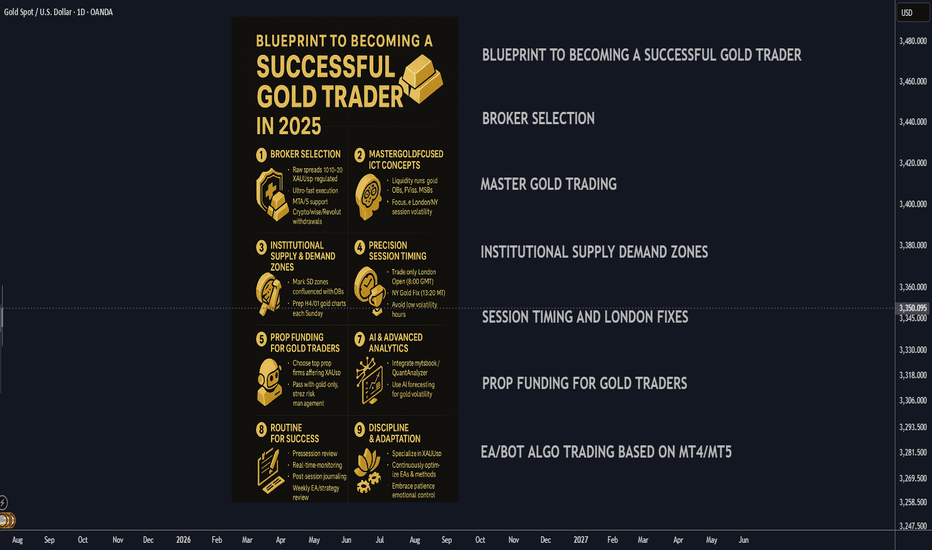

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.