__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Cross-analysis and recommendations

__________________________________________________________________________________

__________________________________________________________________________________

Decision summary

__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

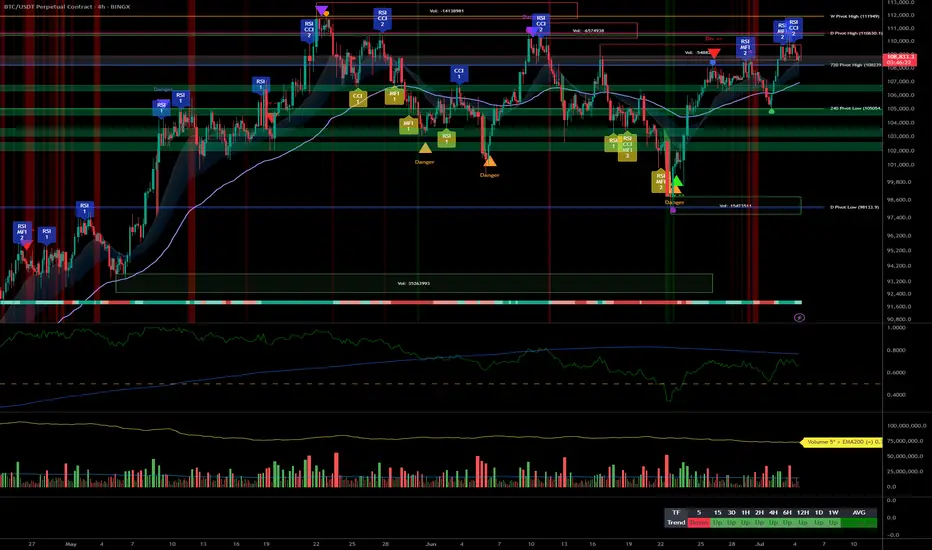

- Momentum: Strong uptrend across all major timeframes (MTFTI “up”). Buyers remain in control; daily/4H/1H structure robust.

- Key supports: 108,239.1 (720min Pivot, critical transversal support), 105,054.7 (240min Pivot), 99,581 (240min Pivot). Active defense seen on 108,239.1 at all timeframes.

- Main resistances: 110,630.1 (1D), 110,483.1 (240min), 111,949 (W). The 110–111k area acts as the short-term ceiling.

- Volume: Moderate activity, no spikes or climaxes, slight intensification noted on the 30min during key tests.

- Risk On / Risk Off Indicator: “STRONG BUY” signal on all Tfs ≥30min, contributing to marked bullish momentum. Minor short-term divergence only on 15min.

- Multi-TF behavior: ISPD DIV and Investor Satisfaction are neutral, no extreme behavioral stress; psychology is balanced, neither panic nor euphoria.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

- Overall bias: Bullish, synchronized multi-timeframes, dominant bullish liquidity.

- Opportunities: Optimal long entries on validated pullback to 108,239.1, add on breakout of 110,630–111,949. Gradual partial take profit recommended in the 111k area.

- Risk zones: Invalidation below 108,239.1 (confirmed H2 close), risk of further correction toward 105k then 99.5k; suggested swing stop under 108,000.

- Macro catalysts: No major event, global markets stable. Geopolitical tensions monitored, low short-term impact.

- Action plan: Prioritize “buy the dip” on pivots, active monitoring for any breakout/failure. Dynamic stop management, partial profit-taking on extension.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

- 1D: Very strong daily structure, high momentum, intermediate supports near 98k/100.5k. Watch for major resistances at 108–111k.

- 12H/6H/4H: Ranging below 110–111k resistance, no fragility. Supports 108,239.1 and 105,054.7 holding, no selling pressure detected. Watch for breakout/impulse.

- 2H/1H: Buy zone if maintained >108,239.1, risk of sell-off below this pivot toward 105k. Price is ranging, momentum remains positive.

- 30min/15min: Consolidation on supports. 15min: temporary divergence on the Risk On / Risk Off Indicator but bullish structure intact unless a clean break below 108,239.1.

- Risk On / Risk Off summaries: Dominant “strong buy” tone, synchronized momentum, only weak short-term divergence. No behavioral stress (ISPD DIV neutral everywhere).

__________________________________________________________________________________

Cross-analysis and recommendations

__________________________________________________________________________________

- Momentum: Bullish environment sustained as long as >108,239.1. Continued upside bias if breakout above 110–111k is confirmed.

- Risks: No major vulnerabilities detected. Very low probability of a local top, except in the case of exogenous macro shock.

- Macro & On-chain: Stable newsflow, no distribution from HODLers or significant new inflows. Preferred strategy: swing trading in trend direction, tight stop under the main pivot.

__________________________________________________________________________________

Decision summary

__________________________________________________________________________________

- Preferred scenario: Hold long >108,239.1, add on validated pullback, look for breakout with volume extension to 111k+.

- Risk management: Stop under 108,000, partial profit-taking in the 110,630–111,949 area.

- No immediate macro constraints: Use this calm window to ride the trend.

- Monitoring: Resilience of the main support, any sudden geopolitical shocks.

BTC/USDT keeps a clear bullish bias, favoring swing or trend-following strategies as long as key pivots hold. Buy the dips remains optimal while technical structure holds; strict stop management is advised pending any “breakout fail”.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.