Bitcoin(

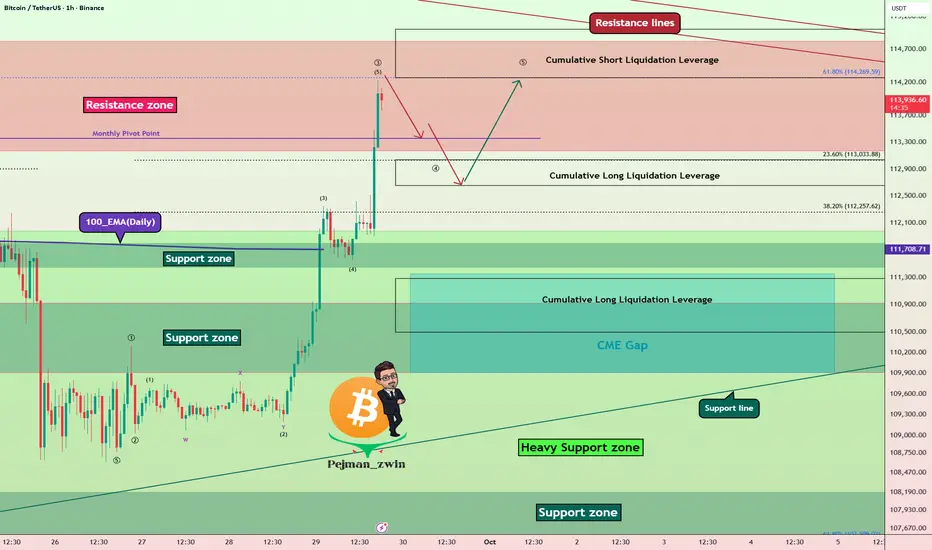

BTCUSDT) has shown strong momentum over the past 5 days, liquidating many traders in both Long and Short positions.

BTCUSDT) has shown strong momentum over the past 5 days, liquidating many traders in both Long and Short positions.

Bitcoin has now entered the Resistance zone($114,820-$113,170) and is moving near the Cumulative Short Liquidation Leverage($115,000-$114,272) and Resistance lines.

From an Elliott Wave Theory perspective, given Bitcoin’s strong bullish momentum over the past 24 hours, it appears to be completing Wave 3. This Wave 3 seems to be of the extended type.

I expect Bitcoin, after a correction, to make another attempt toward the Resistance zone($114,820-$113,170) and potentially test the Resistance lines.

Do you think this bullish move could lead to a new all-time high (ATH) for Bitcoin?

Cumulative Long Liquidation Leverage($113,037-$112,650) + Near Monthly Pivot Point($113,356): An area where Bitcoin could start rising again (if there is a correction, of course).

Cumulative Long Liquidation Leverage: $111,100-$110,500

CME Gap: $111,355-$109,915

Note: Also, Bitcoin approaching the 61.8% golden Fibonacci level could lead to a Bitcoin correction.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analysis (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin has now entered the Resistance zone($114,820-$113,170) and is moving near the Cumulative Short Liquidation Leverage($115,000-$114,272) and Resistance lines.

From an Elliott Wave Theory perspective, given Bitcoin’s strong bullish momentum over the past 24 hours, it appears to be completing Wave 3. This Wave 3 seems to be of the extended type.

I expect Bitcoin, after a correction, to make another attempt toward the Resistance zone($114,820-$113,170) and potentially test the Resistance lines.

Do you think this bullish move could lead to a new all-time high (ATH) for Bitcoin?

Cumulative Long Liquidation Leverage($113,037-$112,650) + Near Monthly Pivot Point($113,356): An area where Bitcoin could start rising again (if there is a correction, of course).

Cumulative Long Liquidation Leverage: $111,100-$110,500

CME Gap: $111,355-$109,915

Note: Also, Bitcoin approaching the 61.8% golden Fibonacci level could lead to a Bitcoin correction.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analysis (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade attivo

Short position touched the target, and the Long position was activated in Cumulative Long Liquidation Leverage($113,037-$112,650).🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.