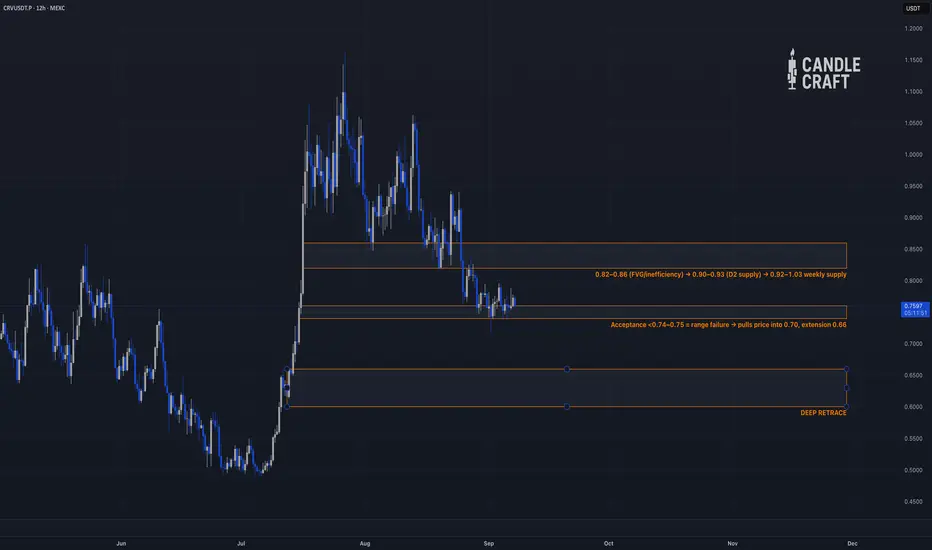

CRV feels like it’s hitting its head on the same doorway every bounce. Each rally into 0.80 gets sold, each dip defended near 0.75. Let’s map the price action.

High Timeframes (Weekly → 2D → 12H)

– Weekly: Corrective drift after 1.0 rejection. Supply 0.92–1.03; demand 0.68–0.72, deeper 0.60–0.66.

– 2D: Lower-highs since Aug; basing 0.74–0.76. Resistance 0.82–0.85, support 0.74–0.76 → 0.70.

– 12H: Range 0.74–0.82. Acceptance ≥0.82 = 0.84–0.86. Break <0.74 = 0.70 → 0.66.

Orderflow / Profile

– POC ~0.76–0.77.

– VAL 0.74–0.75, VAH 0.79–0.80.

– VAH rejections dominate; delta clusters lean distributive.

Derivatives

– OI steady-to-down.

– Funding ~0, CVD net-down.

– No leverage chase, spot flows distributive.

Inter-Market

– BTC mid-range, BTC.D <60%. Alts can rotate, but CRV remains capped unless reclaim ≥0.80.

Conclusion

CRV is balanced-to-heavy around POC 0.76–0.77. Above 0.80 → 0.84–0.86. Below 0.74–0.75 → 0.70, extension 0.60–0.66.

💡 Pro Tip: In markets boxed this tight, grid bots can print profits by automating the support-resistance rotation while waiting for the breakout.

Candle Craft | Signal. Structure. Execution.

High Timeframes (Weekly → 2D → 12H)

– Weekly: Corrective drift after 1.0 rejection. Supply 0.92–1.03; demand 0.68–0.72, deeper 0.60–0.66.

– 2D: Lower-highs since Aug; basing 0.74–0.76. Resistance 0.82–0.85, support 0.74–0.76 → 0.70.

– 12H: Range 0.74–0.82. Acceptance ≥0.82 = 0.84–0.86. Break <0.74 = 0.70 → 0.66.

Orderflow / Profile

– POC ~0.76–0.77.

– VAL 0.74–0.75, VAH 0.79–0.80.

– VAH rejections dominate; delta clusters lean distributive.

Derivatives

– OI steady-to-down.

– Funding ~0, CVD net-down.

– No leverage chase, spot flows distributive.

Inter-Market

– BTC mid-range, BTC.D <60%. Alts can rotate, but CRV remains capped unless reclaim ≥0.80.

Conclusion

CRV is balanced-to-heavy around POC 0.76–0.77. Above 0.80 → 0.84–0.86. Below 0.74–0.75 → 0.70, extension 0.60–0.66.

💡 Pro Tip: In markets boxed this tight, grid bots can print profits by automating the support-resistance rotation while waiting for the breakout.

Candle Craft | Signal. Structure. Execution.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.