Ethereum (ETH/USDT)

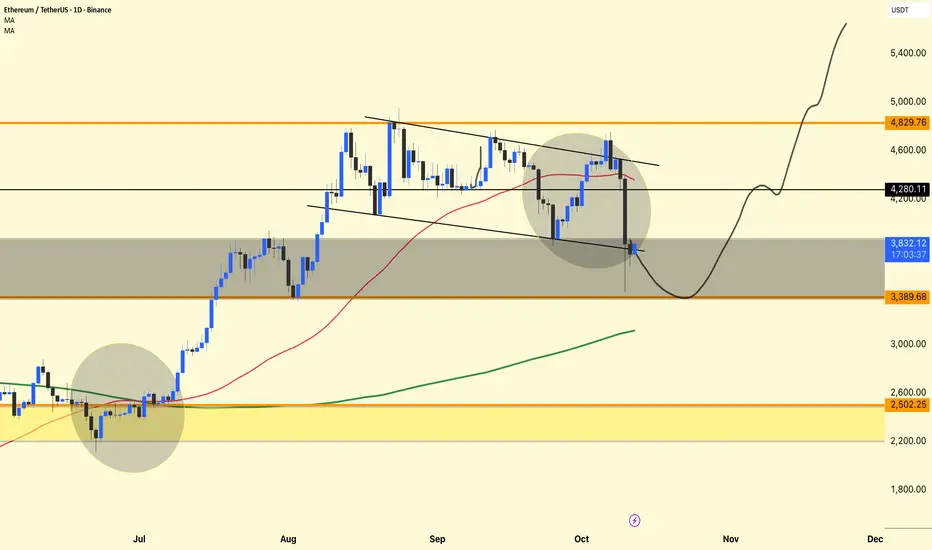

Ethereum is moving at a similar pace to Bitcoin – showing heavy volatility and liquidation pressure, but there are also signs of accumulation near strong support.

The chart shows a return to a key demand zone after a breakout failure from a descending wedge, followed by the formation of a potential reversal structure.

Descending Channel and Breakdown

ETH had been moving within a descending channel for several weeks.

Recently, it attempted a breakout, but sellers regained control, resulting in a false breakout and a retest rejection.

The candle's sharp decline through the red moving average (around $4,300) indicates that bulls were heavily liquidated.

However, the price saw buying interest around the $3,800–$3,400 area, which aligns with the chart's gray support area.

Moving Average Insights

Red MA (50-day): Currently acting as dynamic resistance; ETH needs a clear close above it to confirm a short-term bullish recovery.

Green MA (200-day): Still trending upwards, indicating that the long-term structure remains bullish despite near-term weakness.

If the price stabilizes above the 200-day MA, it will likely attract medium-term investors.

Current Price Activity

At $3,836, ETH is testing the lower boundary of the support zone.

The chart projection (curved black line) suggests:

A possible short-term retest towards $3,380,

Followed by a gradual recovery towards $4,200,

And then a potential continuation towards $4,800+ if momentum strengthens.

This pattern resembles a "spring" setup—a common accumulation behavior before a major reversal.

DYOR | NFA

Ethereum is moving at a similar pace to Bitcoin – showing heavy volatility and liquidation pressure, but there are also signs of accumulation near strong support.

The chart shows a return to a key demand zone after a breakout failure from a descending wedge, followed by the formation of a potential reversal structure.

Descending Channel and Breakdown

ETH had been moving within a descending channel for several weeks.

Recently, it attempted a breakout, but sellers regained control, resulting in a false breakout and a retest rejection.

The candle's sharp decline through the red moving average (around $4,300) indicates that bulls were heavily liquidated.

However, the price saw buying interest around the $3,800–$3,400 area, which aligns with the chart's gray support area.

Moving Average Insights

Red MA (50-day): Currently acting as dynamic resistance; ETH needs a clear close above it to confirm a short-term bullish recovery.

Green MA (200-day): Still trending upwards, indicating that the long-term structure remains bullish despite near-term weakness.

If the price stabilizes above the 200-day MA, it will likely attract medium-term investors.

Current Price Activity

At $3,836, ETH is testing the lower boundary of the support zone.

The chart projection (curved black line) suggests:

A possible short-term retest towards $3,380,

Followed by a gradual recovery towards $4,200,

And then a potential continuation towards $4,800+ if momentum strengthens.

This pattern resembles a "spring" setup—a common accumulation behavior before a major reversal.

DYOR | NFA

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.