hey all! How are you doing?

Date: October 24, 2025

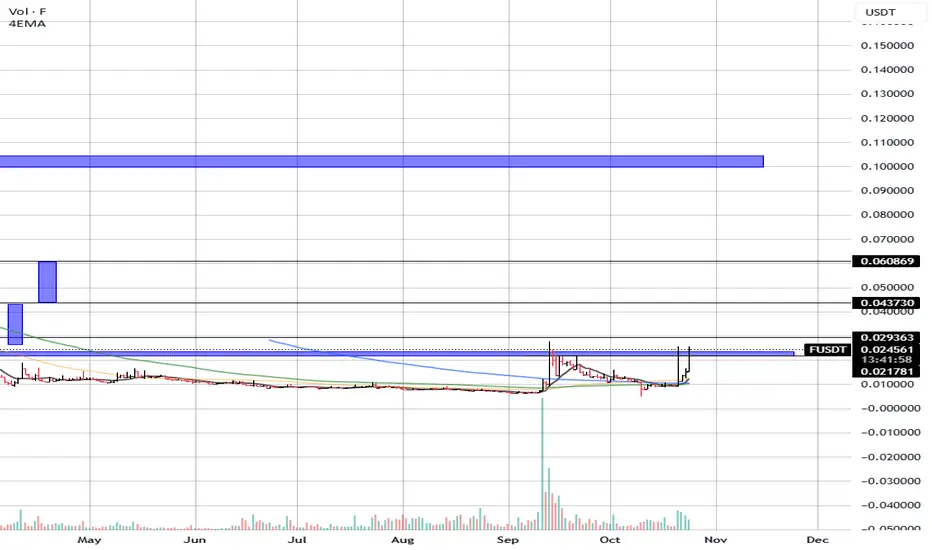

After months of sideways movement and low volatility, F is showing early signs of a potential trend reversal. The token is testing a key resistance level that has capped price since May, and a breakout from this area could open the door to a more sustained recovery phase.

🔍 Technical Overview:

Current Price: $0.0252

4EMA: $0.0122

👉 The price remains well above the short-term EMA, indicating growing bullish momentum.

📊 Market Structure:

F has spent several months forming a wide accumulation range between $0.0100 – $0.0200 (blue zone).

The recent surge in both price and volume suggests renewed interest and accumulation by buyers.

Price is now attempting to break above the $0.029 zone, a crucial structural level that could flip from resistance to support if the move holds.

📉 Support Levels:

$0.0217 → Immediate local support.

$0.0178 → Mid-range support; potential retest level if price pulls back.

$0.0100 → Major accumulation base and invalidation level.

📈 Resistance Levels / Targets:

$0.0293 → Current breakout resistance.

$0.0437 → Next major target aligned with previous local high.

$0.0608 → Larger structural resistance and potential breakout objective.

$0.1100 → Extended target area based on the measured move projection from the base structure.

📊 Volume & Momentum Notes:

The volume expansion seen during the recent move signals a shift in market dynamics, likely the beginning of trend rotation.

The RSI (not visible here but inferred from price structure) likely shows a healthy upward momentum, still below extreme overbought zones.

If price successfully consolidates above $0.025, it would confirm a structural breakout with room for continuation.

🎯 Creative Bullish Scenario:

F looks poised for a potential multi-leg breakout, emerging from a long-term accumulation range.

If the current momentum holds, a short-term rally toward $0.043 – $0.060 is plausible, with the possibility of a larger swing toward $0.110 as liquidity returns and traders re-engage with the asset.

This setup resembles a “spring and expansion” pattern, where a long base builds energy before an impulsive move.

📉 Invalidation:

A close back below $0.0178 would suggest a failed breakout and potential re-entry into the accumulation zone.

⚡ Summary:

F/USDT is showing promising early signs of a trend reversal.

A confirmed breakout above $0.0293 could mark the beginning of a medium-term bullish phase with upside targets at $0.0437 → $0.0608 → $0.1100.

As long as the price holds above $0.0217, the bullish outlook remains valid.

good trading!!

Date: October 24, 2025

After months of sideways movement and low volatility, F is showing early signs of a potential trend reversal. The token is testing a key resistance level that has capped price since May, and a breakout from this area could open the door to a more sustained recovery phase.

🔍 Technical Overview:

Current Price: $0.0252

4EMA: $0.0122

👉 The price remains well above the short-term EMA, indicating growing bullish momentum.

📊 Market Structure:

F has spent several months forming a wide accumulation range between $0.0100 – $0.0200 (blue zone).

The recent surge in both price and volume suggests renewed interest and accumulation by buyers.

Price is now attempting to break above the $0.029 zone, a crucial structural level that could flip from resistance to support if the move holds.

📉 Support Levels:

$0.0217 → Immediate local support.

$0.0178 → Mid-range support; potential retest level if price pulls back.

$0.0100 → Major accumulation base and invalidation level.

📈 Resistance Levels / Targets:

$0.0293 → Current breakout resistance.

$0.0437 → Next major target aligned with previous local high.

$0.0608 → Larger structural resistance and potential breakout objective.

$0.1100 → Extended target area based on the measured move projection from the base structure.

📊 Volume & Momentum Notes:

The volume expansion seen during the recent move signals a shift in market dynamics, likely the beginning of trend rotation.

The RSI (not visible here but inferred from price structure) likely shows a healthy upward momentum, still below extreme overbought zones.

If price successfully consolidates above $0.025, it would confirm a structural breakout with room for continuation.

🎯 Creative Bullish Scenario:

F looks poised for a potential multi-leg breakout, emerging from a long-term accumulation range.

If the current momentum holds, a short-term rally toward $0.043 – $0.060 is plausible, with the possibility of a larger swing toward $0.110 as liquidity returns and traders re-engage with the asset.

This setup resembles a “spring and expansion” pattern, where a long base builds energy before an impulsive move.

📉 Invalidation:

A close back below $0.0178 would suggest a failed breakout and potential re-entry into the accumulation zone.

⚡ Summary:

F/USDT is showing promising early signs of a trend reversal.

A confirmed breakout above $0.0293 could mark the beginning of a medium-term bullish phase with upside targets at $0.0437 → $0.0608 → $0.1100.

As long as the price holds above $0.0217, the bullish outlook remains valid.

good trading!!

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.