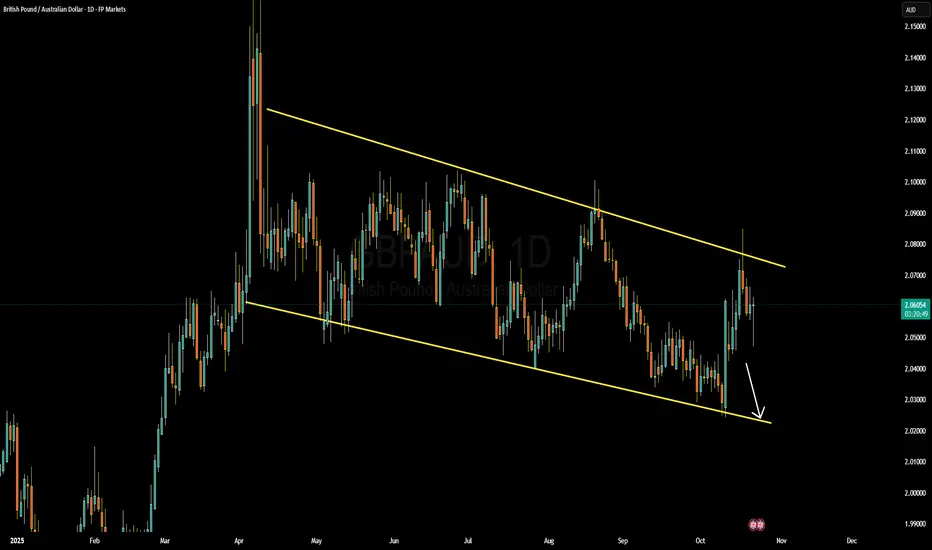

GBPAUD on the daily chart is respecting a well-defined descending channel, showing consistent lower highs and lower lows that confirm a steady bearish market structure. The recent rejection from the upper boundary of the channel around 2.0750 indicates that sellers are regaining control, and momentum could continue driving the pair lower toward the lower channel support near the 2.0200–2.0250 region. This setup highlights a potential short-term bearish continuation as price maintains structure beneath key resistance zones, aligning with broader trend behavior.

From a fundamental perspective, the British pound remains under pressure as UK inflation continues to cool faster than expected, reducing the likelihood of further Bank of England rate hikes. This has led to softer investor sentiment toward GBP. Meanwhile, the Australian dollar has been supported by stronger commodity prices and a more stable domestic outlook, with the Reserve Bank of Australia maintaining a cautious yet firm stance on inflation control. This divergence in central bank tone adds to the downward bias for GBPAUD in the short term.

If price sustains below 2.0650 and fails to reclaim the upper boundary, further downside momentum could drive the pair toward the lower channel target, providing attractive risk-to-reward potential for short setups. However, traders should remain alert to any sharp shifts in risk sentiment or unexpected economic data releases that could spark short-term volatility. Overall, the technical and fundamental outlook both suggest a continuation of the bearish pressure, favoring sell-side strategies for optimal profit potential.

From a fundamental perspective, the British pound remains under pressure as UK inflation continues to cool faster than expected, reducing the likelihood of further Bank of England rate hikes. This has led to softer investor sentiment toward GBP. Meanwhile, the Australian dollar has been supported by stronger commodity prices and a more stable domestic outlook, with the Reserve Bank of Australia maintaining a cautious yet firm stance on inflation control. This divergence in central bank tone adds to the downward bias for GBPAUD in the short term.

If price sustains below 2.0650 and fails to reclaim the upper boundary, further downside momentum could drive the pair toward the lower channel target, providing attractive risk-to-reward potential for short setups. However, traders should remain alert to any sharp shifts in risk sentiment or unexpected economic data releases that could spark short-term volatility. Overall, the technical and fundamental outlook both suggest a continuation of the bearish pressure, favoring sell-side strategies for optimal profit potential.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.