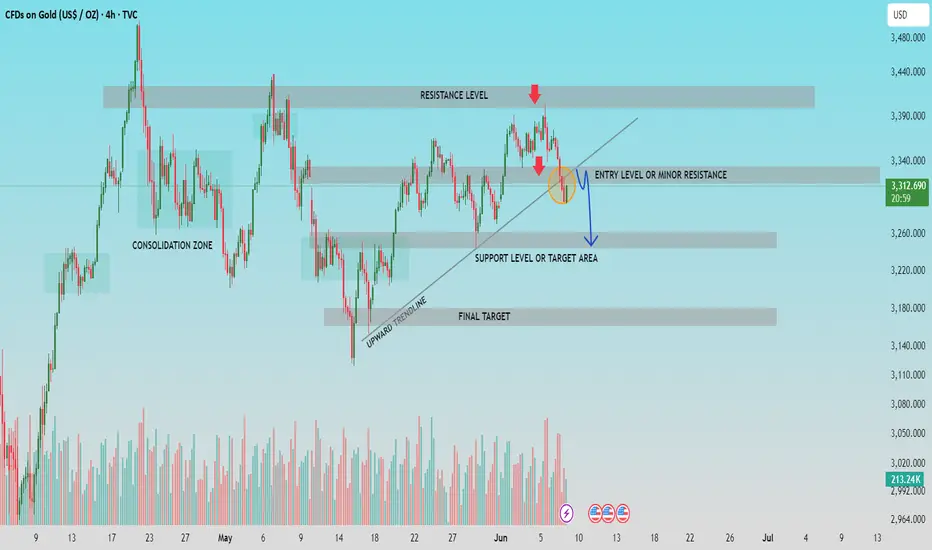

🔹Technical Analysis: Gold (XAU/USD) – 4-Hour Chart

▪️Market Structure & Trendline Break

▫️ Price has broken below the upward trendline, indicating a potential shift in market sentiment from bullish to bearish.

▫️ The failure to sustain above the resistance level near $3,390-$3,440 led to a pullback and bearish rejection (marked by red arrows).

▪️Key Levels

▫️ Minor Resistance / Entry Level: $3,320-$3,340 area may now act as a resistance zone after the trendline break, providing a potential short entry level.

▫️ Support Level / First Target: $3,250-$3,270 zone is identified as the next major support and short-term target.

▫️ Final Target: A deeper correction could push price towards the $3,160-$3,180 region.

▪️Trade Outlook

▫️Current price action suggests a bearish outlook, with potential for a downward move from the minor resistance area.

▫️ Traders may look for sell opportunities on pullbacks into the $3,320-$3,340 zone with confirmation.

▪️Volume Analysis

▫️ Volume has spiked during the breakdown, indicating strong selling interest, supporting the case for downside continuation.

▫️Bias: Bearish, targeting lower support zones after trendline breakdown.

🔹Community Insight:

If you find this analysis helpful in your trading journey, feel free to share your thoughts or questions in the comments. Let’s work together to maintain a disciplined, technical approach to the markets.

▪️Follow for regular updates and trade setups.

▪️Market Structure & Trendline Break

▫️ Price has broken below the upward trendline, indicating a potential shift in market sentiment from bullish to bearish.

▫️ The failure to sustain above the resistance level near $3,390-$3,440 led to a pullback and bearish rejection (marked by red arrows).

▪️Key Levels

▫️ Minor Resistance / Entry Level: $3,320-$3,340 area may now act as a resistance zone after the trendline break, providing a potential short entry level.

▫️ Support Level / First Target: $3,250-$3,270 zone is identified as the next major support and short-term target.

▫️ Final Target: A deeper correction could push price towards the $3,160-$3,180 region.

▪️Trade Outlook

▫️Current price action suggests a bearish outlook, with potential for a downward move from the minor resistance area.

▫️ Traders may look for sell opportunities on pullbacks into the $3,320-$3,340 zone with confirmation.

▪️Volume Analysis

▫️ Volume has spiked during the breakdown, indicating strong selling interest, supporting the case for downside continuation.

▫️Bias: Bearish, targeting lower support zones after trendline breakdown.

🔹Community Insight:

If you find this analysis helpful in your trading journey, feel free to share your thoughts or questions in the comments. Let’s work together to maintain a disciplined, technical approach to the markets.

▪️Follow for regular updates and trade setups.

Trade attivo

from 3326Nota

trade running 140 pips+Nota

one more layer added from 3334, after candlestick confirmations , Nota

after breakdown 3311level , trade activated here, 3311..targets are downside...

Trade chiuso manualmente

in good pips like 420 💸FREE FOREX Signals in Telegram : t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

💸FREE FOREX Signals in Telegram : t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

🔹Join Our Telegram Channel, Pure Price Action Based Signals With Chart Analysis.

t.me/FxInsightsHub0

🚀FREE CRYPTO Signals In Telegram: t.me/FxInsightsHub0

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.