Chart Overview

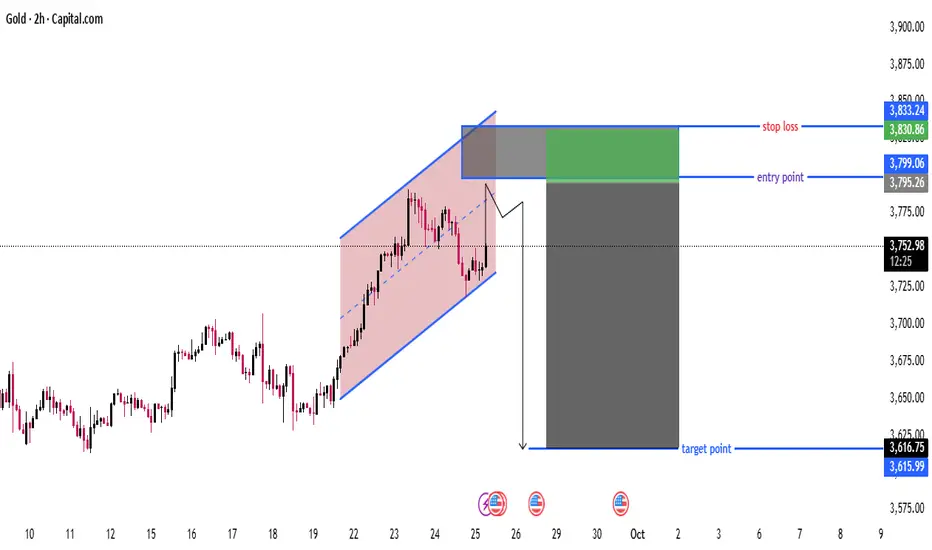

This chart shows a bearish setup for Gold, suggesting a short (sell) trade with the following key components:

🔵 Channel Analysis

Rising Parallel Channel: Price has been moving within an ascending channel (pink shaded area), indicating a short-term uptrend.

The recent candle breaks or touches the lower boundary of this channel, hinting at a potential breakdown.

📉 Trade Setup

This looks like a short (sell) trade idea based on a potential breakout to the downside.

Component Level Details

Entry Point 3,799.06 Entry zone marked in green; at/near the lower trendline of the ascending channel

Stop Loss 3,833.24 Just above the recent highs and the channel top

Target Point 3,616.75–3,615.99 Target area marked in blue; aligns with a prior support zone

✅ Trade Logic

Bearish Bias: Price action shows weakening momentum near the top of the channel.

Breakdown Expected: Entry assumes a breakdown of the ascending channel.

Risk-Reward Ratio (RRR): Very favorable — large potential move down compared to the stop loss range.

📊 Risk Management

Stop Loss: Properly placed above resistance zone — protects against false breakouts.

Target Zone: Based on historical support/resistance structure.

RRR Estimate: Approx. 1:5+, which is excellent if the move materializes.

⚠️ Potential Risks

False Breakout: Price could rebound back into the channel, invalidating the bearish thesis.

Fundamental Triggers: Gold is sensitive to macroeconomic news (e.g., interest rate changes, geopolitical tension, inflation data).

📌 Summary

This is a well-structured short trade setup based on a rising channel breakdown.

With a clear entry, stop loss, and profit target, it presents a high-reward, controlled-risk opportunity.

Best confirmed with:

Bearish candlestick confirmation at the entry point

Volume spike on breakdown

Fundamental catalysts supporting gold weakness

This chart shows a bearish setup for Gold, suggesting a short (sell) trade with the following key components:

🔵 Channel Analysis

Rising Parallel Channel: Price has been moving within an ascending channel (pink shaded area), indicating a short-term uptrend.

The recent candle breaks or touches the lower boundary of this channel, hinting at a potential breakdown.

📉 Trade Setup

This looks like a short (sell) trade idea based on a potential breakout to the downside.

Component Level Details

Entry Point 3,799.06 Entry zone marked in green; at/near the lower trendline of the ascending channel

Stop Loss 3,833.24 Just above the recent highs and the channel top

Target Point 3,616.75–3,615.99 Target area marked in blue; aligns with a prior support zone

✅ Trade Logic

Bearish Bias: Price action shows weakening momentum near the top of the channel.

Breakdown Expected: Entry assumes a breakdown of the ascending channel.

Risk-Reward Ratio (RRR): Very favorable — large potential move down compared to the stop loss range.

📊 Risk Management

Stop Loss: Properly placed above resistance zone — protects against false breakouts.

Target Zone: Based on historical support/resistance structure.

RRR Estimate: Approx. 1:5+, which is excellent if the move materializes.

⚠️ Potential Risks

False Breakout: Price could rebound back into the channel, invalidating the bearish thesis.

Fundamental Triggers: Gold is sensitive to macroeconomic news (e.g., interest rate changes, geopolitical tension, inflation data).

📌 Summary

This is a well-structured short trade setup based on a rising channel breakdown.

With a clear entry, stop loss, and profit target, it presents a high-reward, controlled-risk opportunity.

Best confirmed with:

Bearish candlestick confirmation at the entry point

Volume spike on breakdown

Fundamental catalysts supporting gold weakness

join my telegram channel t.me/goldmitalteam

t.me/goldmitalteam

t.me/goldmitalteam

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

join my telegram channel t.me/goldmitalteam

t.me/goldmitalteam

t.me/goldmitalteam

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.