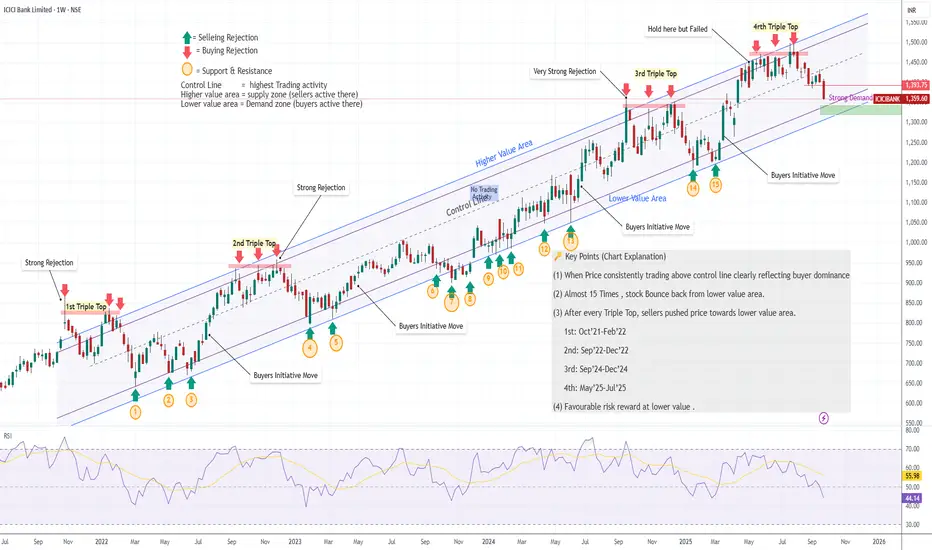

ICICI Bank has been trading inside a long-term uptrend channel for the past 3 years. Within this structure, two clear zones are visible:

Higher Value Area (Supply Zone): Sellers dominate → price faces rejection here.

Lower Value Area (Demand Zone): Buyers dominate → price consistently bounces from here.

👉 Every time price approaches the Lower Value Area around 15 times :

(1) Buyers step in aggressively,

(2) Price reverses strongly,

(3) Risk–Reward becomes highly favorable.

(4) This makes the current setup a good accumulation point.

Now once again, price is testing the Strong Demand Zone (₹1340–1320).

Risk–Reward Setup

Buy Zone: ₹1340–1320

Immediate Resistance: ₹1390–1400

Upside Target: ₹1500–1550 (upper channel boundary)

Risk: Breakdown below ₹1320 may lead to ₹1200.

Fundamental Strength

✔️ Healthy Balance Sheet: Strong capital adequacy, well-managed NPAs.

✔️ Consistent Profit Growth: Strong momentum in NII & PAT over the years.

✔️ Retail & Digital Leadership: Leading share in retail loans + strong digital adoption.

✔️ Sector Tailwind: Indian banking credit growth projected at 14–16%, a positive for ICICI.

✔️ Valuation Comfort: Reasonable PE & PB compared to peers (HDFC Bank, Axis Bank).

Higher Value Area (Supply Zone): Sellers dominate → price faces rejection here.

Lower Value Area (Demand Zone): Buyers dominate → price consistently bounces from here.

👉 Every time price approaches the Lower Value Area around 15 times :

(1) Buyers step in aggressively,

(2) Price reverses strongly,

(3) Risk–Reward becomes highly favorable.

(4) This makes the current setup a good accumulation point.

Now once again, price is testing the Strong Demand Zone (₹1340–1320).

Risk–Reward Setup

Buy Zone: ₹1340–1320

Immediate Resistance: ₹1390–1400

Upside Target: ₹1500–1550 (upper channel boundary)

Risk: Breakdown below ₹1320 may lead to ₹1200.

Fundamental Strength

✔️ Healthy Balance Sheet: Strong capital adequacy, well-managed NPAs.

✔️ Consistent Profit Growth: Strong momentum in NII & PAT over the years.

✔️ Retail & Digital Leadership: Leading share in retail loans + strong digital adoption.

✔️ Sector Tailwind: Indian banking credit growth projected at 14–16%, a positive for ICICI.

✔️ Valuation Comfort: Reasonable PE & PB compared to peers (HDFC Bank, Axis Bank).

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.