The Bull Case - Operational Excellence:

IREN delivered another impressive month with record monthly revenue of $86m, record 728 BTC (#1 among Bitcoin miners and surpassed Mara, Cleanspark, Cango, Riot, and BitFuFu) and record hardware profits of $66m in July IREN July 2025 Monthly Update. The company's operational metrics are genuinely strong:

Mining Efficiency: 45.4 EH/s average operating hashrate with best-in-class efficiency (15 J/TH) and healthy 76% hardware profit margin

AI Pivot Execution: Successfully expanding beyond Bitcoin with 2.4k NVIDIA B200/B300 GPUs and 98% hardware profit margin on AI services

Infrastructure Scale: Massive pipeline with 1,400MW Sweetwater 1 and additional 600MW Sweetwater 2 projects

The Valuation Concern:

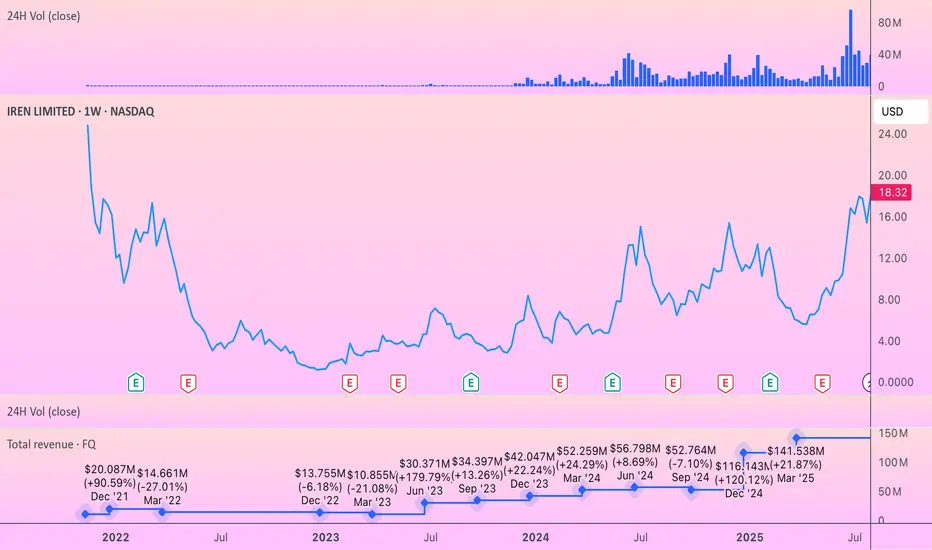

However, the market appears to have gotten ahead of itself. IREN is trading at $18.32 with a 52-week range of $5.13 to $21.54, representing a ~257% gain from its lows. Current analyst consensus shows mixed signals - while 12 analysts give it a Buy rating with an $17.78 price target, this suggests minimal upside at current levels.

Key Risk Factors:

Bitcoin Dependency: Despite AI diversification, Bitcoin still drives 97% of revenue (~$83.6M vs $2.3M AI)

Execution Risk: Aggressive expansion timeline with April 2026 energization for Sweetwater 1 creates delivery pressure

Capital Intensity: Massive CapEx requirements for 2GW+ of planned capacity in a rising rate environment

IREN is operationally executing exceptionally well, but the stock price already reflects much of this success. The 320%+ rally from 2024 lows has created a situation where even strong execution may not drive meaningful returns from current levels. The company's transformation into a diversified digital infrastructure play is promising, but investors are paying a premium multiple for what remains largely a Bitcoin mining operation.

IREN delivered another impressive month with record monthly revenue of $86m, record 728 BTC (#1 among Bitcoin miners and surpassed Mara, Cleanspark, Cango, Riot, and BitFuFu) and record hardware profits of $66m in July IREN July 2025 Monthly Update. The company's operational metrics are genuinely strong:

Mining Efficiency: 45.4 EH/s average operating hashrate with best-in-class efficiency (15 J/TH) and healthy 76% hardware profit margin

AI Pivot Execution: Successfully expanding beyond Bitcoin with 2.4k NVIDIA B200/B300 GPUs and 98% hardware profit margin on AI services

Infrastructure Scale: Massive pipeline with 1,400MW Sweetwater 1 and additional 600MW Sweetwater 2 projects

The Valuation Concern:

However, the market appears to have gotten ahead of itself. IREN is trading at $18.32 with a 52-week range of $5.13 to $21.54, representing a ~257% gain from its lows. Current analyst consensus shows mixed signals - while 12 analysts give it a Buy rating with an $17.78 price target, this suggests minimal upside at current levels.

Key Risk Factors:

Bitcoin Dependency: Despite AI diversification, Bitcoin still drives 97% of revenue (~$83.6M vs $2.3M AI)

Execution Risk: Aggressive expansion timeline with April 2026 energization for Sweetwater 1 creates delivery pressure

Capital Intensity: Massive CapEx requirements for 2GW+ of planned capacity in a rising rate environment

IREN is operationally executing exceptionally well, but the stock price already reflects much of this success. The 320%+ rally from 2024 lows has created a situation where even strong execution may not drive meaningful returns from current levels. The company's transformation into a diversified digital infrastructure play is promising, but investors are paying a premium multiple for what remains largely a Bitcoin mining operation.

I am a research analyst specializing in Bitcoin mining and blockchain infrastructure. With a focus on mining economics, energy efficiency, and the evolving regulatory landscape, I provide data-driven insights into global mining trends.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

I am a research analyst specializing in Bitcoin mining and blockchain infrastructure. With a focus on mining economics, energy efficiency, and the evolving regulatory landscape, I provide data-driven insights into global mining trends.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.