⚡ WaverVanir Market Intel —  IWM Outlook (Nov 10 2025)

IWM Outlook (Nov 10 2025)

Setup Summary:

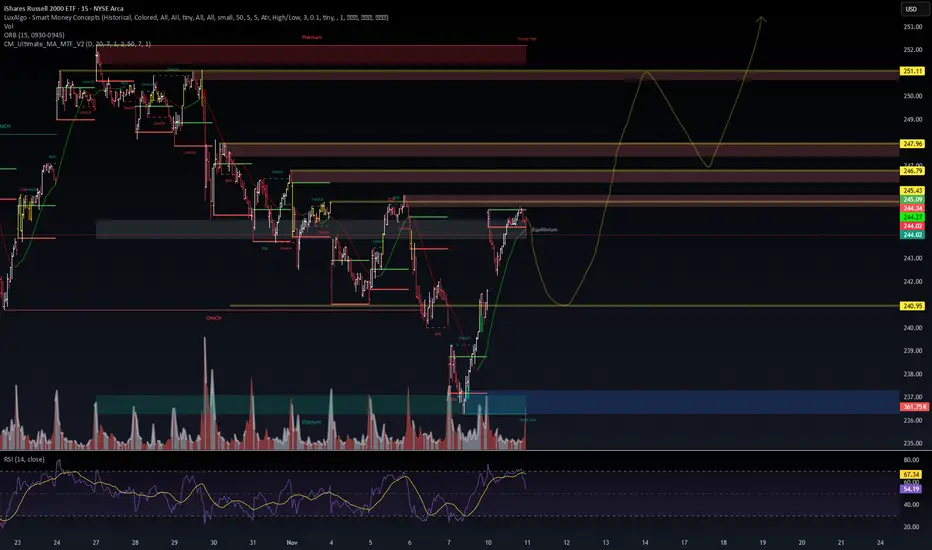

IWM consolidates around $244 after reclaiming the mid-discount zone. The Smart Money Concepts framework shows equilibrium retest before a potential push toward $247 – $251. Institutional DSS and ensemble models align with a mild bullish bias (+0.6 – 1.5 % 30-day upside) but emphasize a HOLD stance while liquidity rebalances.

IWM consolidates around $244 after reclaiming the mid-discount zone. The Smart Money Concepts framework shows equilibrium retest before a potential push toward $247 – $251. Institutional DSS and ensemble models align with a mild bullish bias (+0.6 – 1.5 % 30-day upside) but emphasize a HOLD stance while liquidity rebalances.

🔍 Technical Structure

Liquidity Zones: $240.9 (demand / discount), $247.9 → $251 (premium liquidity targets)

Key Levels: Equilibrium ≈ $244 | Premium Range $251 | Discount $240.9

Smart Money Signals: CHoCH → BOS → Reclaim pattern suggests potential continuation after equilibrium sweep.

RSI (15 m): Pullback likely → opportunity for re-entry near $241 – $242 zone.

🧠 VolanX / Institutional Model Consensus

DSS Forecast: $245.34 (+1.5 % in 30 days)

Institutional Model: Target $245.46 (+0.6 %), R² = −0.341, Volatility ≈ 3.7 %

Sentiment Score: 39 / 100 (mixed neutral)

Trade Plan: 2 of 9 models bullish → HOLD bias until confirmation of breakout > $247.

🌍 Macro Catalysts & Themes

CPI and Inflation Data (Upcoming Week): A softer print could reinforce risk-on rotation into small-caps.

Fed Outlook: Dovish tone from regional Fed speeches and rising rate-cut probabilities support Russell strength.

Yield Curve Normalization: 2Y yield falling below 4 % spurs rotation from mega-caps to broader equities.

AI + Infrastructure Policy Spending: Fiscal stimulus flows into mid-cap industrials boost IWM relative momentum.

IWM relative momentum.

Dollar Weakness: DXY under 105 enhances US exporter appeal, further benefiting $IWM.

DXY under 105 enhances US exporter appeal, further benefiting $IWM.

🎯 Trading View

Base Case (60 % prob.):

🟩 Re-accumulation → pullback to $241 – $242 → break $247 → extend to $251.

Alternate Case (40 % prob.):

🟥 Failure below $240.9 → retest discount zone $237 – $238 before reactivation.

⚙️ WaverVanir Outlook

“Liquidity seeks expansion — the small-cap cycle reloads. Wait for the sweep, not the hype.”

#WaverVanir #VolanX #IWM #SmartMoneyConcepts #MarketIntel #QuantForecast #Russell2000 #AITrading #InstitutionalFlow #MacroUpdate #RiskOn

Setup Summary:

🔍 Technical Structure

Liquidity Zones: $240.9 (demand / discount), $247.9 → $251 (premium liquidity targets)

Key Levels: Equilibrium ≈ $244 | Premium Range $251 | Discount $240.9

Smart Money Signals: CHoCH → BOS → Reclaim pattern suggests potential continuation after equilibrium sweep.

RSI (15 m): Pullback likely → opportunity for re-entry near $241 – $242 zone.

🧠 VolanX / Institutional Model Consensus

DSS Forecast: $245.34 (+1.5 % in 30 days)

Institutional Model: Target $245.46 (+0.6 %), R² = −0.341, Volatility ≈ 3.7 %

Sentiment Score: 39 / 100 (mixed neutral)

Trade Plan: 2 of 9 models bullish → HOLD bias until confirmation of breakout > $247.

🌍 Macro Catalysts & Themes

CPI and Inflation Data (Upcoming Week): A softer print could reinforce risk-on rotation into small-caps.

Fed Outlook: Dovish tone from regional Fed speeches and rising rate-cut probabilities support Russell strength.

Yield Curve Normalization: 2Y yield falling below 4 % spurs rotation from mega-caps to broader equities.

AI + Infrastructure Policy Spending: Fiscal stimulus flows into mid-cap industrials boost

Dollar Weakness:

🎯 Trading View

Base Case (60 % prob.):

🟩 Re-accumulation → pullback to $241 – $242 → break $247 → extend to $251.

Alternate Case (40 % prob.):

🟥 Failure below $240.9 → retest discount zone $237 – $238 before reactivation.

⚙️ WaverVanir Outlook

“Liquidity seeks expansion — the small-cap cycle reloads. Wait for the sweep, not the hype.”

#WaverVanir #VolanX #IWM #SmartMoneyConcepts #MarketIntel #QuantForecast #Russell2000 #AITrading #InstitutionalFlow #MacroUpdate #RiskOn

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.