🚀🇯🇵 JP225 (JAPAN 225) CFD - THIEF STRATEGY BULLISH PLAN [SWING/DAY TRADE] 🇯🇵🚀

🎯 Core Trading Idea

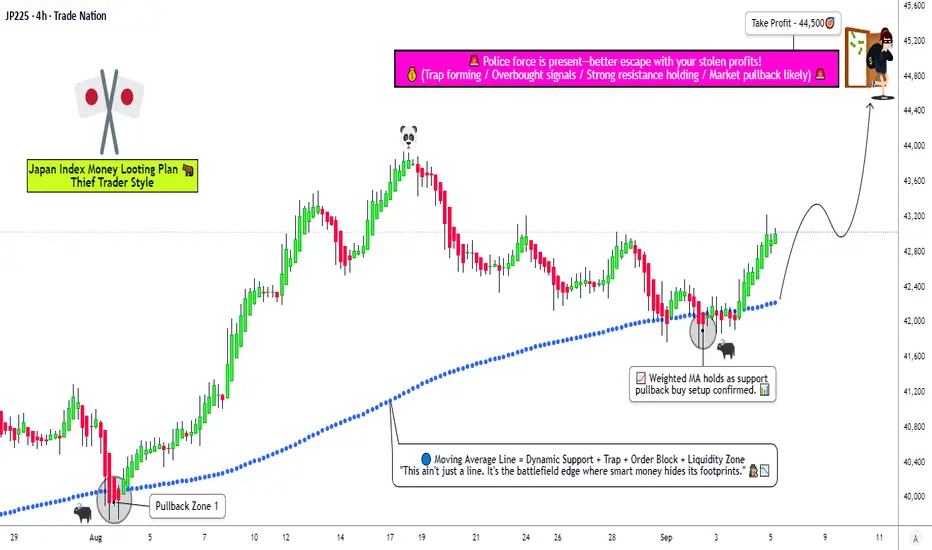

The "Thief Strategy" uses layered limit orders to stealthily accumulate positions during bullish momentum, targeting a swift escape before key resistance levels. This approach maximizes entry efficiency while minimizing market impact – perfect for the current JP225 setup!

📊 THIEF STRATEGY EXECUTION PLAN

⚡ Entry Protocol (Layered Limit Orders)

🔰 Layer 1: 42,200

🔰 Layer 2: 42,400

🔰 Layer 3: 42,600

🔰 Layer 4: 42,800

💡 Pro Tip: Add more layers based on your risk tolerance and capital allocation

🛑 Stop Loss Configuration

Thief OG SL: 41,800 (Strategic support breach level)

⚠️ Disclaimer: Adjust SL based on your personal risk management rules. This is NOT financial advice.

🎯 Profit-Taking Target

Primary Escape Zone: 44,500 (Take profits before police barricade resistance at 45,000)

Remember: Escape with your stolen money wisely! Partial profits at 43,800 and 44,200 recommended

📈 WHY THIS PLAN? MARKET CONTEXT & ANALYSIS

🎯 Real-Time Index Snapshot (Sep 05, 2025)

Current Price: 43,002.00 (+423.82 / +1.00% 📈)

Monthly Gain: +5.48% (Strong momentum ✅)

Yearly Gain: +18.24% (Bullish trend intact ✅)

All-Time High: 43,876.42 (August 2025 🏆)

😰😊 Market Sentiment: Fear & Greed Index

Current Reading: Greed (Score ~70/100) 😊

Momentum: Strong (Above 125-day MA) 📈

Volatility: Low to Moderate 😌

Safe Haven Demand: Low 🚫

Options Activity: Neutral 📊

✅ Fundamental Drivers (BULLISH CATALYSTS)

🏎️ Trade Policy Win: U.S. auto tariffs reduced to 15% (from 27.5%) - massive boost for Japanese exporters

💰 Wage Growth Breakthrough: Real wages turned positive (+0.5%) for first time since December 2024

💵 Investment Surge: $550B Japanese investments in U.S. projects announced

🌍 Global Liquidity Support: Fed rate cut expectations supporting risk assets

🏢 Corporate Strength: Toyota (+1.98%), Honda (+1.14%), and Mitsubishi UFJ (+0.93%) leading gains

⚠️ Key Risks (BE AWARE)

💴 Yen Appreciation Risk: Potential JPY strength if U.S. accelerates rate cuts

🎯 Inflation Pressure: Consumer inflation at 3.6% (above BoJ's 2% target)

📉 Mixed Economic Signals: Coincident index dropped to 113.3 (from 116.7)

📊 Technical Assessment

🎯 Trend Structure: Bullish above 41,500 support

📊 Momentum: Strong upward trajectory with occasional consolidation

🧱 Resistance Levels: 43,900 (Recent high), 45,000 (Psychological barrier)

🛡️ Support Levels: 41,800 (Strategy SL), 41,200 (Strong weekly support)

🌐 RELATED PAIRS TO WATCH

USDJPY - Critical for exporter competitiveness

USDJPY - Critical for exporter competitiveness

NKY - Nikkei 225 futures correlation

NKY - Nikkei 225 futures correlation

SPX - Global risk sentiment gauge

SPX - Global risk sentiment gauge

EURJPY - Yen strength indicator

EURJPY - Yen strength indicator

📊 BULLISH/BEARISH SCORECARD

Technical: 80% Bullish ✅ | 20% Bearish

Fundamental: 75% Bullish ✅ | 25% Bearish

Sentiment: 70% Bullish ✅ | 30% Bearish

Risk/Reward: 80% Favorable ✅ | 20% Unfavorable

OVERALL: 76% BULLISH ✅ | 24% BEARISH

👑 TRADER PERSPECTIVES

🎯 Retail Traders: Optimistic but cautious near ATHs. Watch for breakout above 43,900

🏦 Institutional Flow: Accumulating on dips, focusing on exporters and tech names

🇯🇵 Domestic Investors: Positive on wage growth and trade developments

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

⚠️ RISK DISCLAIMER

This idea is for educational purposes only. I am not a financial advisor. The "Thief Strategy" is a personal approach and may not suit all traders. Always conduct your own analysis and manage risk appropriately. Past performance doesn't guarantee future results. Trading CFDs carries substantial risk of loss.

#JP225 #Japan225 #NIKKEI #TradingSetup #SwingTrading #DayTrading #TradingStrategy #CFD #MarketAnalysis #TechnicalAnalysis #TradingView #ThiefStrategy #Bullish #Investing #Stocks #Finance

🎯 Core Trading Idea

The "Thief Strategy" uses layered limit orders to stealthily accumulate positions during bullish momentum, targeting a swift escape before key resistance levels. This approach maximizes entry efficiency while minimizing market impact – perfect for the current JP225 setup!

📊 THIEF STRATEGY EXECUTION PLAN

⚡ Entry Protocol (Layered Limit Orders)

🔰 Layer 1: 42,200

🔰 Layer 2: 42,400

🔰 Layer 3: 42,600

🔰 Layer 4: 42,800

💡 Pro Tip: Add more layers based on your risk tolerance and capital allocation

🛑 Stop Loss Configuration

Thief OG SL: 41,800 (Strategic support breach level)

⚠️ Disclaimer: Adjust SL based on your personal risk management rules. This is NOT financial advice.

🎯 Profit-Taking Target

Primary Escape Zone: 44,500 (Take profits before police barricade resistance at 45,000)

Remember: Escape with your stolen money wisely! Partial profits at 43,800 and 44,200 recommended

📈 WHY THIS PLAN? MARKET CONTEXT & ANALYSIS

🎯 Real-Time Index Snapshot (Sep 05, 2025)

Current Price: 43,002.00 (+423.82 / +1.00% 📈)

Monthly Gain: +5.48% (Strong momentum ✅)

Yearly Gain: +18.24% (Bullish trend intact ✅)

All-Time High: 43,876.42 (August 2025 🏆)

😰😊 Market Sentiment: Fear & Greed Index

Current Reading: Greed (Score ~70/100) 😊

Momentum: Strong (Above 125-day MA) 📈

Volatility: Low to Moderate 😌

Safe Haven Demand: Low 🚫

Options Activity: Neutral 📊

✅ Fundamental Drivers (BULLISH CATALYSTS)

🏎️ Trade Policy Win: U.S. auto tariffs reduced to 15% (from 27.5%) - massive boost for Japanese exporters

💰 Wage Growth Breakthrough: Real wages turned positive (+0.5%) for first time since December 2024

💵 Investment Surge: $550B Japanese investments in U.S. projects announced

🌍 Global Liquidity Support: Fed rate cut expectations supporting risk assets

🏢 Corporate Strength: Toyota (+1.98%), Honda (+1.14%), and Mitsubishi UFJ (+0.93%) leading gains

⚠️ Key Risks (BE AWARE)

💴 Yen Appreciation Risk: Potential JPY strength if U.S. accelerates rate cuts

🎯 Inflation Pressure: Consumer inflation at 3.6% (above BoJ's 2% target)

📉 Mixed Economic Signals: Coincident index dropped to 113.3 (from 116.7)

📊 Technical Assessment

🎯 Trend Structure: Bullish above 41,500 support

📊 Momentum: Strong upward trajectory with occasional consolidation

🧱 Resistance Levels: 43,900 (Recent high), 45,000 (Psychological barrier)

🛡️ Support Levels: 41,800 (Strategy SL), 41,200 (Strong weekly support)

🌐 RELATED PAIRS TO WATCH

📊 BULLISH/BEARISH SCORECARD

Technical: 80% Bullish ✅ | 20% Bearish

Fundamental: 75% Bullish ✅ | 25% Bearish

Sentiment: 70% Bullish ✅ | 30% Bearish

Risk/Reward: 80% Favorable ✅ | 20% Unfavorable

OVERALL: 76% BULLISH ✅ | 24% BEARISH

👑 TRADER PERSPECTIVES

🎯 Retail Traders: Optimistic but cautious near ATHs. Watch for breakout above 43,900

🏦 Institutional Flow: Accumulating on dips, focusing on exporters and tech names

🇯🇵 Domestic Investors: Positive on wage growth and trade developments

✨ "If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!"

⚠️ RISK DISCLAIMER

This idea is for educational purposes only. I am not a financial advisor. The "Thief Strategy" is a personal approach and may not suit all traders. Always conduct your own analysis and manage risk appropriately. Past performance doesn't guarantee future results. Trading CFDs carries substantial risk of loss.

#JP225 #Japan225 #NIKKEI #TradingSetup #SwingTrading #DayTrading #TradingStrategy #CFD #MarketAnalysis #TechnicalAnalysis #TradingView #ThiefStrategy #Bullish #Investing #Stocks #Finance

Trade attivo

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.