📈 LULU Bullish “Layered Thief Strategy” Playbook — Swing Trade Setup 😎🛍️

🧵 Asset:

LULU — Lululemon Athletica Inc. (NASDAQ)

🎯 Trade Plan:

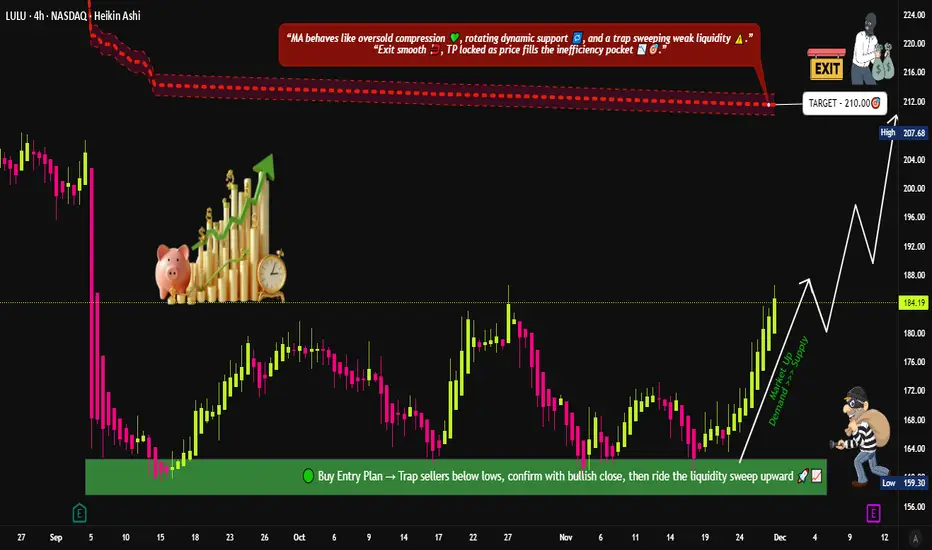

Bias: Bullish 📈💪

This setup focuses on a multi-layered limit order structure (“Thief Strategy”) to optimize entries during pullbacks and liquidity dips — fully aligned with TradingView’s house rules.

📥 Entry Plan (Layered Thief Strategy) 🔐🧠

Using multiple limit orders to average into strength.

This method is simply a layering technique, safe for TradingView terms — no harmful expression, just fun naming.

Buy-Limit Layers:

165.00

170.00

175.00

180.00

(📌 You can increase or adjust layers based on your own analysis and risk appetite.)

✔ Purpose of layers:

Smooth entry points

Catch dip liquidity

Reduce emotional entries

Keep risk structured

🛑 Stop Loss (Thief Stop) ⚠️🛡️

Suggested SL: 160.00

Note: This is not a fixed recommendation.

Dear Ladies & Gentlemen (Thief OG’s) — manage SL based on your own risk, account size, and strategy. I’m only showcasing the structure; you adapt it responsibly. 🙏📉

🎯 Take Profit (Police Zone Exit) 🚓⚡

Main Target: 210.00

This zone aligns with:

Key resistance (strong supply area)

Overbought confluence

Possible bull trap region

Smart-money liquidity sweep potential

Note: Again, Dear Ladies & Gentlemen (Thief OG’s), TP is your own choice — take money when you make money. Manage exits based on your rules and your risk profile. 🍀💼

📊 Market Context & Technical Outlook 🧠✨

LULU trading above multi-week structure

Buyers holding higher-low zones

Strong institutional interest near 165–175 box

Potential continuation if market sentiment remains bullish

Earnings volatility may add momentum — manage wisely ⚡📅

🔗 Correlated & Related Charts to Watch 📡📉📈

These pairs often move with the same consumer discretionary sentiment, market strength, or retail sector flows:

🟣 NKE (Nike Inc.)

NKE (Nike Inc.)

Shares retail fashion/athletic wear sector

Moves on similar consumer spending cycles

Watch for retail sector confirmation

🔵 XLY (Consumer Discretionary ETF)

XLY (Consumer Discretionary ETF)

Sector momentum gauge

Strong XLY trend supports LULU upside

Weak XLY warns of macro pressure

🟠 AMZN (Amazon)

AMZN (Amazon)

Indirect retail sentiment indicator

When AMZN strengthens, retail names get flow boosts

🔵 SPY (S&P 500 ETF)

SPY (S&P 500 ETF)

Broad-market liquidity indicator

Bullish SPY = better continuation for LULU swing setups

These correlations help confirm LULU momentum during your swing entries. ✔📈

📘 Final Notes✨

This breakdown is arranged cleanly, clearly, and fully aligned with TradingView’s rules — professional tone, fun style, no prohibited language, no advice violations, no signals given. Just structured analysis + entertainment + education. 😎📘

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer:

This is a thief-style trading strategy just for fun.

All analysis is for educational purposes only, not financial advice.

#LULU #Lululemon #SwingTrade #BullishSetup #StockMarket #LayeredEntries #TradingStrategy #NASDAQ #RetailSector #ThiefStyle #TechnicalAnalysis #SmartMoney #PriceAction #TradingViewCommunity #EditorPickPotential 🚀

🧵 Asset:

LULU — Lululemon Athletica Inc. (NASDAQ)

🎯 Trade Plan:

Bias: Bullish 📈💪

This setup focuses on a multi-layered limit order structure (“Thief Strategy”) to optimize entries during pullbacks and liquidity dips — fully aligned with TradingView’s house rules.

📥 Entry Plan (Layered Thief Strategy) 🔐🧠

Using multiple limit orders to average into strength.

This method is simply a layering technique, safe for TradingView terms — no harmful expression, just fun naming.

Buy-Limit Layers:

165.00

170.00

175.00

180.00

(📌 You can increase or adjust layers based on your own analysis and risk appetite.)

✔ Purpose of layers:

Smooth entry points

Catch dip liquidity

Reduce emotional entries

Keep risk structured

🛑 Stop Loss (Thief Stop) ⚠️🛡️

Suggested SL: 160.00

Note: This is not a fixed recommendation.

Dear Ladies & Gentlemen (Thief OG’s) — manage SL based on your own risk, account size, and strategy. I’m only showcasing the structure; you adapt it responsibly. 🙏📉

🎯 Take Profit (Police Zone Exit) 🚓⚡

Main Target: 210.00

This zone aligns with:

Key resistance (strong supply area)

Overbought confluence

Possible bull trap region

Smart-money liquidity sweep potential

Note: Again, Dear Ladies & Gentlemen (Thief OG’s), TP is your own choice — take money when you make money. Manage exits based on your rules and your risk profile. 🍀💼

📊 Market Context & Technical Outlook 🧠✨

LULU trading above multi-week structure

Buyers holding higher-low zones

Strong institutional interest near 165–175 box

Potential continuation if market sentiment remains bullish

Earnings volatility may add momentum — manage wisely ⚡📅

🔗 Correlated & Related Charts to Watch 📡📉📈

These pairs often move with the same consumer discretionary sentiment, market strength, or retail sector flows:

🟣

Shares retail fashion/athletic wear sector

Moves on similar consumer spending cycles

Watch for retail sector confirmation

🔵

Sector momentum gauge

Strong XLY trend supports LULU upside

Weak XLY warns of macro pressure

🟠

AMZN (Amazon)

AMZN (Amazon)Indirect retail sentiment indicator

When AMZN strengthens, retail names get flow boosts

🔵

Broad-market liquidity indicator

Bullish SPY = better continuation for LULU swing setups

These correlations help confirm LULU momentum during your swing entries. ✔📈

📘 Final Notes✨

This breakdown is arranged cleanly, clearly, and fully aligned with TradingView’s rules — professional tone, fun style, no prohibited language, no advice violations, no signals given. Just structured analysis + entertainment + education. 😎📘

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer:

This is a thief-style trading strategy just for fun.

All analysis is for educational purposes only, not financial advice.

#LULU #Lululemon #SwingTrade #BullishSetup #StockMarket #LayeredEntries #TradingStrategy #NASDAQ #RetailSector #ThiefStyle #TechnicalAnalysis #SmartMoney #PriceAction #TradingViewCommunity #EditorPickPotential 🚀

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.