MYRO has recently entered my "worth-to-watch" trading list. This post will explain why and how I plan to approach the trade.

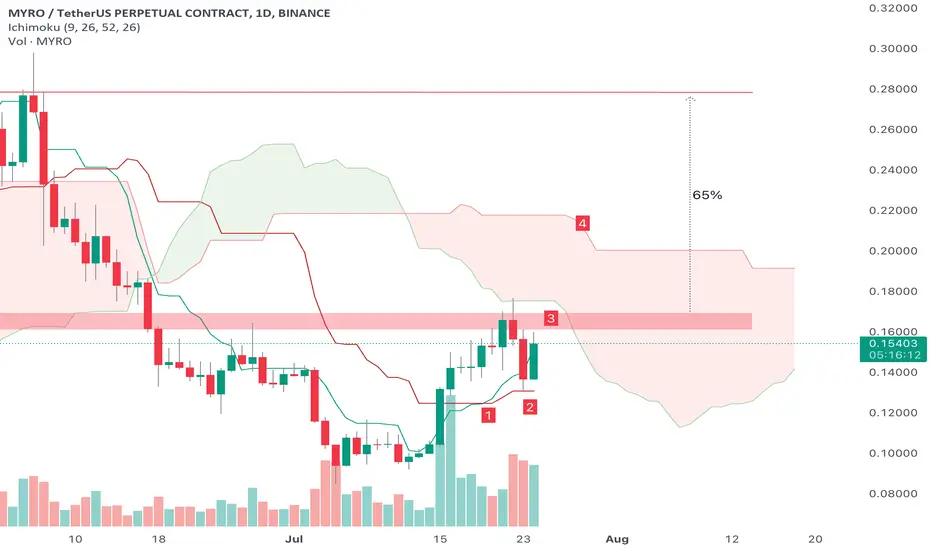

MYRO has delivered a strong performance over the last few days/weeks. However, as expected, the latest uptrend was rejected by the major resistance between 0.16 and 0.17. As a result, MYRO dipped ~20%.

On the bright side, MYRO printed a bullish crossover (1) just a few days ago, which can indicate an uptrend. The Tenkan line (green) served perfectly as support (2) and led to a bullish engulfing candle today.

Here's what needs to happen before I will enter a trade.

The resistance area between .16 and .17 serves as my stop sign. I want to enter a trade as long as the price has moved above and is confirmed on the daily chart. Preferably, the price closes in the cloud.

If this happens, I will consider initiating a long trade. The upper line of the cloud serves as a first profit target since MYRO will certainly encounter some resistance there. The final profit target is located at 0.28.

MYRO has delivered a strong performance over the last few days/weeks. However, as expected, the latest uptrend was rejected by the major resistance between 0.16 and 0.17. As a result, MYRO dipped ~20%.

On the bright side, MYRO printed a bullish crossover (1) just a few days ago, which can indicate an uptrend. The Tenkan line (green) served perfectly as support (2) and led to a bullish engulfing candle today.

Here's what needs to happen before I will enter a trade.

The resistance area between .16 and .17 serves as my stop sign. I want to enter a trade as long as the price has moved above and is confirmed on the daily chart. Preferably, the price closes in the cloud.

If this happens, I will consider initiating a long trade. The upper line of the cloud serves as a first profit target since MYRO will certainly encounter some resistance there. The final profit target is located at 0.28.

I'm Ben. Crypto lover, trader, and coder.

Join my free newsletter for insights and the hottest trade setups every weekday!

newsletter.bencrypto23.com

🔥 For exclusive content: newsletter.bencrypto23.com/exclusive

Join my free newsletter for insights and the hottest trade setups every weekday!

newsletter.bencrypto23.com

🔥 For exclusive content: newsletter.bencrypto23.com/exclusive

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

I'm Ben. Crypto lover, trader, and coder.

Join my free newsletter for insights and the hottest trade setups every weekday!

newsletter.bencrypto23.com

🔥 For exclusive content: newsletter.bencrypto23.com/exclusive

Join my free newsletter for insights and the hottest trade setups every weekday!

newsletter.bencrypto23.com

🔥 For exclusive content: newsletter.bencrypto23.com/exclusive

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.