Actionable Trading Framework

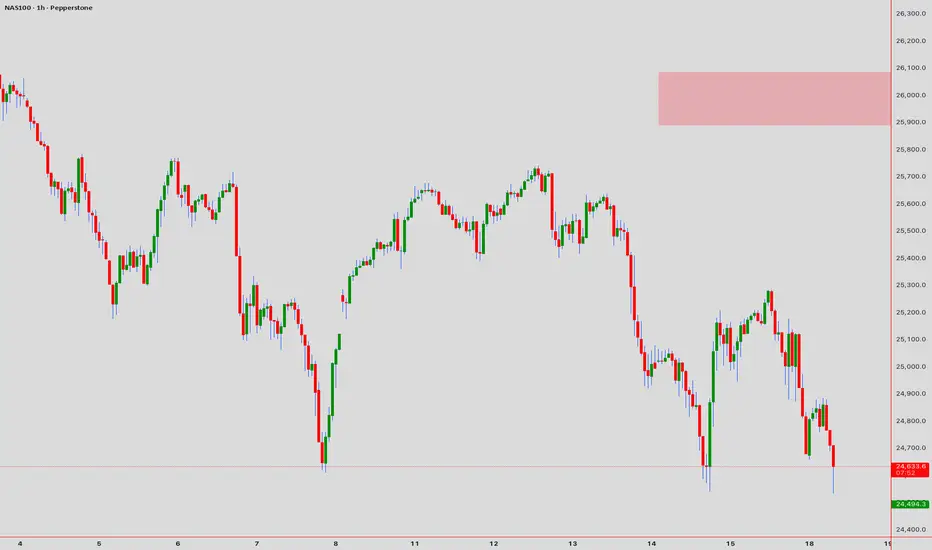

Bullish Scenario (Probability: 60%)

Entry: 24,595-24,620 (consolidation breach confirmation)

Target 1:24,680 (+$62 risk/reward)

Target 2: 24,750 (+$132 profit extension)

Stop Loss: 24,550 (-$45)

Trigger: Break above 24,650 with volume confirmation on 5/15-min charts

Bearish Scenario (Probability: 40%)

Entry: 24,680-24,710 (rejection candle formation)

Target 1: 24,600 (-$80 to +$30 range)

Target 2: 24,520 (-$160 reversal)

Stop Loss: 24,760 (+$50)

Trigger: Failed breakout attempt + RSI divergence on 1-hour chart

Key Technical Confluences

✓ EMA 20/50 Crossover Zone → Dynamic support (1-hour timeframe)

✓ VWAP Alignment → Acts as pivot point at 24,635

✓ Harmonic Pattern → Potential bullish AB=CD completion near current zone

✓ Ichimoku Tenkan-sen → Resistance pressure at 24,705

Execution Rules

1. Entry Confirmation: Engulfing or Pin Bar + Volume Spike on 5-min chart

2. Risk Management: Maximum risk per trade = 1% account size

3. Time Window: Optimal trading 08:00-15:00 UTC+4 (high liquidity period)

4. Exit Protocol: Trail stop at 15-pips after Target 1 achievement

Bullish Scenario (Probability: 60%)

Entry: 24,595-24,620 (consolidation breach confirmation)

Target 1:24,680 (+$62 risk/reward)

Target 2: 24,750 (+$132 profit extension)

Stop Loss: 24,550 (-$45)

Trigger: Break above 24,650 with volume confirmation on 5/15-min charts

Bearish Scenario (Probability: 40%)

Entry: 24,680-24,710 (rejection candle formation)

Target 1: 24,600 (-$80 to +$30 range)

Target 2: 24,520 (-$160 reversal)

Stop Loss: 24,760 (+$50)

Trigger: Failed breakout attempt + RSI divergence on 1-hour chart

Key Technical Confluences

✓ EMA 20/50 Crossover Zone → Dynamic support (1-hour timeframe)

✓ VWAP Alignment → Acts as pivot point at 24,635

✓ Harmonic Pattern → Potential bullish AB=CD completion near current zone

✓ Ichimoku Tenkan-sen → Resistance pressure at 24,705

Execution Rules

1. Entry Confirmation: Engulfing or Pin Bar + Volume Spike on 5-min chart

2. Risk Management: Maximum risk per trade = 1% account size

3. Time Window: Optimal trading 08:00-15:00 UTC+4 (high liquidity period)

4. Exit Protocol: Trail stop at 15-pips after Target 1 achievement

I am nothing @shunya.trade

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

I am nothing @shunya.trade

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.