Closing Price (Sept 1): 24,527.55 (▲ +0.42%)

Current Session (Intraday – Sept 2): Around 24,425–24,430

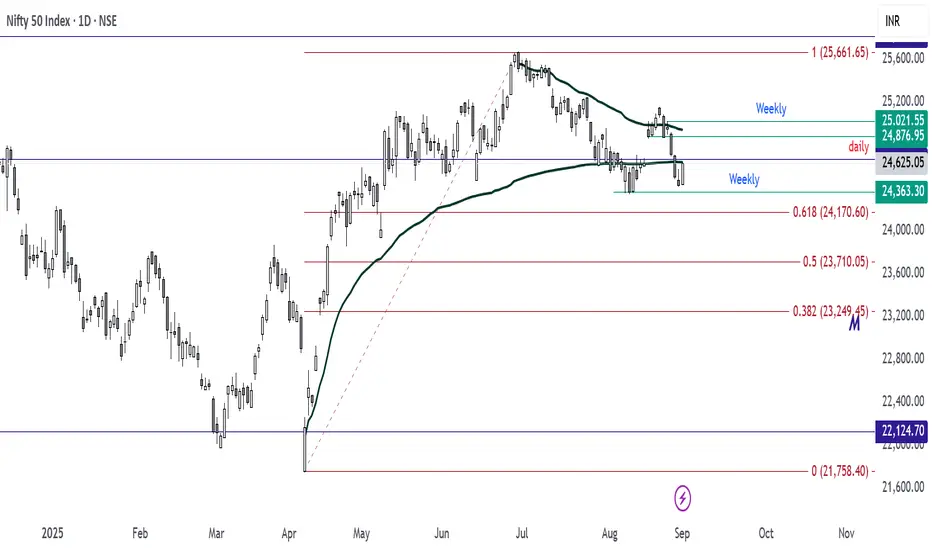

Technical Levels:

Immediate Support: 24,350

Next Support: 24,250

Immediate Resistance: 24,600

Next Resistance: 24,750

🔹 Advanced Levels

Anchored Volume Profile Resistance: 24,626 and 24,930

Fibonacci Daily Resistance (0.618): 25,170

Daily Time Frame Zone: 24,624 – 24,876

🔹 Indicators

RSI (14): Neutral zone (~52)

20-Day SMA: Flat, showing consolidation

50-Day SMA: Uptrend intact, but momentum fading

Candle Setup (Sept 1): Small-bodied with upper wick → selling pressure near highs

🔹 Price Action Notes

On Monday (Sept 1), Nifty broke above Friday’s high which is crucial

If sustained, upside momentum possible toward resistance zones

Seasonal sentiment (festival & marriage season) may provide additional support

🔹 Trade Setup (1H Time Frame)

Bullish Scenario:

If price sustains above 24,664 → go long,

Stop Loss (SL): 1H candle low (confirmed using 15-min chart)

Target: 24,876

Bearish Scenario:

If a Pin Bar forms near 24,624 on 1H → go short

Stop Loss (SL): Pin Bar candle high (confirmed on 15-min chart)

Target 1: 24,550 Target 2: Trail using 15-min candles down to 24,500 → 24,400

🔹 Chart View

Range: 24,350 – 24,600 (critical breakout zone)

Upside expansion possible if 24,626/24,664 holds

Downside risk if rejection occurs at 24,624 zone

🔖 Disclaimer: This is a technical chart-based study for educational purposes only. Not financial advice.

Current Session (Intraday – Sept 2): Around 24,425–24,430

Technical Levels:

Immediate Support: 24,350

Next Support: 24,250

Immediate Resistance: 24,600

Next Resistance: 24,750

🔹 Advanced Levels

Anchored Volume Profile Resistance: 24,626 and 24,930

Fibonacci Daily Resistance (0.618): 25,170

Daily Time Frame Zone: 24,624 – 24,876

🔹 Indicators

RSI (14): Neutral zone (~52)

20-Day SMA: Flat, showing consolidation

50-Day SMA: Uptrend intact, but momentum fading

Candle Setup (Sept 1): Small-bodied with upper wick → selling pressure near highs

🔹 Price Action Notes

On Monday (Sept 1), Nifty broke above Friday’s high which is crucial

If sustained, upside momentum possible toward resistance zones

Seasonal sentiment (festival & marriage season) may provide additional support

🔹 Trade Setup (1H Time Frame)

Bullish Scenario:

If price sustains above 24,664 → go long,

Stop Loss (SL): 1H candle low (confirmed using 15-min chart)

Target: 24,876

Bearish Scenario:

If a Pin Bar forms near 24,624 on 1H → go short

Stop Loss (SL): Pin Bar candle high (confirmed on 15-min chart)

Target 1: 24,550 Target 2: Trail using 15-min candles down to 24,500 → 24,400

🔹 Chart View

Range: 24,350 – 24,600 (critical breakout zone)

Upside expansion possible if 24,626/24,664 holds

Downside risk if rejection occurs at 24,624 zone

🔖 Disclaimer: This is a technical chart-based study for educational purposes only. Not financial advice.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.