Hello Traders!

Today, let’s explore a powerful intraday price action concept that most traders completely miss — the “Ghost Wick” Rejection Setup. These are subtle but strong rejections that only show up on 1-min or 2-min charts, often disappearing or getting absorbed on 5-min or higher timeframes. If you’ve ever felt like your breakout failed but others caught it — this is what they saw!

What is the Ghost Wick Rejection Setup?

How to Trade the Ghost Wick Setup

Real Example from Nifty Future Chart – 2 Min Timeframe (10th June Opening Candle)

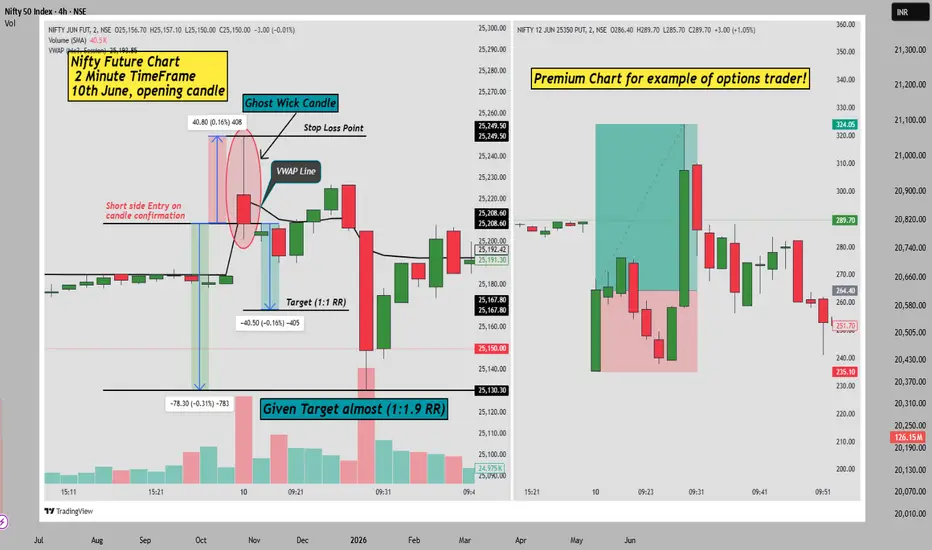

In the chart above, you’ll see how a sharp rejection candle formed exactly at the VWAP line, followed by a breakdown. The “ghost wick” rejection triggered a precise short trade with a clean move downwards. The setup achieved nearly 1:1.9 RR, showing how accurate this rejection can be when spotted early.

Options Premium Chart on right side (Nifty 25350 PE)

To show how it impacts option Traders or scalpers — the 25350 PE premium spiked right after this rejection, hitting an exact 1:2 Risk-Reward target. It’s a perfect demonstration of how this setup works even for options traders, especially those trading momentum scalps.

Why This Setup Works

Rahul’s Tip

Use this only in high-volume environments — like market open or near key news events. Also, confirm with levels marked from higher timeframe. Don’t scalp in the middle of nowhere!

Conclusion

The “Ghost Wick” Rejection Setup is an advanced scalping trick that can massively improve your accuracy. It’s invisible to most — unless you’re watching closely on LTFs. Once you master it, you’ll never see price action the same way again.

Have you noticed ghost wicks before? Drop a 🕯️ in the comments if you’ve traded one!

If you found this post valuable, don't forget to LIKE and FOLLOW!

I regularly share real-world trading setups, actionable strategies, and learning-focused content — all from real trading experience, not theory. Stay connected if you're serious about growing as a trader!

Today, let’s explore a powerful intraday price action concept that most traders completely miss — the “Ghost Wick” Rejection Setup. These are subtle but strong rejections that only show up on 1-min or 2-min charts, often disappearing or getting absorbed on 5-min or higher timeframes. If you’ve ever felt like your breakout failed but others caught it — this is what they saw!

What is the Ghost Wick Rejection Setup?

- Appears Only on Lower Timeframes: You’ll notice sharp rejections with long wicks on 1-min or 2-min charts — but those wicks vanish on higher timeframes.

- Happens at Key Levels: These setups often occur around VWAP, supply/demand zones, or previous highs/lows.

- Used by Scalpers & Smart Money: Institutions and pro scalpers use these short-term traps to grab liquidity and reverse quickly.

How to Trade the Ghost Wick Setup

- Watch Key Zones on 1–2 Min Chart: Look for long rejection wicks forming right at structure (VWAP, previous day’s high, etc.).

- Wait for Confirmation Candle: Once the wick forms, wait for a strong opposite candle with higher volume or engulfing structure.

- Enter with Tight SL: Enter at close of the confirmation candle. Place SL just above the wick (for shorts) or below (for longs).

- Target Logical Zones: Go for quick 1:2 or 1:3 scalps — next support/resistance or VWAP reversion.

Real Example from Nifty Future Chart – 2 Min Timeframe (10th June Opening Candle)

In the chart above, you’ll see how a sharp rejection candle formed exactly at the VWAP line, followed by a breakdown. The “ghost wick” rejection triggered a precise short trade with a clean move downwards. The setup achieved nearly 1:1.9 RR, showing how accurate this rejection can be when spotted early.

Options Premium Chart on right side (Nifty 25350 PE)

To show how it impacts option Traders or scalpers — the 25350 PE premium spiked right after this rejection, hitting an exact 1:2 Risk-Reward target. It’s a perfect demonstration of how this setup works even for options traders, especially those trading momentum scalps.

Why This Setup Works

- Retail Traders Miss It: Most people trade 5-min or 15-min charts and never see this trap setting up.

- Algos Trigger Liquidity: These rejections are engineered to trap early breakout traders and reverse with force.

- Scalping Precision: This setup allows tight stop losses with high R:R in just a few candles.

Rahul’s Tip

Use this only in high-volume environments — like market open or near key news events. Also, confirm with levels marked from higher timeframe. Don’t scalp in the middle of nowhere!

Conclusion

The “Ghost Wick” Rejection Setup is an advanced scalping trick that can massively improve your accuracy. It’s invisible to most — unless you’re watching closely on LTFs. Once you master it, you’ll never see price action the same way again.

Have you noticed ghost wicks before? Drop a 🕯️ in the comments if you’ve traded one!

If you found this post valuable, don't forget to LIKE and FOLLOW!

I regularly share real-world trading setups, actionable strategies, and learning-focused content — all from real trading experience, not theory. Stay connected if you're serious about growing as a trader!

Premium Signals: 77% accuracy in Intraday & Positional trades for Stocks, Nifty, Bank Nifty, Gold, Silver & Crypto. Take demo & decide — most traders don’t leave after joining.

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Premium Signals: 77% accuracy in Intraday & Positional trades for Stocks, Nifty, Bank Nifty, Gold, Silver & Crypto. Take demo & decide — most traders don’t leave after joining.

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.